Free 1172-2 Form Download: A Comprehensive Guide to Accurate Tax Reporting

Navigating the complexities of tax reporting can be daunting, but understanding and completing the 1172-2 form is crucial for businesses and individuals alike. This form plays a significant role in ensuring accurate tax reporting, and this guide will provide you with a comprehensive overview of the 1172-2 form, including its purpose, download process, completion requirements, and common errors to avoid.

Whether you’re a seasoned tax professional or an individual seeking guidance, this guide will empower you with the knowledge and resources necessary to successfully download, complete, and file the 1172-2 form.

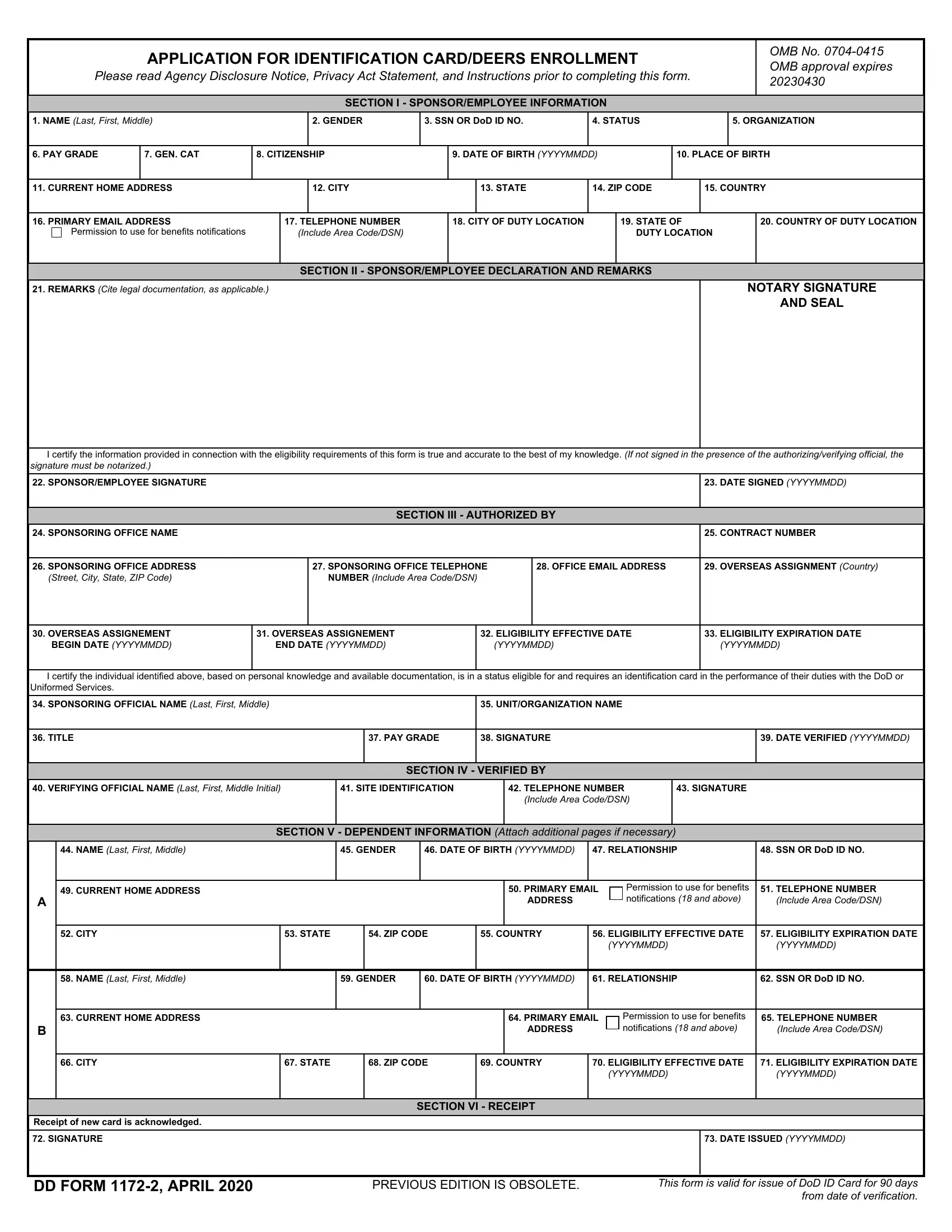

Form Description

The 1172-2 form is a vital document used for reporting the sale or exchange of certain types of property. It’s a crucial part of the tax reporting process, providing essential information to the tax authorities.

