Free 2018 Form W-4 Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but understanding and completing Form W-4 is crucial for ensuring accurate withholding and minimizing tax-related surprises. This guide will provide a comprehensive overview of the 2018 Form W-4, empowering you with the knowledge to download, fill out, and submit it with confidence.

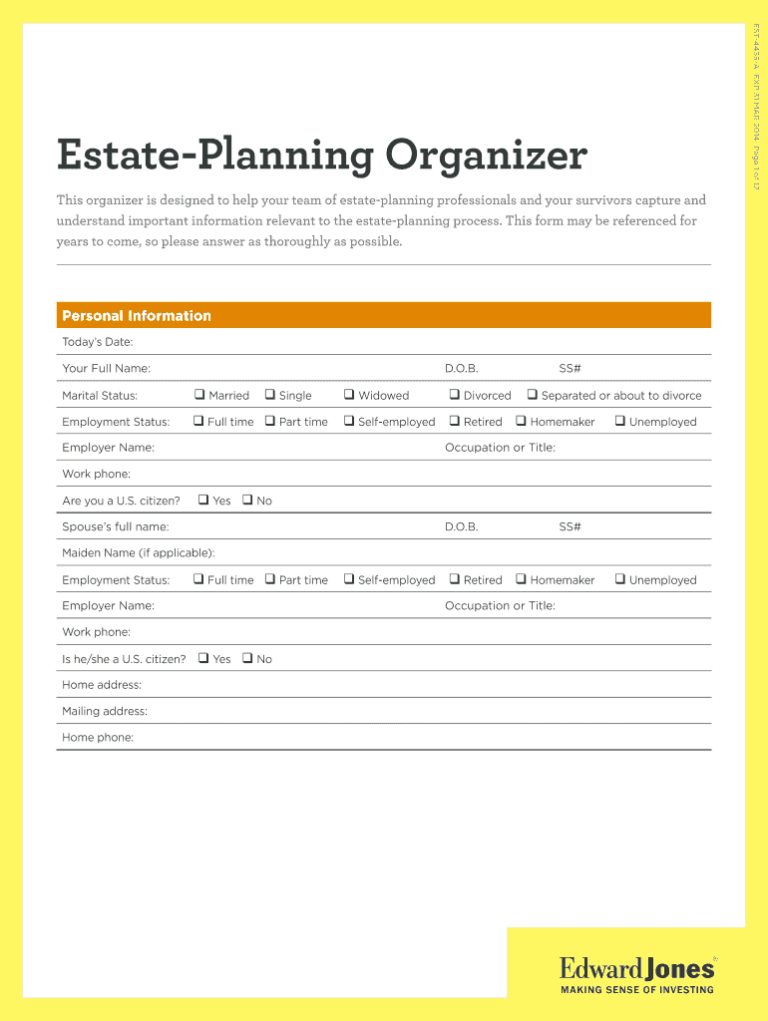

The Form W-4, also known as the Employee’s Withholding Certificate, is a vital document that determines the amount of federal income tax withheld from your paycheck. By understanding the information required on the form and utilizing the resources available, you can ensure that the appropriate amount of taxes is being withheld, avoiding potential penalties or refunds.

Free 2018 Form W-4 Download Basics

Intro: The Form W-4, also known as the Employee’s Withholding Allowance Certificate, is a crucial document that helps determine the amount of federal income tax withheld from your paycheck. It’s important to fill out this form accurately to ensure you’re paying the correct amount of taxes.

Explanatory paragraph: The Form W-4 collects information such as your filing status, number of allowances you claim, and any additional withholding you want to have taken out of your paycheck. This information is used by your employer to calculate how much tax to withhold from your wages. Filing out the Form W-4 correctly can help you avoid underpaying or overpaying your taxes.

Benefits of Downloading a Free 2018 Form W-4

There are several benefits to downloading a free 2018 Form W-4:

- It’s free: You don’t have to pay anything to download the form.

- It’s convenient: You can download the form from the IRS website or from a number of other websites.

- It’s easy to use: The form is straightforward and easy to fill out.

- It’s accurate: The form is provided by the IRS, so you can be sure that it’s accurate and up-to-date.

Downloading the Free 2018 Form W-4

Bruv, listen up! If you need to fill out a W-4 form for the 2018 tax year, you can download it for free online. Here’s the tea:

Step 1: Visit the Official Website

Head over to the Internal Revenue Service (IRS) website at https://www.irs.gov/forms-pubs/about-form-w-4. This is the official spot where you can grab the latest version of the form.

