Free 15227 Irs Form Download: A Comprehensive Guide to Understanding and Filing

Navigating the complexities of tax filing can be daunting, but with the right resources, it doesn’t have to be. IRS Form 15227 plays a crucial role in reporting certain types of income and expenses. In this comprehensive guide, we’ll delve into the purpose, eligibility, and benefits of downloading this form online. We’ll also provide step-by-step instructions on how to download and complete it accurately, ensuring a seamless filing experience.

Whether you’re a seasoned tax filer or new to the process, this guide will empower you with the knowledge and confidence to tackle IRS Form 15227 effectively. So, let’s dive right in and explore the ins and outs of this essential tax document.

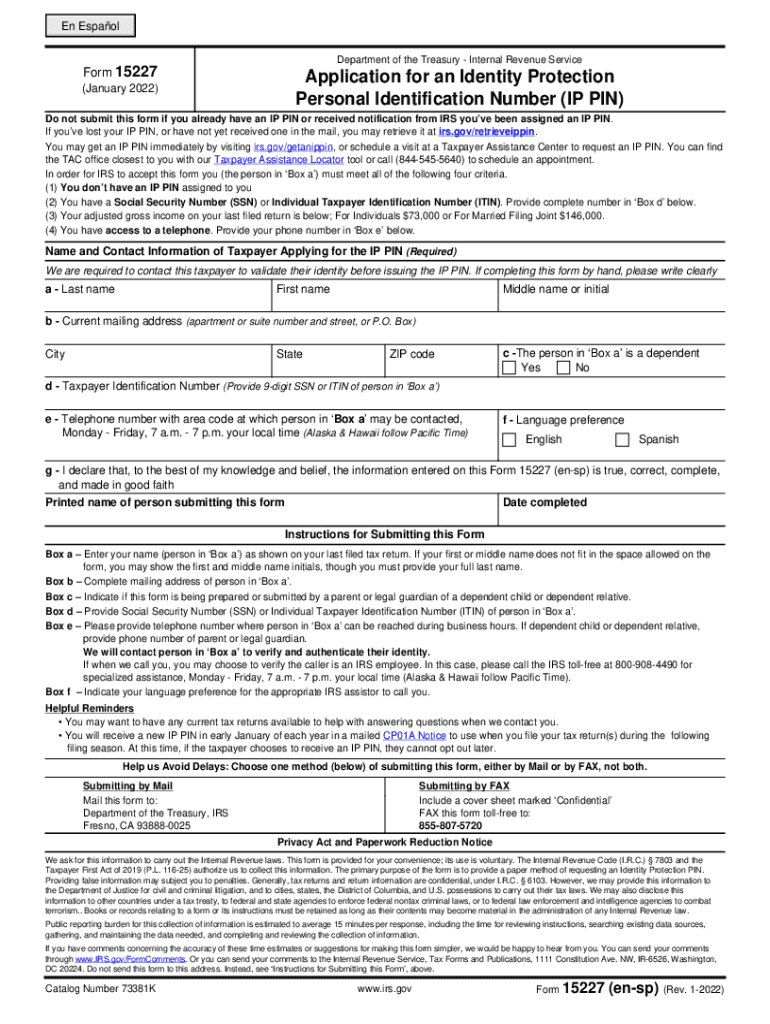

Form Overview

IRS Form 15227, Application for an IRS Determination for Tax-Exempt Status, is a document that you need to file with the Internal Revenue Service (IRS) if you want to establish your organization as a tax-exempt entity. Once your organization is recognized by the IRS as tax-exempt, it means that you will not have to pay taxes on your income. There are several different types of tax-exempt organizations, including charities, churches, and educational institutions.

Eligibility Criteria

In order to be eligible to file Form 15227, your organization must meet certain requirements. These requirements include:

- Your organization must be a corporation, trust, or unincorporated association.

- Your organization must be organized and operated exclusively for exempt purposes.

- Your organization must not be organized or operated for profit.

- Your organization must not be a private foundation.

