Free 2024 1099 Forms Download: A Comprehensive Guide

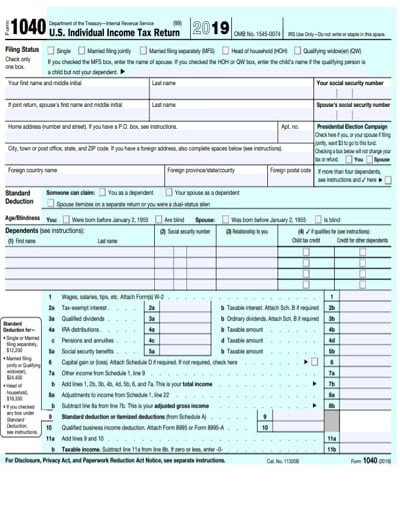

As the 2024 tax season approaches, it’s crucial to understand the significance of 1099 forms in tax reporting. These forms serve as essential documents for both individuals and businesses, providing a record of income earned from non-employee sources. In this comprehensive guide, we’ll delve into the world of 1099 forms, exploring their purpose, types, and the benefits of downloading free forms for 2024. Additionally, we’ll provide practical tips for completing these forms accurately, ensuring seamless tax preparation.

1099 forms play a vital role in the tax reporting process, providing the Internal Revenue Service (IRS) with information about income earned from sources other than wages or salaries. Understanding the different types of 1099 forms and their specific purposes is essential for accurate tax filing. Whether you’re a freelancer, contractor, or business owner, this guide will empower you with the knowledge and resources necessary to navigate the 1099 form landscape.

Tips for Completing 1099 Forms Accurately

1099 forms are essential for reporting income earned from self-employment or freelance work. Completing these forms accurately is crucial to avoid penalties and ensure you receive the correct tax refund. Here are some tips to help you fill out your 1099 forms accurately:

Gather the Necessary Information

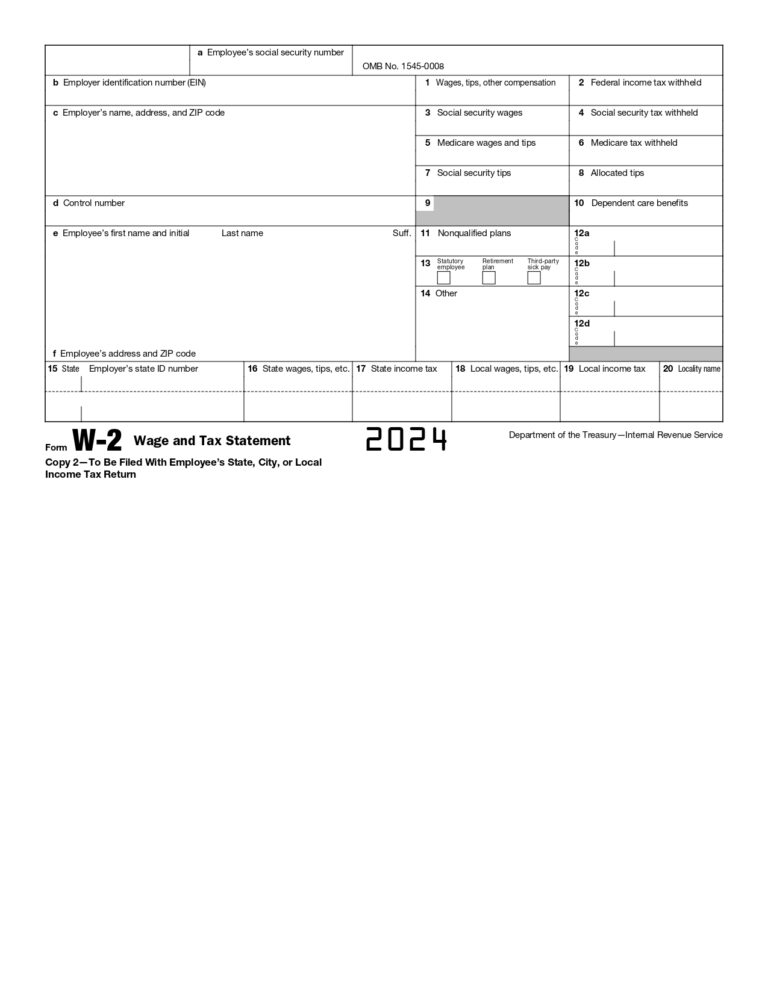

Before you start filling out your 1099 forms, it’s important to gather all the necessary information. This includes your Social Security number, employer identification number (EIN), and the amount of income you earned from each source.

