Free 15g Form PF Download: A Comprehensive Guide

Form PF is a critical document for private fund managers, and understanding its intricacies is essential for compliance and accuracy. This guide provides a comprehensive overview of Form PF, including where to find a free download, tips for completing it, and common pitfalls to avoid. Whether you’re a seasoned professional or new to the world of private fund management, this guide will equip you with the knowledge you need to navigate Form PF confidently.

In this guide, we’ll delve into the purpose and significance of Form PF, discuss the regulatory requirements for filing it, and provide a brief history of its development. We’ll also guide you to trusted sources for obtaining a free Form PF download, explain the benefits of using a free download, and provide step-by-step instructions on how to complete each section of the form.

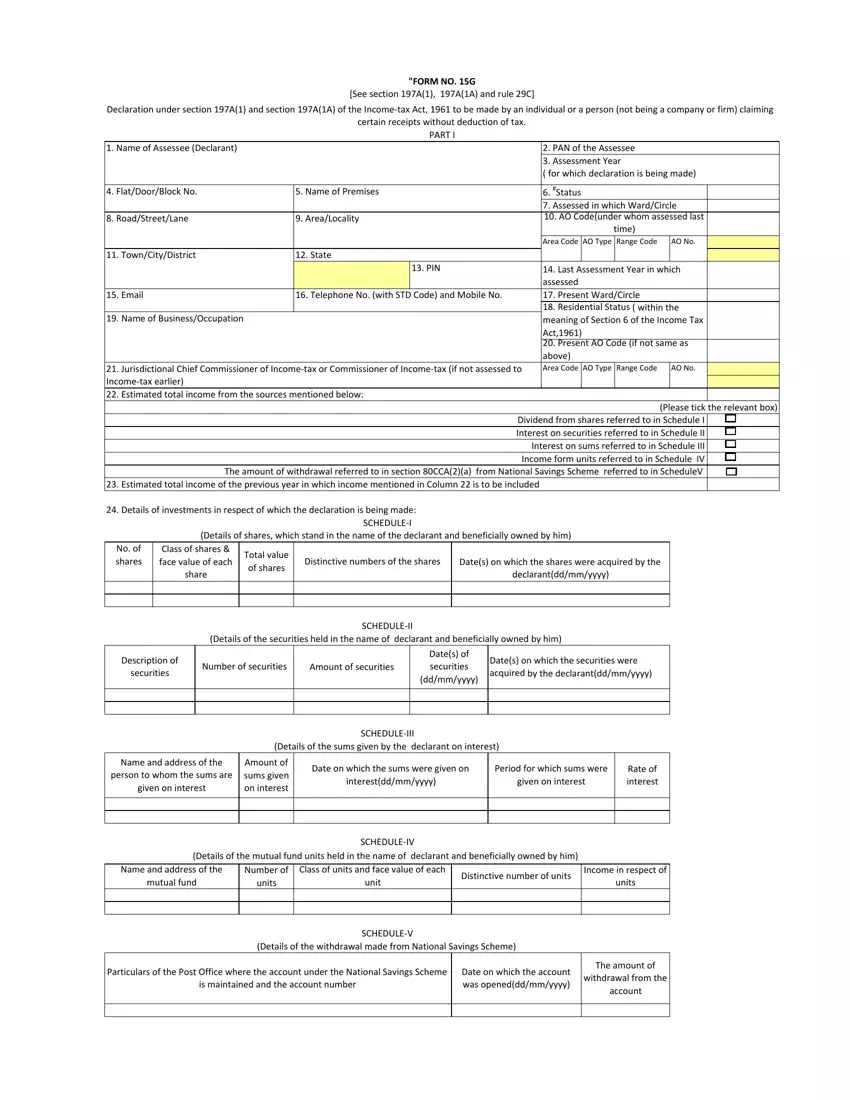

Form PF Overview

Form PF is a regulatory filing submitted by private funds to the U.S. Securities and Exchange Commission (SEC). It provides detailed information about the fund’s investments, operations, and risks.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 requires certain private funds to file Form PF. These funds include hedge funds, private equity funds, and commodity pools.

