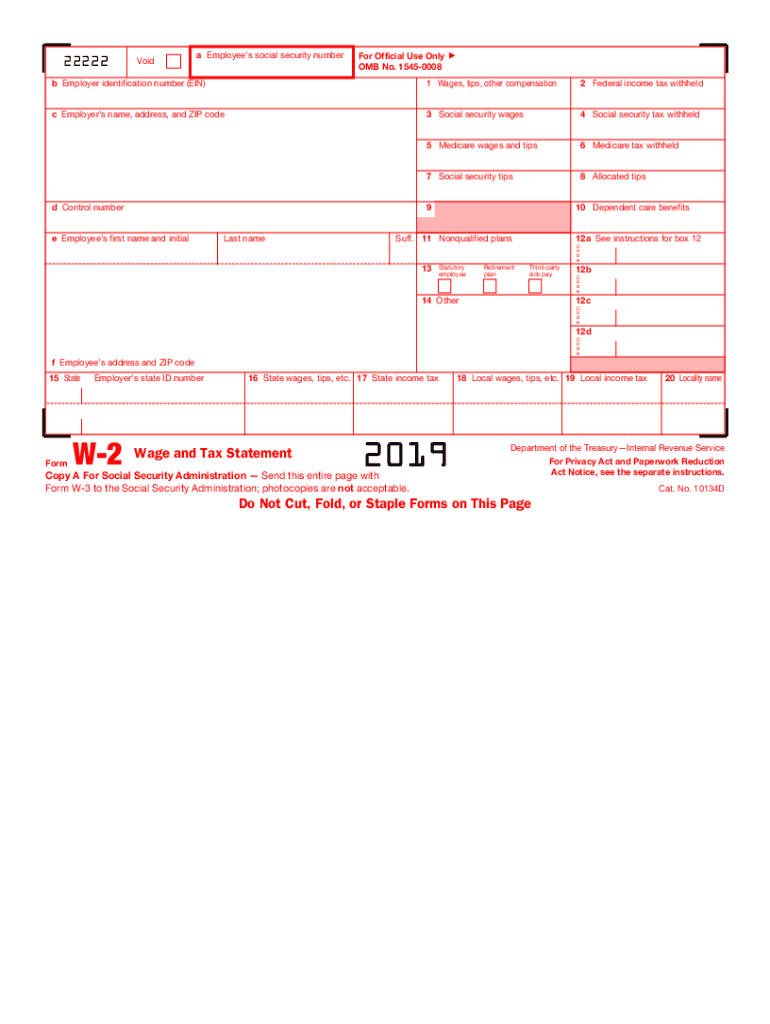

Free 2019 W2 Form Download: A Comprehensive Guide

Filing your taxes can be a daunting task, but having the right forms can make the process much easier. One of the most important forms you’ll need is the W2, which reports your income and withholdings for the year. If you don’t have a W2 from your employer, you can download a free copy from the IRS website. In this guide, we’ll walk you through the steps of downloading a free W2 form, as well as provide some tips on how to keep your personal information safe.

Downloading a free W2 form from the IRS website is quick and easy. First, you’ll need to create an account on the IRS website. Once you have an account, you can log in and click on the “Get Transcript” link. On the next page, select the “Wage and Income Transcript” option and enter the year for which you need the W2. The IRS will then generate a PDF file of your W2, which you can save to your computer or print out.

Free W2 Form Download

Filing taxes can be a daunting task, but having the right documents can make it much easier. One of the most important documents you need is your W2 form. This form shows your earnings and taxes withheld for the year, and you need it to file your tax return.

If you don’t have a physical copy of your W2 form, you can download one for free from the IRS website. This is a great option if you’ve lost your form or if you need a copy for your records.

Steps to Download a Free W2 Form from the IRS Website

Downloading a free W2 form from the IRS website is easy. Just follow these steps:

1. Go to the IRS website at www.irs.gov.

2. Click on the “Forms and Publications” tab.

3. In the search bar, type “W2”.

4. Click on the “W-2, Wage and Tax Statement” link.

5. On the W2 form page, click on the “Get Transcript” button.

6. Enter your personal information and click on the “Continue” button.

7. Select the tax year for which you need the W2 form and click on the “Continue” button.

8. Review your W2 form and click on the “Download” button.

Your W2 form will be downloaded as a PDF file. You can then save the file to your computer or print it out.

Accessibility and Convenience

Free W2 forms are highly accessible online, making it convenient to obtain them from any location with an internet connection. This accessibility eliminates the need for physical visits to tax offices or waiting for forms to be mailed.

Convenience of Downloading W2 Forms

Downloading a free W2 form online offers several advantages:

- Immediate access: Forms can be downloaded instantly, saving time compared to traditional methods.

