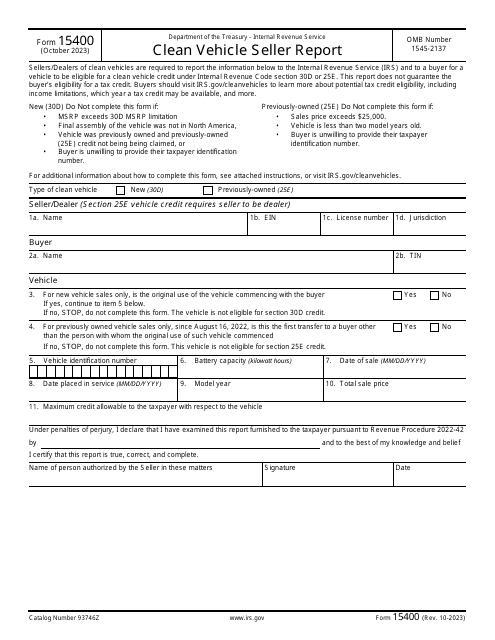

Free 15400 Irs Form Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but with the right resources, it doesn’t have to be. The IRS Form 15400 is a crucial document for many taxpayers, and understanding how to download, fill out, and submit it can save you time, effort, and potential penalties.

In this comprehensive guide, we’ll delve into everything you need to know about the IRS Form 15400, from its purpose and structure to the various options for downloading and filing it. Whether you’re a seasoned tax filer or a first-timer, this guide will empower you with the knowledge and confidence to tackle this essential form.

Free 15400 IRS Form Overview

The IRS Form 15400 is an important tax document that is used to report income from self-employment or as a gig worker. It is essential for individuals who are not traditional employees and need to calculate and pay their taxes accurately.

This form is designed for individuals who have net earnings from self-employment of $400 or more. It is also used to report income from farming, fishing, or other types of self-employment activities.

Purpose and Significance

The main purpose of Form 15400 is to help self-employed individuals calculate their net income and taxes owed. It also allows them to claim certain deductions and credits that may reduce their tax liability.

Target Audience

The target audience for Form 15400 is individuals who are self-employed, including:

- Freelancers

- Independent contractors

- Gig workers

- Small business owners

- Farmers and fishermen

History and Updates

Form 15400 was first introduced in 1976. Since then, it has undergone several revisions to reflect changes in tax laws and regulations.

The most recent update to Form 15400 was made in 2020 to incorporate changes related to the Tax Cuts and Jobs Act.

Downloading Options

Downloading the IRS Form 15400 is a straightforward process that can be done from a variety of official sources. Let’s take a look at some of the most popular options and how to use them.

It’s important to ensure that you’re downloading the form from a secure source to avoid any potential security risks. Stick to official government websites or reputable third-party providers who have a proven track record of providing accurate and secure tax forms.

Internal Revenue Service (IRS) Website

The official IRS website is the most reliable source for downloading the IRS Form 15400. Here’s how you can do it:

- Visit the IRS website at www.irs.gov.

- Click on the “Forms & Publications” tab at the top of the page.

- In the search bar, type “Form 15400” and hit enter.

- Click on the “Download” button next to the form title.

- Choose the format you want to download the form in (PDF or XML) and click “Download.”

Third-Party Providers

There are several third-party providers who offer free downloads of the IRS Form 15400. Some popular options include:

- TurboTax: www.turbotax.com

- H&R Block: www.hrblock.com

- TaxSlayer: www.taxslayer.com

To download the form from a third-party provider, simply visit their website and search for “Form 15400.” Once you’ve found the form, click on the “Download” button and choose the format you want to download it in.

Form Structure and Sections

The IRS Form 15400 is a multi-page document with a specific structure and layout. It consists of several sections, each designed to collect specific information from the taxpayer.

