Free 13 G Form Download: A Comprehensive Guide

Navigating the complexities of financial reporting can be a daunting task, but it doesn’t have to be. With the advent of digital resources, accessing essential forms like the Form 13G has become easier than ever. In this guide, we’ll delve into the world of Form 13G, exploring its various types, eligibility criteria, benefits, and the step-by-step process for downloading it.

Form 13G is a crucial document for individuals and organizations looking to report their ownership of certain securities. Understanding its purpose and the process involved in obtaining it can save you time, effort, and ensure compliance with regulatory requirements.

Forms Available for Download

There are two main types of Form 13G available for download: Form 13G and Form 13G (ST).

Form 13G is used by individuals and Hindu Undivided Families (HUFs) to self-declare that their income is below the taxable limit and they are not required to file an income tax return.

Form 13G (ST) is used by senior citizens (aged 60 years or above) to self-declare that their income is below the taxable limit and they are not required to file an income tax return.

Purpose of Each Form

The purpose of Form 13G is to inform the Income Tax Department that the individual or HUF does not have any taxable income and is not required to file an income tax return.

The purpose of Form 13G (ST) is to inform the Income Tax Department that the senior citizen does not have any taxable income and is not required to file an income tax return.

Eligibility Criteria

To download Form 13G, certain eligibility criteria must be met. These criteria are designed to ensure that only those who are eligible can access and use the form.

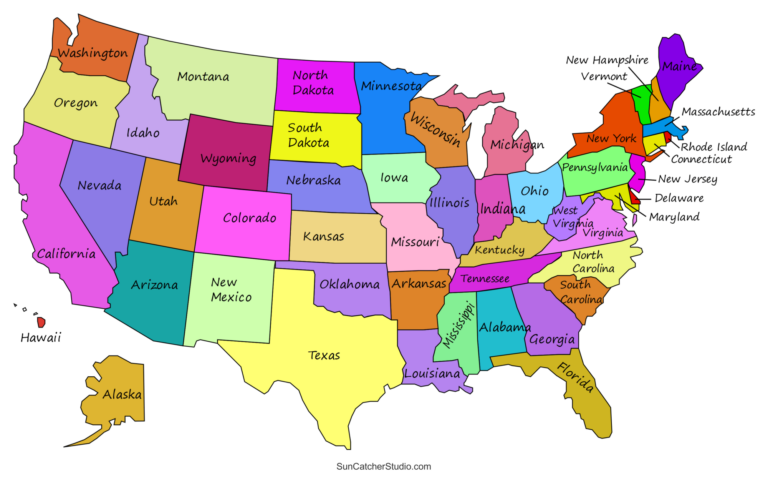

The eligibility criteria vary depending on whether the applicant is an individual or an organization. For individuals, they must be a resident of India and have a valid PAN card. For organizations, they must be registered under the Income Tax Act, 1961, and have a valid TAN (Tax Deduction and Collection Account Number).

Determining Eligibility

The process for determining eligibility is straightforward. Individuals can check their eligibility by visiting the Income Tax Department’s website and entering their PAN card details. Organizations can check their eligibility by visiting the same website and entering their TAN details.

Benefits of Downloading Form 13G

Downloading Form 13G offers a range of advantages, making it a smart choice for individuals and organizations alike. This digital form streamlines the donation process, saving time and effort, and provides a secure and convenient way to manage donations.

Convenience and Time-saving

Downloading Form 13G eliminates the need for manual filling and submission, which can be time-consuming and prone to errors. The digital format allows you to fill in the form at your convenience, without the hassle of printing, signing, and mailing. This saves you valuable time and reduces the risk of delays or lost paperwork.

Digital Storage and Accessibility

Having a digital copy of Form 13G provides easy access to your donation records. You can store the form securely on your computer or cloud storage, making it readily available for future reference or amendments. This eliminates the need for physical storage and the risk of losing important documents.

Environmental Friendliness

Downloading Form 13G contributes to environmental sustainability by reducing paper consumption and eliminating the need for postage. By opting for the digital format, you play a part in preserving natural resources and reducing your carbon footprint.

Procedure for Downloading Form 13G

Downloading Form 13G is a breeze, bruv! Follow these sick steps and you’ll be sorted in no time.

First, head over to the Income Tax Department’s website. Once you’re there, click on the “Forms” tab and then select “Form 13G” from the dropdown menu.

Step 1: Navigate to the Form 13G Download Page

On the Form 13G download page, you’ll see a link to download the PDF version of the form. Click on that link to start the download.

Alternatively, you can click on the “Online Form” link to fill out the form online. Once you’ve filled out the form, you can download it as a PDF or print it out.

Step 2: Choose Your Preferred Download Method

Once you’ve downloaded the form, open it up and fill it out. Make sure you fill out all the required fields and sign the form before submitting it.

Step 3: Fill Out and Submit the Form

You can submit the form online or by mail. If you’re submitting it online, you’ll need to scan the form and upload it to the Income Tax Department’s website.

If you’re submitting it by mail, you’ll need to send it to the address provided on the form.

Step 4: Submit the Form

FAQ Summary

What types of Form 13G are available for download?

There are two main types of Form 13G: Form 13G/A and Form 13G/B. Form 13G/A is used to report beneficial ownership of more than 5% of a class of equity securities, while Form 13G/B is used to report beneficial ownership of more than 5% of a class of debt securities.

Who is eligible to download Form 13G?

Individuals or organizations that are required to file a Form 13G with the Securities and Exchange Commission (SEC) are eligible to download the form.

What are the benefits of downloading Form 13G?

Downloading Form 13G provides several benefits, including the ability to save time and effort, reduce the risk of errors, and have a digital copy for easy access and storage.

How do I download Form 13G?

You can download Form 13G from the SEC’s website. The process involves navigating to the SEC’s website, selecting the “Forms” tab, and then choosing Form 13G from the list of available forms.