- No physical storage: Digital downloads eliminate the need for physical storage space, reducing clutter and simplifying record-keeping.

- Accuracy: Online forms are typically pre-formatted, ensuring accuracy and reducing errors.

Legal Considerations

Downloading a free W2 form from the IRS website is completely legal. The IRS provides these forms for free as a service to taxpayers.

The free W2 forms downloaded from the IRS website are authentic and valid. They are the same forms that are used by employers to report employee wages and other information to the IRS.

Ensuring Accuracy and Completeness

It is important to ensure that the downloaded W2 form is accurate and complete. Here are some tips:

- Make sure that the form is the correct year.

- Check that all of the information on the form is correct, including your name, address, Social Security number, and wages.

- If you have any questions about the form, contact the IRS.

Variations and Options

There are various types of W2 forms available for download, catering to different needs and preferences. These forms may differ in terms of their format, layout, and the level of detail they provide.

Types of W2 Forms

- Federal W2 Form: This is the standard W2 form prescribed by the Internal Revenue Service (IRS) for reporting wages and taxes to the federal government.

- State W2 Form: Some states require employers to file separate W2 forms for state tax purposes. These forms may have additional fields or sections specific to the state’s tax laws.

- Local W2 Form: Certain localities may also require employers to file local W2 forms. These forms are typically used for reporting local income taxes or other local assessments.

Formats for Downloading W2 Forms

W2 forms can be downloaded in various formats, including:

- PDF (Portable Document Format): PDF is a widely accepted format that preserves the original layout and formatting of the W2 form. It can be opened and viewed using Adobe Acrobat Reader or other PDF viewers.

- XML (Extensible Markup Language): XML is a structured data format that allows for easy exchange and processing of W2 information. It is commonly used for electronic filing and data integration purposes.

- CSV (Comma-Separated Values): CSV is a simple text-based format that represents data in a tabular structure. It can be easily imported into spreadsheet software or other data analysis tools.

Selecting the Appropriate W2 Form

The choice of W2 form depends on the specific requirements of the individual or organization. For federal tax purposes, the standard Federal W2 Form is generally sufficient. However, if you need to file state or local taxes, you may need to obtain the appropriate state or local W2 forms from the relevant tax authorities.

When selecting a W2 form format, consider factors such as compatibility with your software, ease of sharing, and the level of security required.

Security and Privacy

Ensuring the security and privacy of your personal information is paramount when downloading W2 forms. The IRS employs robust security measures to protect your data, and it’s equally important for you to take steps to safeguard your privacy.

Security Measures Implemented by the IRS

- Encryption: W2 forms are encrypted during transmission to prevent unauthorized access.

- Firewall Protection: Firewalls prevent unauthorized access to IRS systems and data.

- Regular Security Audits: The IRS conducts regular security audits to identify and address potential vulnerabilities.

Maintaining Privacy

To maintain privacy, it’s crucial to:

- Use a Secure Connection: Download W2 forms over a secure internet connection (HTTPS).

- Avoid Public Wi-Fi: Public Wi-Fi networks can be vulnerable to eavesdropping.

- Be Cautious of Phishing Emails: Do not click on links or open attachments in emails from unknown senders.

Tips for Safeguarding Personal Information

- Use a Strong Password: Create a strong password for your IRS account.

- Enable Two-Factor Authentication: Add an extra layer of security by enabling two-factor authentication.

- Review Your Account Regularly: Monitor your IRS account for any unauthorized activity.

Accessibility for Individuals with Disabilities

The IRS website provides several accessibility features for individuals with disabilities who need to download W2 forms. These features include:

- Alternative formats such as Braille, large print, and audio

- Assistive technologies such as screen readers and magnifiers

- Guidance on accessing W2 forms in accessible formats

Resources and Guidance

The IRS website provides resources and guidance for accessing W2 forms in accessible formats. These resources include:

- A guide to accessible IRS forms and publications

- Instructions on how to request accessible formats

- Contact information for the IRS Disability Assistance Helpline

Frequently Asked Questions

Q: What is a W2 form?

A: A W2 form is a tax document that reports your income and withholdings for the year. It is used to file your taxes with the IRS.

Q: Why do I need a W2 form?

A: You need a W2 form to file your taxes. The W2 form reports your income and withholdings for the year, which is used to calculate your tax liability.

Q: How do I get a free W2 form?

A: You can download a free W2 form from the IRS website. To do this, you will need to create an account on the IRS website and then log in. Once you are logged in, click on the “Get Transcript” link and select the “Wage and Income Transcript” option. Enter the year for which you need the W2 and the IRS will generate a PDF file of your W2.

Q: Is it safe to download a W2 form from the IRS website?

A: Yes, it is safe to download a W2 form from the IRS website. The IRS website is a secure website and your personal information will be protected.