The main sections of the form include:

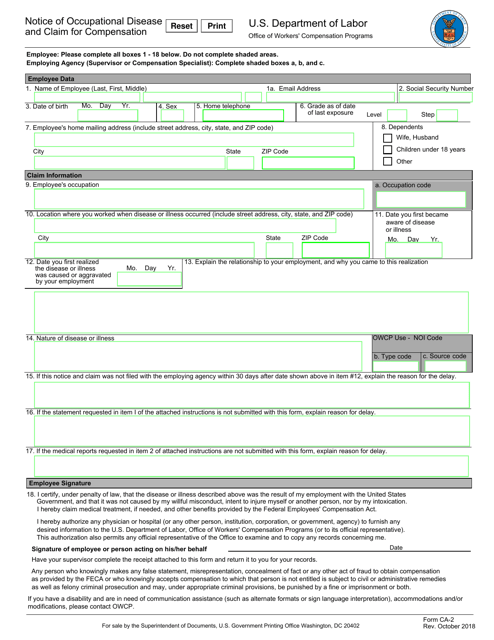

Personal Information

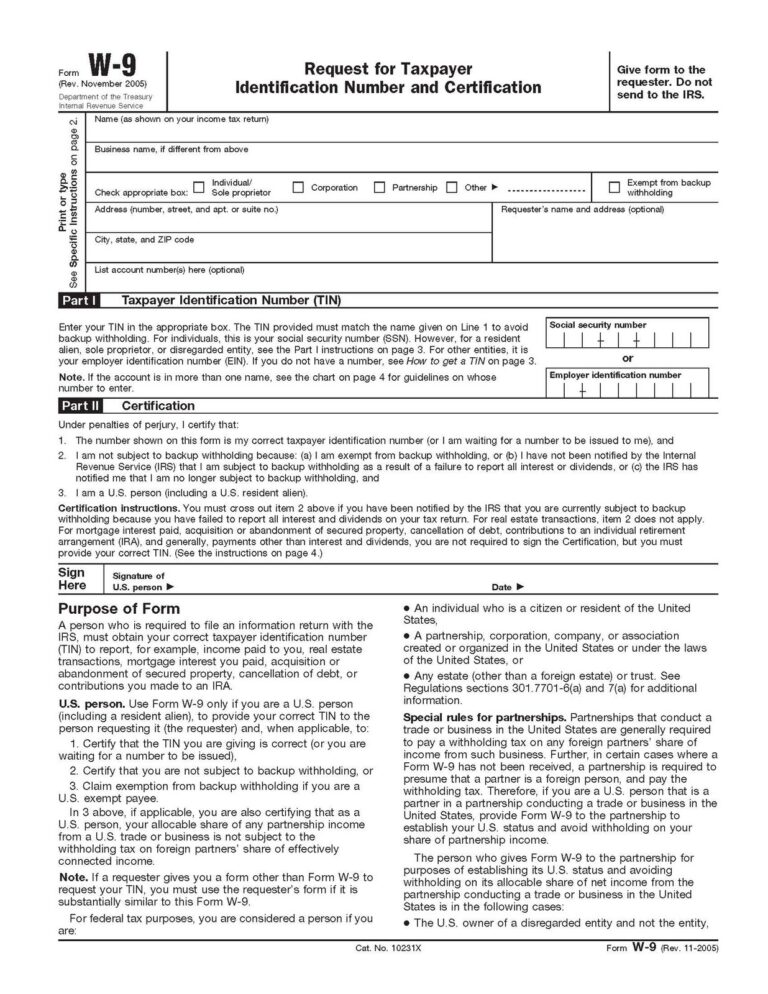

This section gathers basic personal information about the taxpayer, such as their name, address, and Social Security number.

Income

This section includes several subsections that collect information about the taxpayer’s income from various sources, such as wages, salaries, tips, and self-employment income.

Adjustments to Income

This section allows the taxpayer to make adjustments to their income, such as deducting certain expenses or contributions.

Taxable Income

This section calculates the taxpayer’s taxable income by subtracting the adjustments to income from their total income.

