Free 2024 A-4 Form Download: A Comprehensive Guide to Filing and Understanding

The Form A-4 is an essential document in the tax filing process, providing the Internal Revenue Service (IRS) with crucial information about your income and deductions. Understanding how to download, fill out, and file Form A-4 accurately is paramount to ensuring a smooth tax filing experience. This guide will provide a comprehensive overview of Form A-4, including detailed instructions on downloading the form, a breakdown of its sections, and helpful tips for completing it correctly. Whether you’re a seasoned tax filer or navigating the process for the first time, this guide will empower you with the knowledge and resources you need to successfully file your Form A-4.

To begin, let’s delve into the significance of Form A-4 and its role in the tax filing process. This form serves as a bridge between you and the IRS, allowing you to communicate your income, deductions, and other relevant financial information. Understanding the purpose and contents of Form A-4 will lay the foundation for accurate and timely tax filing.

Introduction

Yo, check it, tax time is rollin’ around the corner, and if you’re a UK taxpayer, you’re gonna need to file a Form A-4.

This form is like your tax roadmap, telling HMRC how much tax to take out of your pay each month. Getting it right is crucial, or you could end up with a nasty tax bill or a refund that’s too small.

Purpose of Form A-4

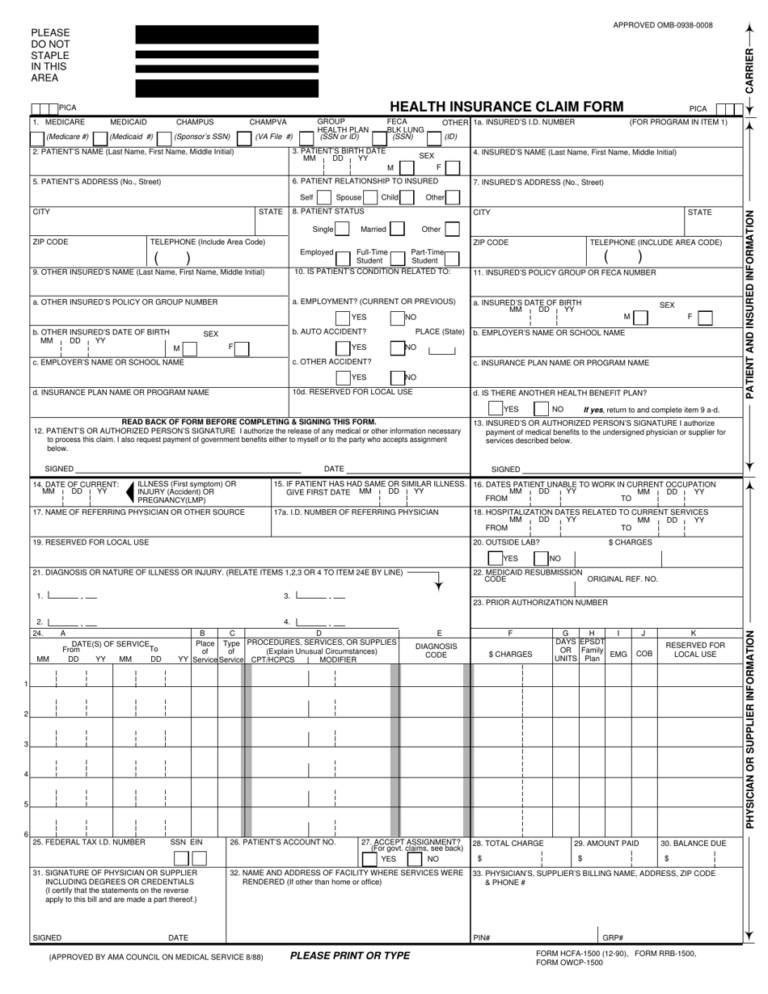

Form A-4 is used to calculate your tax code. This code tells your employer how much tax to deduct from your wages or salary before you get paid.

