Free 2018 1040 Form And Instructions Download

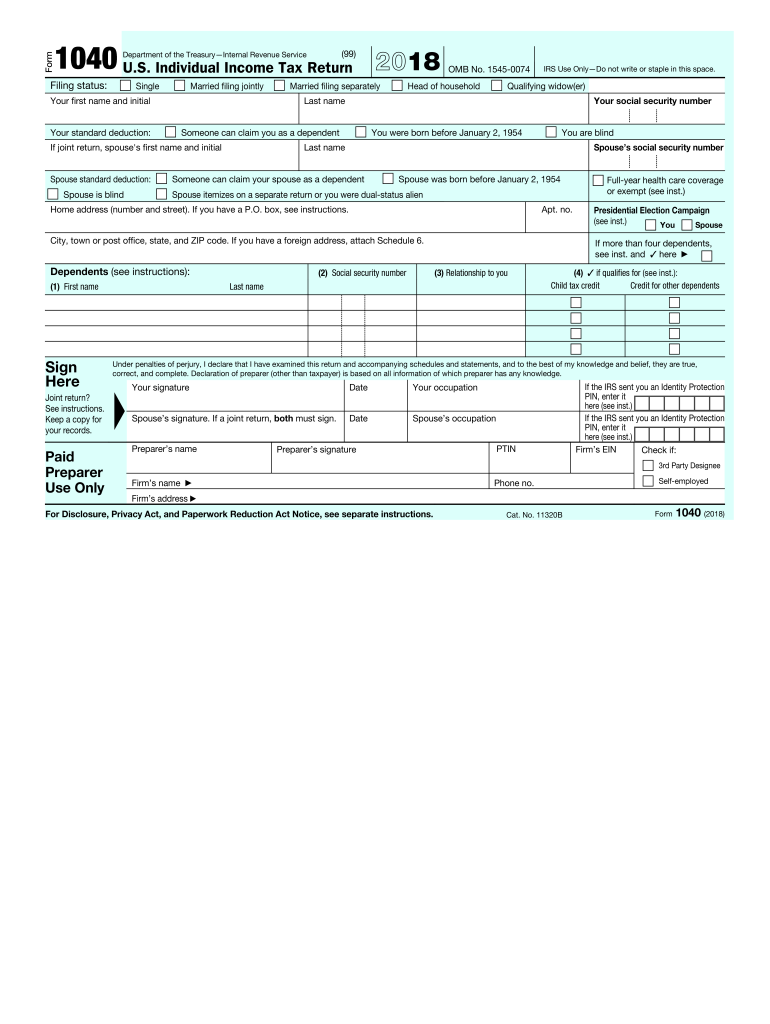

The 1040 tax form is a crucial document used by individuals to file their annual income taxes with the Internal Revenue Service (IRS). Understanding how to access, complete, and submit this form is essential for fulfilling your tax obligations accurately and efficiently. In this comprehensive guide, we will provide you with all the necessary information and resources to successfully navigate the Free 2018 1040 Form and Instructions Download process.

In this guide, we will cover key features, changes, and step-by-step instructions to ensure you can complete your tax return with confidence. We will also address common questions and provide support resources to assist you throughout the process. Whether you are a first-time filer or have been filing taxes for years, this guide will provide valuable insights and guidance to make your tax preparation experience as smooth as possible.

Accessing and Downloading the Free 2018 1040 Form and s

Getting your hands on the free 2018 1040 form and s is a breeze. Here’s a step-by-step guide to make it a doddle:

Head on over to the official IRS website at https://www.irs.gov/forms-pubs/about-form-1040. Once you’re there, click on the “Download Forms and Instructions” button.

Accessing the 1040 Form

On the next page, you’ll see a list of available forms. Scroll down until you find “Form 1040, U.S. Individual Income Tax Return.” Click on the link to download the PDF file.

Accessing the 1040 s

To download the s, click on the “Instructions for Form 1040” link on the same page. The PDF file will include all the s you need to fill out your tax return.

Potential Challenges

In case you run into any hiccups while downloading the form or s, check your internet connection first. If that’s not the issue, try using a different browser or clearing your browser’s cache.

Key Features and Changes in the 2018 1040 Form

The 2018 1040 form has undergone several key changes compared to previous years. These modifications aim to simplify tax filing, reflect changes in tax laws, and improve the accuracy of tax calculations.

The most notable change is the introduction of a new deduction for qualified business income (QBI). This deduction allows certain taxpayers to deduct up to 20% of their QBI, which includes income from sole proprietorships, partnerships, and S corporations. The QBI deduction is intended to provide tax relief to small business owners and encourage economic growth.