Tax

This section calculates the taxpayer’s tax liability based on their taxable income.

Credits

This section allows the taxpayer to claim certain tax credits, such as the child tax credit or the earned income tax credit.

Payments

This section includes information about any payments the taxpayer has made towards their tax liability, such as withholding from their paycheck or estimated tax payments.

Refund or Amount You Owe

This section calculates the taxpayer’s refund or the amount they owe based on the difference between their tax liability and their payments.

Filling Out the Form

Filling out the IRS Form 15400 requires careful attention to detail and adherence to specific guidelines. Here are some general tips to consider:

* Use black ink or typewritten text.

* Write clearly and legibly.

* Complete all applicable sections of the form.

* If a section does not apply to you, write “N/A” or “None” instead of leaving it blank.

* Attach any necessary supporting documents.

Section-by-Section Instructions

Section 1: Taxpayer Information

* Provide your full name, address, and Social Security number.

* Indicate your filing status (single, married, etc.).

* If you are filing jointly, include your spouse’s information as well.

Section 2: Income

* Report all taxable income, including wages, salaries, dividends, and interest.

* Use the appropriate schedules to report specific types of income, such as Schedule C for business income or Schedule D for capital gains.

Section 3: Adjustments to Income

* Deduct certain expenses from your income, such as student loan interest or contributions to retirement accounts.

* These adjustments reduce your taxable income before calculating your tax liability.

Section 4: Taxable Income

* Calculate your taxable income by subtracting your adjustments to income from your total income.

* This amount is used to determine your tax liability.

Section 5: Tax

* Calculate your tax liability based on your taxable income and the applicable tax rates.

* Use the tax tables or software to determine the amount of tax you owe.

Section 6: Payments and Credits

* Report any estimated tax payments, tax credits, or other payments that reduce your tax liability.

* These amounts are subtracted from your total tax liability to determine your refund or balance due.

Section 7: Other Information

* Provide additional information, such as your occupation, health insurance coverage, and any dependents.

* This information is used for various purposes, such as determining eligibility for certain tax credits or programs.

Common Errors to Avoid

* Leaving sections blank or incomplete.

* Making math errors or transposing numbers.

* Failing to attach necessary supporting documents.

* Filing late or missing the deadline.

* Providing incorrect or fraudulent information.

Filing and Submission

You’ve got a few options for getting your Form 15400 to the IRS. You can file it electronically, by mail, or through a tax preparer.

Filing Deadlines

The deadline for filing Form 15400 is April 15th. If you file late, you may have to pay penalties and interest.

Filing Electronically

Filing electronically is the quickest and easiest way to file your Form 15400. You can use the IRS e-file system or a tax software program.

Filing by Mail

If you file by mail, you’ll need to send your form to the IRS address for your state. You can find the address on the IRS website.

Filing Through a Tax Preparer

If you’re not comfortable filing your taxes yourself, you can hire a tax preparer to do it for you. Tax preparers can help you fill out your form and make sure it’s filed correctly.

FAQs

Q: Where can I find the official IRS Form 15400 for download?

A: You can download the official IRS Form 15400 from the IRS website (www.irs.gov) or from authorized third-party providers.

Q: Is there a fee to download the IRS Form 15400?

A: No, the IRS Form 15400 is available for free download from the IRS website and authorized third-party providers.

Q: What are the common errors to avoid when filling out the IRS Form 15400?

A: Common errors include incorrect Social Security numbers, missing or incomplete information, and mathematical errors. Carefully review your form before submitting it to avoid delays or penalties.

Q: Can I file the IRS Form 15400 electronically?

A: Yes, you can file the IRS Form 15400 electronically using the IRS e-file system or through authorized tax software.

Q: What is the deadline for filing the IRS Form 15400?

A: The deadline for filing the IRS Form 15400 is typically April 15th. However, if you file for an extension, you have until October 15th to submit your form.