Specifically, the 1172-2 form is utilized when reporting the sale or exchange of real estate, stocks, bonds, and other capital assets. By providing details of the transaction, including the purchase price, selling price, and any gains or losses incurred, the form assists in determining the taxpayer’s tax liability.

Relevance in Tax Reporting

The 1172-2 form plays a significant role in tax reporting, ensuring that individuals and businesses accurately report their income and expenses. By providing detailed information about the sale or exchange of assets, the form helps prevent underreporting of gains and overreporting of losses.

Moreover, the form allows tax authorities to verify the accuracy of reported transactions, reducing the risk of tax evasion and ensuring fair and equitable tax collection.

Download Process

Downloading the 1172-2 form from the IRS website is a straightforward process that can be completed in a few simple steps.

Follow these steps to download the form:

Step 1

Visit the IRS website at www.irs.gov.

Step 2

In the search bar, type “Form 1172-2” and press enter.

Step 3

Click on the “Forms” tab in the search results.

Step 4

Scroll down to the “Form 1172-2” section and click on the “Download PDF” button.

Step 5

The 1172-2 form will be downloaded to your computer.

Form Completion

Filling out the 1172-2 form properly is crucial for a successful application. Read each section carefully and ensure all information is accurate and complete.

The form consists of several sections, each requiring specific details. Let’s break it down:

Section 1: Personal Information

This section gathers basic personal information such as name, address, contact details, and citizenship status. Ensure all information matches your official documents.

Section 2: Eligibility

Here, you must provide evidence of your eligibility to apply. This could include documents proving your financial status, employment, or residency.

Section 3: Dependents

If you have any dependents, you must list their names, ages, and relationship to you. This information is essential for determining your eligibility for certain benefits.

Section 4: Signature

Once you’ve completed the form, sign and date it in the designated area. This serves as your confirmation of the information provided.

Common Errors

Completing the 1172-2 form accurately is crucial to avoid errors that can delay processing or lead to rejection. Some common errors to watch out for include:

Mistakes to Avoid

- Incorrect Social Security Number (SSN): Ensure the SSN provided on the form matches the individual’s official records to avoid delays or rejections.

- Incomplete or Inaccurate Address: Provide a complete and up-to-date address, including street number, street name, city, state, and zip code. Missing or incorrect information can cause mail delivery issues.

- Missing Signature: The 1172-2 form requires a valid signature. Omitting or providing an invalid signature can result in the form being rejected.

- Illegible Handwriting: If completing the form by hand, write legibly to ensure all information can be processed accurately. Inaccurate or unclear handwriting can lead to errors or delays.

- Incomplete or Inconsistent Dates: Provide accurate and consistent dates throughout the form, including the date of birth, date of application, and any other relevant dates. Discrepancies or missing dates can cause confusion and potential issues.

Additional Resources

Innit, fam? Check out these bangin’ resources from the IRS for more info on the 1172-2 form:

These bits and bobs will help you get the lowdown on everything you need to know.

IRS Publication 1783

This cheeky wee guide is packed with all the juicy details about the 1172-2 form, including who needs to file it and how to fill it out.

IRS Form 1172-2 Instructions

These are the official instructions from the IRS, so you can be sure you’re getting the straight dope. They’ll walk you through every step of filling out the form.

IRS FAQs on Form 1172-2

Got a burning question about the 1172-2 form? Chances are, the IRS has answered it in their FAQs. Check ’em out!

FAQs

What is the purpose of the 1172-2 form?

The 1172-2 form, also known as the Schedule K-1 (Form 1120-S), is used to report the income, deductions, credits, and other tax information of S corporations to their shareholders. It is an essential document for shareholders to accurately report their share of the S corporation’s income and expenses on their individual tax returns.

Where can I download the 1172-2 form?

You can download the 1172-2 form from the Internal Revenue Service (IRS) website at www.irs.gov. Go to the “Forms and Publications” section and search for “Form 1120-S.” You can also order the form by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

When is the deadline for filing the 1172-2 form?

The deadline for filing the 1172-2 form is the same as the deadline for filing the S corporation’s tax return, which is generally March 15th. However, if the S corporation files an extension for its tax return, the deadline for filing the 1172-2 form is extended to September 15th.

What are some common errors to avoid when completing the 1172-2 form?

Some common errors to avoid when completing the 1172-2 form include:

- Incorrectly reporting the shareholder’s name, address, or Social Security number

- Failing to report all of the shareholder’s income and expenses

- Making mathematical errors

- Not signing the form