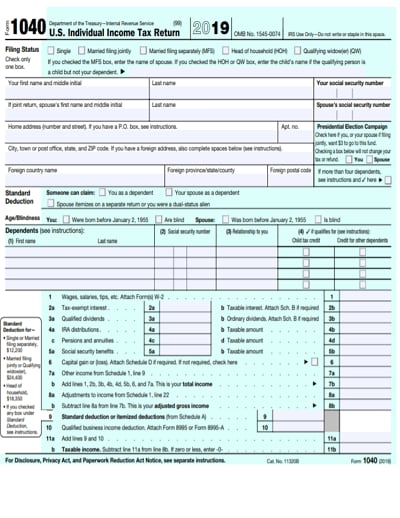

Free 2018 Instructions For Form 1040 Download: A Comprehensive Guide

Filing your taxes can be a daunting task, but it doesn’t have to be. With the right tools and guidance, you can navigate the process with ease. This guide will provide you with everything you need to know about Form 1040, including step-by-step instructions for downloading the form and completing it accurately.

Form 1040 is the main tax form used by individuals to file their annual income taxes. It is a comprehensive document that requires you to report your income, deductions, and credits. The form can be complex, but by following the instructions carefully, you can ensure that you file your taxes correctly and avoid any potential penalties.

Introduction to Form 1040

Alright, listen up, fam. Form 1040 is the main event when it comes to filing your taxes. It’s the OG document that the IRS uses to calculate how much you owe Uncle Sam or how much you’re getting back. It’s like the grand finale of tax season, the moment you’ve been waiting for.

Now, Form 1040 ain’t no walk in the park. It’s got a whole bunch of schedules and forms that go along with it. These schedules are like extra sheets where you can fill in more details about your income, deductions, and credits. It’s like having a squad of backup dancers to help you get your taxes done right.

Schedules Associated with Form 1040

Let’s talk about the most common schedules you might need:

- Schedule A: This is where you list your itemized deductions, like medical expenses, charitable donations, and mortgage interest. It’s like a detailed breakdown of all the ways you’re trying to save some dough.

- Schedule B: This is for reporting interest and dividend income. It’s like a tally of all the extra money you’re making from your investments.

- Schedule C: This is where you report income and expenses from self-employment. It’s like your own personal business ledger, showing how much you’re making and spending.

s for Downloading Form 1040

Blud, getting Form 1040 from the taxman’s crib is a doddle. Just follow these easy peasy steps, fam.

First off, head to the IRS website and click on “Forms”. Then, type “1040” in the search bar and hit enter. You’ll see a list of different versions of Form 1040, so make sure you grab the one that’s right for you, innit.

Once you’ve found the right form, click on the “Download” button. You’ll be asked to choose a format, so go for PDF or whatever floats your boat. Then, just click “Save” and you’re sorted.

That’s it, my friend. You’ve now got Form 1040 safely stashed on your comp. Easy as pie, eh?

Key Features of Form 1040

Blud, Form 1040 is like the main gig when it comes to telling the taxman what’s what. It’s a right faff, but it’s got everything you need to show ’em how much dough you made and what you owe ’em.

The form’s split into sections, each one covering a different bit of your financial life. We’ll break it down, bruv, so you can navigate it like a pro and get your tax return sorted without any hassle.

Section 1: Personal Info

This is where you spill the beans on who you are and where you’re at. It’s got fields for your name, address, and social security number. Make sure you fill ’em in right, or the taxman might get confused and send your refund to the wrong crib.

Section 2: Income

Now it’s time to show off your earnings. This section’s got lines for all sorts of income, like wages, salaries, tips, and investments. Add up all your dough and chuck it in the right boxes. Don’t forget to include any benefits you got from your job, like health insurance or a company car.

Section 3: Adjustments to Income

This is where you get to make some adjustments to your income. You can deduct certain expenses, like student loan interest or contributions to a retirement account. These deductions can lower your taxable income, which means you might owe less tax.

Section 4: Taxable Income

Once you’ve made all your adjustments, you’re left with your taxable income. This is the amount of money that the taxman’s gonna use to calculate how much you owe. The higher your taxable income, the more tax you’ll pay.

Section 5: Tax

This is the nitty-gritty, mate. This section’s got a table that shows how much tax you owe based on your taxable income. Find your bracket and multiply your taxable income by the rate. That’s how much tax you’re gonna have to cough up.

Section 6: Payments and Credits

Time to take a breather. This section’s where you can claim any credits or deductions that can reduce your tax bill. You might be able to get a credit for things like child care or education expenses. Check the instructions to see what you’re eligible for.

Section 7: Other Taxes

This is where you pay up for any other taxes you might owe, like self-employment tax or alternative minimum tax. Don’t skip this section, or you might end up owing even more dough to the taxman.

Section 8: Refund or Amount You Owe

Finally, we’re at the end of the road. This section shows how much you’re getting back or how much you owe. If you’re getting a refund, congrats! If you owe money, make sure you pay up on time to avoid any penalties.

Resources for Further Assistance

If you need more help understanding or completing your tax return, there are several resources available.

The IRS website has a wealth of information, including forms, instructions, and publications. You can also use the IRS e-file system to file your return electronically.

Tax Preparation Software

Tax preparation software can make it easier to prepare your tax return. There are many different software programs available, so you can choose one that fits your needs and budget.

Professional Tax Assistance

If you have a complex tax situation, you may want to consider getting professional tax assistance. A tax professional can help you understand the tax laws and make sure that you are claiming all of the deductions and credits that you are entitled to.

Common Queries

What is Form 1040?

Form 1040 is the main tax form used by individuals to file their annual income taxes.

Where can I download Form 1040?

You can download Form 1040 from the IRS website.

How do I complete Form 1040?

Follow the instructions in this guide to complete Form 1040.

What if I need help completing Form 1040?

You can seek professional help from a tax preparer or accountant.