Avoid Common Errors

There are a few common errors that people make when filling out 1099 forms. These include:

- Using the wrong form. There are different 1099 forms for different types of income, so it’s important to use the correct one.

- Entering incorrect information. Make sure to enter all of your information accurately, including your name, address, and Social Security number.

- Missing deadlines. The deadline for filing 1099 forms is January 31st, so it’s important to file them on time.

Importance of Accuracy

It’s important to complete your 1099 forms accurately for several reasons. First, inaccurate information can lead to penalties from the IRS. Second, incorrect reporting can affect your tax refund. Third, accurate reporting helps the IRS track income and ensure that everyone is paying their fair share of taxes.

FAQs

Q: Where can I download free 1099 forms for 2024?

A: The official website of the Internal Revenue Service (IRS) provides free downloadable 1099 forms for 2024. Additionally, many tax software providers offer free or low-cost options for downloading and filling out 1099 forms online.

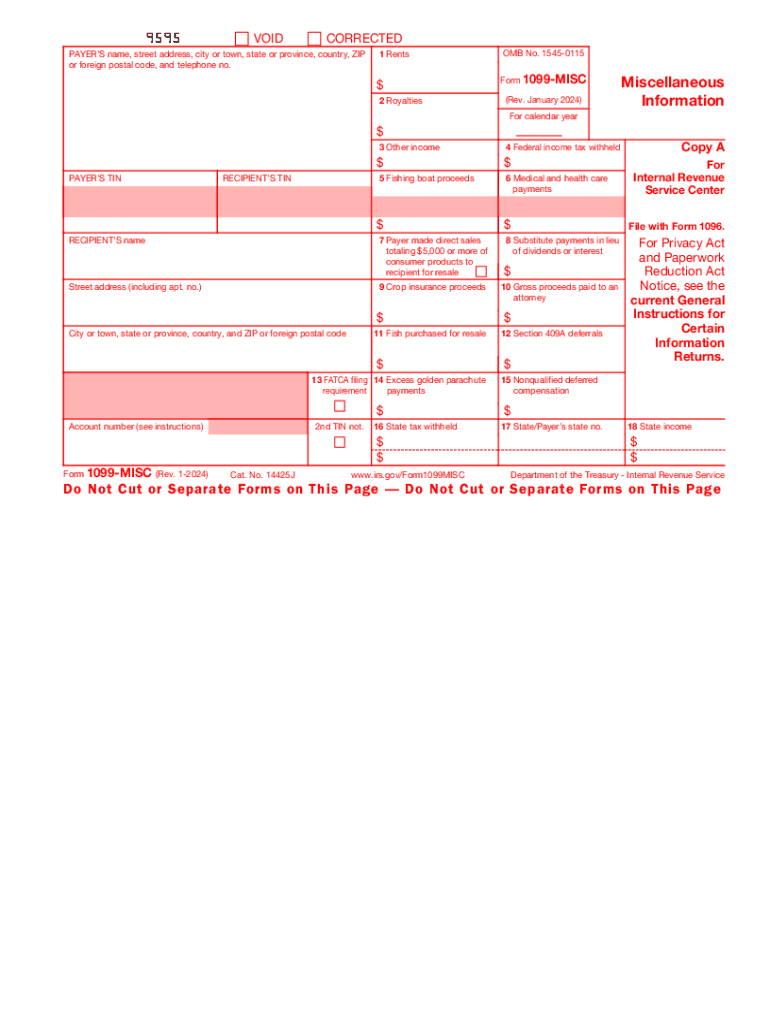

Q: What are the different types of 1099 forms?

A: There are several types of 1099 forms, each designed for a specific purpose. Some common types include 1099-NEC for nonemployee compensation, 1099-MISC for miscellaneous income, and 1099-DIV for dividends.

Q: What information should I gather before completing a 1099 form?

A: To complete a 1099 form accurately, it’s essential to gather the following information: the recipient’s name and address, the payer’s name and address, the amount of income paid, and the type of income (e.g., nonemployee compensation, dividends).