Your tax code is based on a number of factors, including your personal allowance, which is the amount of income you can earn tax-free.

Downloading Options

If you’re a bit of a tech-head, there are a couple of ways you can get your mitts on Form A-4. You can either:

- Download it straight from the IRS website:

- Cruise over to the official IRS website.

- Search for “Form A-4.”

- Click the link that says “Get Form A-4.”

- Scroll down and click the “Download Form A-4” button.

- Open the file and start filling it in.

- Request it by post:

If you’re not feeling the digital vibe, you can also order Form A-4 by post. Just send a letter to the IRS at the address below, and they’ll send you a copy:

Internal Revenue Service

P.O. Box 120

Cincinnati, OH 45201

- Give ’em a ring:

Fancy having a chinwag with a real live human? You can call the IRS at 1-800-829-3676 and ask them to send you Form A-4.

Form A-4 Details

Get ready, peeps! Form A-4 is like a secret code that unlocks your future. It’s your ticket to ride on the uni gravy train. Let’s break it down into bite-sized chunks so you can fill it out like a boss.

This form is your chance to show off your skills and aspirations. It’s like a CV on steroids, but with more details that’ll make unis drool over your potential.

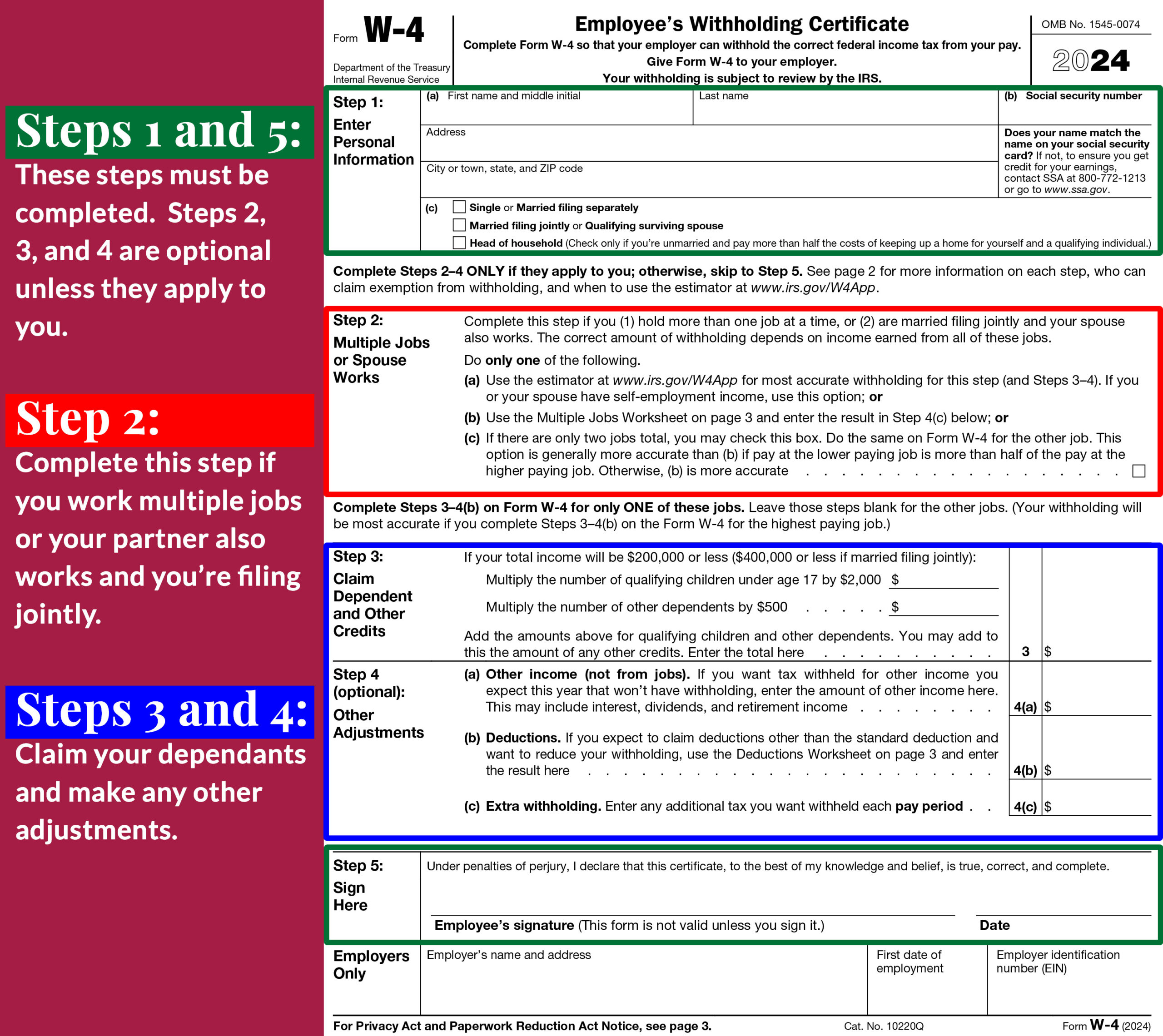

Sections of Form A-4

Form A-4 is like a jigsaw puzzle with different pieces that fit together to create a masterpiece. Each section is a vital part of the puzzle, so make sure you fill them out carefully.

- Personal Details: Name, date of birth, and all that jazz. Easy peasy, lemon squeezy.

- Educational Qualifications: Brag about your academic achievements. List all your qualifications, from GCSEs to A-Levels, and any other courses you’ve smashed.

- Work Experience: Show off your work ethic and any relevant experience you’ve got. Even if it’s just flipping burgers, it shows you’re a go-getter.

- Personal Statement: This is your chance to shine and sell yourself. Tell unis why you’re the bee’s knees and why they should be lucky to have you.

- References: Get some bigwigs to vouch for your awesomeness. Teachers, employers, or anyone who can sing your praises.

