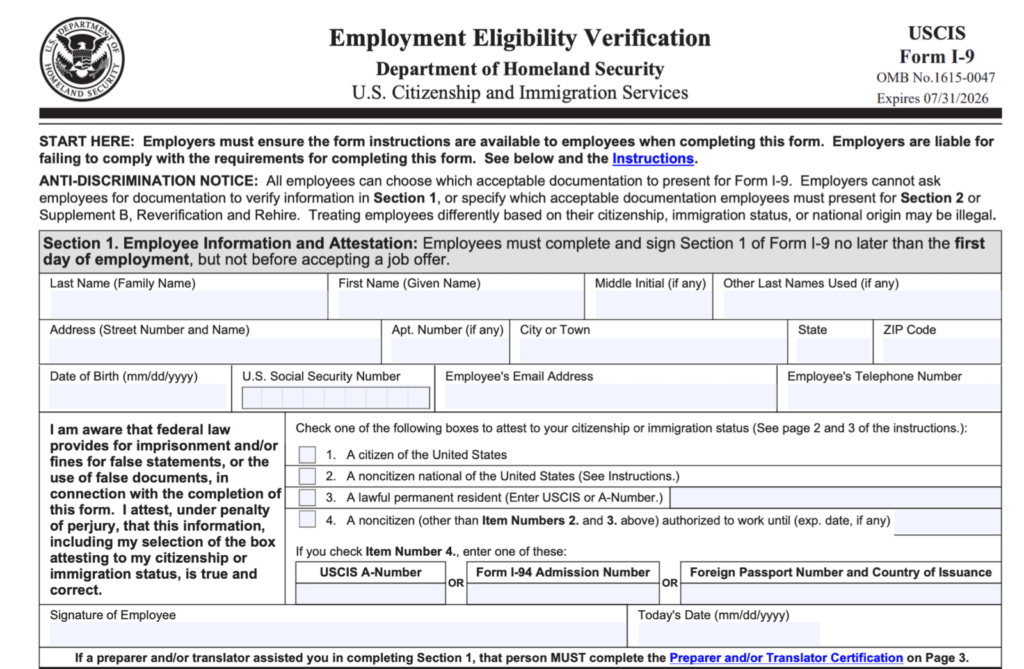

Free 2024 1-9 Form Download: A Comprehensive Guide

Navigating the complexities of Form 1-9 can be a daunting task, but with the right guidance, you can ensure accurate completion and avoid costly penalties. This comprehensive guide provides a clear overview of the Form 1-9, its requirements, and best practices, empowering you to fulfill your legal obligations seamlessly.

Within this guide, we will delve into the purpose, structure, and eligibility criteria for Form 1-9. We will explore the intricacies of document verification, recordkeeping, and retention. Additionally, we will highlight common mistakes and penalties associated with Form 1-9, equipping you with the knowledge to avoid pitfalls and maintain compliance.

Document Verification

Innit, when you’re fillin’ out that Form 1-9, you gotta make sure you’ve got the right documents to back it up. That’s what we call document verification, bruv.

Acceptable Documents

Now, let’s chat about the types of documents you need. For identity, you can show your passport, driver’s license, or state ID. For employment eligibility, you can use your Social Security card, birth certificate, or permanent resident card.

Verifying Documents

To verify the documents, you need to check that they’re real and that they belong to the person who’s fillin’ out the form. You can do this by lookin’ at the photo, checkin’ the signatures, and makin’ sure the documents are up to date.

Recordkeeping and Retention

Employers are required to maintain Form 1-9 for all employees for the following periods:

- For three years after the date of hire, or

- For one year after the date of termination, whichever is later.

Employers can store Form 1-9 in either paper or electronic format. If stored electronically, the employer must ensure that the electronic system is secure and can produce legible copies of the Form 1-9.

Storage and Maintenance

Employers should store Form 1-9 in a secure location, such as a locked filing cabinet or a secure electronic system. Employers should also take steps to protect the Form 1-9 from damage or loss.

If Form 1-9 is damaged or lost, the employer should make a copy of the original Form 1-9 and store the copy in a secure location.

Common Mistakes and Penalties

When filling out Form 1-9, it’s crucial to be cautious and avoid errors. Common mistakes include leaving fields blank, providing incorrect or incomplete information, and failing to sign and date the form.

The penalties for not completing Form 1-9 correctly can be severe. Employers may face fines of up to £3,000 per employee for each violation, while employees may be denied employment or terminated.

To prevent mistakes, ensure you:

– Read the instructions carefully before completing the form.

– Fill out all fields accurately and completely.

– Double-check your information before submitting the form.

– Keep a copy of the completed form for your records.

Resources and Support

Innit, blud? Need a hand with Form 1-9? We got you covered. Here’s the lowdown on where to get it and who to chat to if you’re stuck.

Obtaining Form 1-9

Getting your hands on Form 1-9 is a doddle. Just pop over to the U.S. Citizenship and Immigration Services (USCIS) website, or give ’em a bell on 1-800-375-5283. They’ll sort you out, no sweat.

Contact Information for Support

If you’re having a bit of a mare with Form 1-9, don’t fret. The USCIS crew is on standby to help. You can reach ’em at 1-800-375-5283, or drop ’em an email at [email protected]. They’re there to hold your hand and guide you through the process.

Training and Educational Materials

Fancy brushing up on your Form 1-9 knowledge? USCIS has got a whole stash of training and educational materials just for you. Check out their website or give ’em a call to find out more.

FAQ Corner

Is Form 1-9 required for all employees?

No, Form 1-9 is only required for individuals hired to work in the United States.

What documents are acceptable for identity verification?

Acceptable documents include passports, driver’s licenses, and birth certificates.

How long must I retain Form 1-9?

Form 1-9 must be retained for three years after the date of hire or one year after the date of termination, whichever is later.