Step 2: Find the Download Link

Once you’re on the IRS website, look for the “Forms” tab at the top of the page. Hover over it and select “Individual Forms” from the drop-down menu. On the next page, scroll down to the “W-4 Form” section and click on the “Download” link next to the 2018 version.

Step 3: Save or Print

The form will open as a PDF file. You can either save it to your computer or print it out right away. Make sure you save the file in a place where you can easily find it later.

Tips:

- Use the latest version of the form, as the tax laws may have changed since previous years.

- Fill out the form carefully and completely. Any errors could delay your refund or result in penalties.

- If you need help filling out the form, you can visit the IRS website or contact a tax professional.

Additional Considerations

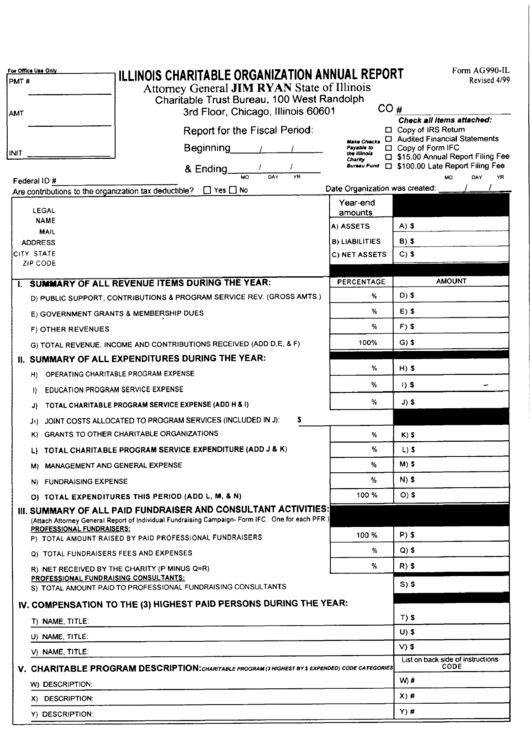

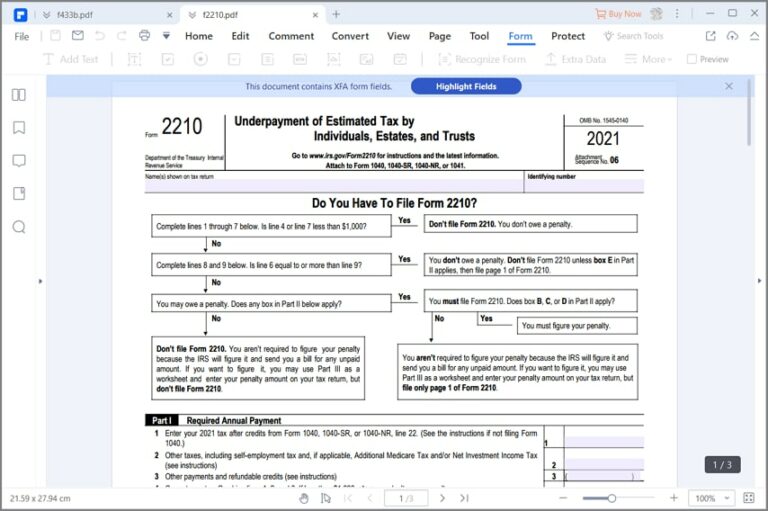

There are other tax forms that you may need to complete in addition to Form W-4, such as Form W-9, Form 1040, and Form 1040-ES. For more information on these forms, visit the IRS website.

Form W-4 has been updated since 2018. The most significant change is that the form now includes a new line for taxpayers to enter their Social Security number. This change was made to help prevent identity theft and fraud.

Relevant Resources

Q&A

Can I download the 2018 Form W-4 if I am not a US citizen?

Yes, you can download the 2018 Form W-4 regardless of your citizenship status. However, the information you provide on the form will determine how your income is taxed.

What if I make a mistake on my Form W-4?

If you discover an error on your Form W-4, you should complete a new Form W-4 and submit it to your employer as soon as possible. The new form will supersede the previous one.

Where can I find additional resources or assistance with Form W-4?

The IRS website provides a wealth of information and resources related to Form W-4. You can also contact the IRS directly for personalized assistance.