Filling Out Form A-4

Filling out Form A-4 is like playing a game of Jenga. One wrong move and the whole thing could come crashing down. Here are some tips to help you avoid any disasters:

- Read the instructions carefully: Don’t skip this step, or you might end up with a form that’s more confusing than a Rubik’s Cube.

- Be accurate and honest: Don’t try to blag it or make stuff up. Unis will be able to tell if you’re fibbing, and it’s not a good look.

- Check your work: Once you’ve filled it out, take a moment to check everything over. Make sure there are no mistakes or typos.

Additional Resources

Innit, need a bit more help? Don’t stress, bruv. We’ve got your back with these extra bits:

These official IRS resources and tax-related websites can sort you out with all the info you need:

Official IRS Resources

- IRS website: https://www.irs.gov/

- Form A-4 instructions: https://www.irs.gov/forms-pubs/about-form-a-4

- IRS Helpline: 1-800-829-1040

Tax Preparation Software

If you’re not feeling too confident about doing your taxes on your own, these software options can help you out:

- TurboTax: https://www.turbotax.com/

- H&R Block: https://www.hrblock.com/

- TaxAct: https://www.taxact.com/

Professional Assistance

If you’re still struggling, don’t be afraid to seek professional help from an accountant or tax advisor. They can guide you through the process and make sure your taxes are filed correctly.

Common Queries

What are the eligibility criteria for filing Form A-4?

To be eligible to file Form A-4, you must be a U.S. citizen or resident alien who is required to file a federal income tax return.

What is the deadline for filing Form A-4?

The deadline for filing Form A-4 is April 15th of each year. However, if you file an extension, you will have until October 15th to file.

What are the penalties for filing Form A-4 late?

If you file Form A-4 late, you may be subject to penalties and interest charges. The penalty for filing late is 5% of the unpaid tax for each month or part of a month that your return is late, up to a maximum of 25%. The interest rate is determined by the IRS and is adjusted periodically.