Brief History of Form PF

Form PF was created in 2010 as part of the Dodd-Frank Act. The SEC implemented Form PF to improve transparency and oversight of the private fund industry.

Free Form PF Download

Form PF is a regulatory filing required by the Securities and Exchange Commission (SEC) from certain private funds. It provides detailed information about the fund’s investments, operations, and financial condition. If you’re looking to obtain a free Form PF download, there are several trusted sources you can turn to.

Locating the Latest Version of Form PF

The latest version of Form PF can be found on the SEC’s website. The SEC regularly updates the form to reflect changes in regulations and reporting requirements. To locate the latest version, visit the SEC’s website and navigate to the “Forms” section. From there, you can search for “Form PF” and download the most recent version.

Benefits of Using a Free Form PF Download

There are several benefits to using a free Form PF download. First, it can save you time and money. Purchasing a commercial version of Form PF can be expensive, and downloading a free version can help you avoid these costs. Second, it can give you access to the most up-to-date information. The SEC regularly updates Form PF, and downloading a free version ensures that you have the latest information available. Third, it can help you make informed decisions. Form PF provides detailed information about a fund’s investments, operations, and financial condition. This information can help you make informed decisions about whether or not to invest in a particular fund.

Completing Form PF

Filling out Form PF can be a daunting task, but it’s essential to do it accurately and completely. Here’s a guide to help you navigate each section and avoid common pitfalls.

Section 1: Header Information

This section is straightforward. Provide your firm’s name, address, and contact information. Double-check that everything is correct, as this information will be used to identify your firm.

Section 2: Reporting Period

Indicate the beginning and end dates of the reporting period. Make sure the dates align with the information you’re providing in the form.

Section 3: Fund Information

This section requires detailed information about each fund you’re reporting on. Be precise when entering fund names, CIKs, and other identifying details.

Section 4: Investment Information

Here’s where you’ll report the investments held by each fund. Use accurate values and classifications to ensure the information is reliable.

Section 5: Leverage Information

If your fund uses leverage, provide details in this section. Clearly indicate the type of leverage and the amount used.

Section 6: Counterparty Information

This section is for reporting information about counterparties to your fund’s investments. Ensure you have the correct CIKs and other identifying details.

Section 7: Other Information

Use this section to provide any additional information that doesn’t fit elsewhere in the form. Keep it concise and relevant.

Tips for Accuracy and Completeness

- Gather all necessary information before starting.

- Use reliable sources and double-check your data.

- Proofread carefully before submitting.

Common Errors to Avoid

- Incorrect fund or counterparty information.

- Inaccurate investment values or classifications.

- Missing or incomplete data.

Resources for Form PF Filers

For those navigating the complexities of Form PF, a range of resources are available to provide guidance and support. These include professional organizations dedicated to fund management and government agencies tasked with overseeing the form’s compliance.

Professional organizations such as the Investment Company Institute (ICI) and the American Investment Council (AIC) offer a wealth of resources, including webinars, training materials, and industry guidance on Form PF reporting requirements.

Government Agencies

- Securities and Exchange Commission (SEC): The SEC’s Division of Investment Management provides guidance on Form PF, including a dedicated website with resources and contact information.

- Commodity Futures Trading Commission (CFTC): The CFTC’s Division of Market Oversight offers support on Form PF reporting for commodity pool operators and commodity trading advisors.

FAQ Corner

Where can I find a free download of Form PF?

You can find a free download of Form PF on the website of the Securities and Exchange Commission (SEC) at https://www.sec.gov/divisions/investment/privatefunds/form-pf.

How often do I need to file Form PF?

Form PF must be filed annually within 60 days of the end of the private fund’s fiscal year.

What are the penalties for failing to file Form PF?

Failure to file Form PF can result in civil penalties of up to $25,000 per day.