Another significant change is the increase in the standard deduction. The standard deduction for single filers has increased from $6,350 to $12,000, and the standard deduction for married couples filing jointly has increased from $12,700 to $24,000. This increase in the standard deduction will result in lower taxes for many taxpayers.

The 2018 1040 form also includes several other changes, such as:

– An increase in the child tax credit from $1,000 to $2,000 per child

– A new deduction for educator expenses of up to $250

– A new credit for energy-efficient home improvements

These changes are designed to make the tax filing process easier and more beneficial for taxpayers. It is important to review the 2018 1040 form carefully to ensure that you are taking advantage of all of the available deductions and credits.

Implications of Changes for Taxpayers

The changes to the 2018 1040 form will have a significant impact on many taxpayers. The increased standard deduction will result in lower taxes for many people, while the new QBI deduction will provide tax relief to small business owners. The other changes, such as the increase in the child tax credit and the new deduction for educator expenses, will also benefit many taxpayers.

It is important to note that the changes to the 2018 1040 form may also affect your tax refund. If you are expecting a refund, you may want to file your taxes early to take advantage of the new deductions and credits. You can also use the IRS’s online refund tracker to check the status of your refund.

Navigating the 2018 1040 Form and s

Navigating the 2018 1040 form and schedules can be a bit daunting, but it doesn’t have to be. Here’s a step-by-step guide to help you get through it.

The 1040 form is divided into several sections, each of which covers a different aspect of your income and expenses. The first section is for your personal information, such as your name, address, and Social Security number. The second section is for your income, including wages, salaries, tips, and other forms of income. The third section is for your adjustments to income, such as deductions for student loan interest or contributions to a retirement account. The fourth section is for your taxable income, which is your income minus your adjustments to income. The fifth section is for your taxes, including income tax, Social Security tax, and Medicare tax. The sixth section is for your credits, such as the child tax credit or the earned income tax credit. The seventh section is for your payments, such as estimated tax payments or withholding from your paycheck. The eighth section is for your refund or amount you owe.

The schedules are used to provide additional information about your income and expenses. For example, Schedule A is used to itemize your deductions, Schedule B is used to report interest and dividends, and Schedule C is used to report self-employment income.

Here are some helpful tips for completing each section of the 1040 form:

- Start by filling out the personal information section. This information is used to identify you and to ensure that you receive the correct refund or amount owed.

- Next, fill out the income section. Be sure to include all of your income, even if it is from multiple sources.

- After you have filled out the income section, you can fill out the adjustments to income section. This section is used to reduce your taxable income.

- Once you have filled out the adjustments to income section, you can fill out the taxable income section. This section is used to calculate your taxes.

- After you have filled out the taxable income section, you can fill out the taxes section. This section is used to calculate your income tax, Social Security tax, and Medicare tax.

- Next, you can fill out the credits section. This section is used to reduce your taxes.

- After you have filled out the credits section, you can fill out the payments section. This section is used to report your estimated tax payments or withholding from your paycheck.

- Finally, you can fill out the refund or amount you owe section. This section is used to calculate your refund or amount owed.

Common Questions and Support for Using the 2018 1040 Form

Taxpayers may encounter various questions or challenges while completing the 2018 1040 form. This section anticipates some common queries and provides guidance to address them.

In addition to the resources mentioned above, taxpayers can seek support from the following sources:

Online Forums

Online forums offer a platform for taxpayers to connect with others who have completed or are working on the 2018 1040 form. By participating in these forums, taxpayers can share experiences, ask questions, and get insights from fellow filers.

IRS Phone Lines

The IRS operates phone lines dedicated to assisting taxpayers with their tax-related questions. Taxpayers can call the IRS at 1-800-829-1040 for general tax inquiries or 1-800-829-4933 for specific questions about the 2018 1040 form.

Tax Professionals

Tax professionals, such as accountants and tax preparers, are experts in tax matters. Taxpayers who need personalized guidance or assistance with completing their 2018 1040 form can consider consulting a tax professional.

FAQ

What are the key changes in the 2018 1040 form?

The 2018 1040 form includes several key changes from previous years, including updates to the standard deduction and tax brackets. It also introduces new lines for reporting qualified business income and alimony payments.

How can I access the Free 2018 1040 Form and Instructions Download?

You can access the Free 2018 1040 Form and Instructions Download from the official IRS website or through tax software providers.

What if I encounter difficulties while downloading or completing the form?

If you encounter any difficulties, you can refer to the IRS website for troubleshooting tips or contact the IRS directly for assistance.