Benefits of Downloading

Downloading the IRS Form 15227 online is a breeze, innit? It’s the ultimate time-saver and hassle-free way to get your hands on the form. No more trekking to the post office or waiting for it to arrive in the mail. Just a few clicks, and you’re good to go. Plus, it’s accessible 24/7, so you can download it whenever you need it, whether it’s midnight or midday.

Convenience and Accessibility

The convenience of digital downloads is off the charts. No need to worry about losing the form or having it damaged in transit. It’s safely stored on your computer or device, ready to be accessed anytime, anywhere. And because it’s a digital file, you can easily share it with others if needed. It’s like having a superpower in your pocket!

Downloading Process

Downloading the IRS Form 15227 is a straightforward process that can be completed in just a few simple steps. By following these steps, you can ensure that you have the most up-to-date version of the form and can avoid any potential errors or delays in processing your tax return.

To begin, you will need to access the official IRS website. You can do this by typing “IRS.gov” into your web browser’s address bar or by clicking on the following link: https://www.irs.gov. Once you are on the IRS website, hover over the “Forms” tab located at the top of the page and select “Forms, Instructions & Publications” from the drop-down menu. On the next page, scroll down and click on the link for “Form 15227.” This will take you to the official IRS website for Form 15227, where you can download the form in PDF format.

Step-by-Step Instructions

- Open your web browser and go to the official IRS website: https://www.irs.gov.

- Hover over the “Forms” tab at the top of the page and select “Forms, Instructions & Publications” from the drop-down menu.

- Scroll down and click on the link for “Form 15227.”

- Click on the “Download” button to download the form in PDF format.

- Save the PDF file to your computer.

Form Features

IRS Form 15227 is a crucial document for reporting the sale of your home and any gain or loss you may have made. The form comprises several key sections and fields that must be completed accurately to ensure a smooth and hassle-free tax filing process.

Completing the form with precision is of utmost importance as it forms the basis for calculating your capital gains or losses. These figures directly impact your tax liability, so it’s essential to provide accurate information to avoid any discrepancies or potential penalties.

Key Sections and Fields

The form is divided into distinct sections, each designed to collect specific information. Here’s a breakdown of the key sections and fields:

- Part I: Sale or Exchange of Principal Residence – This section captures details about the sale of your primary residence, including the date of sale, purchase price, and selling price.

- Part II: Gain or Loss – This section calculates your capital gain or loss based on the information provided in Part I. It also includes provisions for claiming exclusions and adjustments.

- Part III: Reporting of Real Estate Agent Commissions – If you used a real estate agent to facilitate the sale, you must report their commission in this section.

- Part IV: Other Information – This section collects additional information, such as the number of years you owned and lived in the property.

Filing Options

Yo, check it, there are a few ways you can file your IRS Form 15227, innit? Whether you’re feeling old-school or wanna go digital, we got you covered, fam.

Let’s break it down, shall we?

Electronic Filing

If you’re all about speed and convenience, electronic filing is the bomb. It’s quick, easy, and you can do it from the comfort of your own crib. Plus, you’ll get confirmation that your form has been received, so you can chill and not stress about it.

Paper Filing

Now, if you’re more of a traditionalist, paper filing is still an option. Just print out the form, fill it in, and send it to the IRS by post. It’s a bit slower than electronic filing, but it’s still a valid way to get the job done.

Additional Resources

For further assistance with Form 15227, check out these useful links:

If you have any questions or need help filing your form, don’t hesitate to reach out to the IRS for assistance.

IRS Contact Information

You can contact the IRS by phone, mail, or online:

- Phone: 1-800-829-1040

- Mail: Internal Revenue Service, P.O. Box 25044, Cincinnati, OH 45225

- Online: IRS website

FAQ Summary

What are the eligibility criteria for filing IRS Form 15227?

To file IRS Form 15227, you must meet specific criteria, such as reporting foreign trusts or foreign-related transactions.

Where can I find the official IRS website to download Form 15227?

The official IRS website for downloading Form 15227 is www.irs.gov.

Can I file IRS Form 15227 electronically?

Yes, you can file IRS Form 15227 electronically using the IRS e-file system.