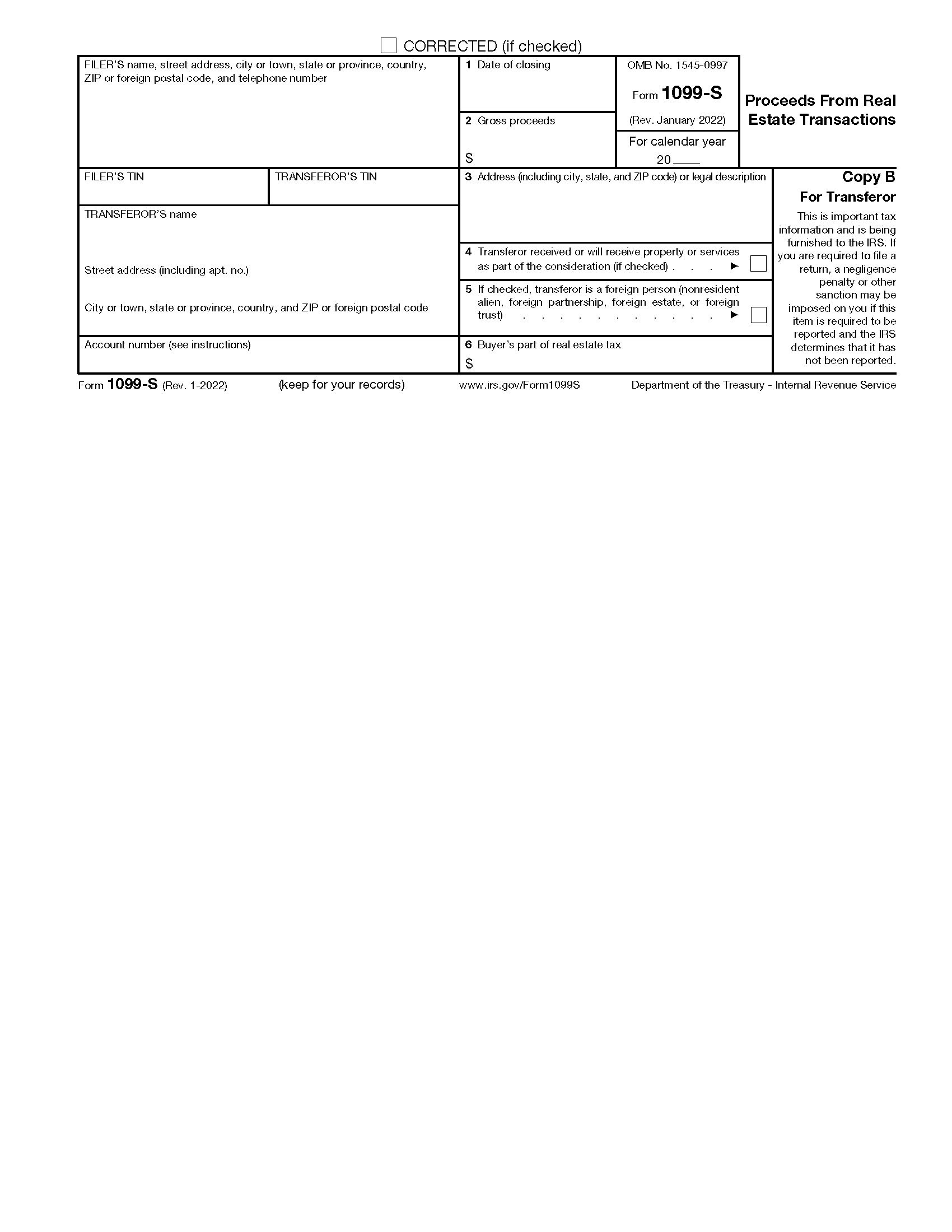

Free 1099s 2024 Form Download: A Comprehensive Guide

Navigating the complexities of tax season can be daunting, especially when it comes to filing 1099 forms. Fortunately, there’s a cost-effective solution: free 1099s forms for 2024. In this comprehensive guide, we’ll delve into the significance of these forms, provide tips on how to locate and download them, and explore the benefits and considerations associated with their use.

1099 forms are essential for reporting income earned from non-employee sources, such as freelance work, self-employment, and dividends. Having free access to these forms empowers individuals and businesses to fulfill their tax obligations without incurring additional expenses. Moreover, the availability of various types of 1099 forms ensures that specific income categories are accurately reported.

Alternative Options for Obtaining 1099s Forms

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg?w=700)

There are numerous options for acquiring 1099s forms, including purchasing paid versions from reputable providers. Paid forms offer various advantages, such as enhanced features and streamlined processes.

Different providers offer distinct features and pricing structures for their paid 1099s forms. It’s crucial to compare these aspects to determine the best fit for your specific needs and budget.

Paid 1099s Form Providers

Numerous reputable providers offer paid 1099s forms, each with its unique set of features and pricing. Consider the following factors when evaluating providers:

- Features: Assess the features offered by each provider, such as electronic filing, error checking, and support for multiple form types.

- Cost: Compare the pricing structures of different providers to find the most cost-effective option that meets your needs.

- Reputation: Research the reputation of each provider by reading reviews and testimonials from previous customers.

When to Use Paid 1099s Forms

Using paid 1099s forms may be advantageous in certain situations:

- Large Volume of Forms: If you need to file a substantial number of 1099s forms, paid forms can streamline the process and reduce errors.

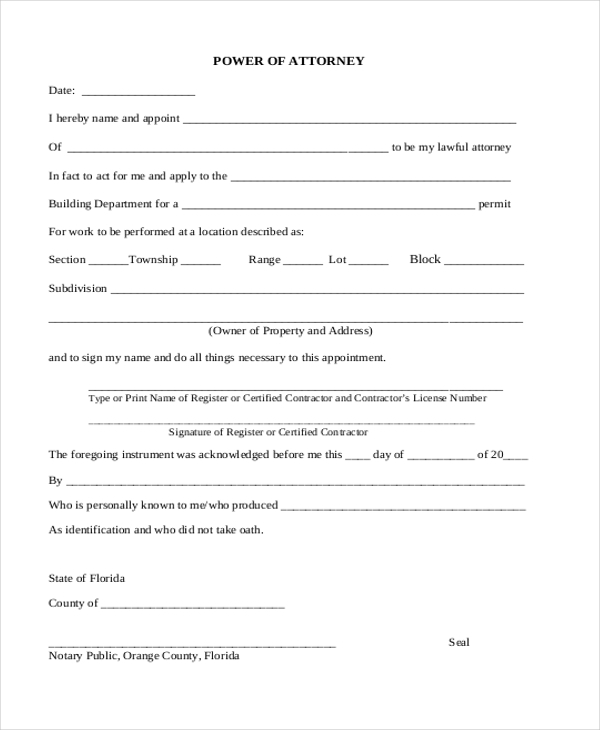

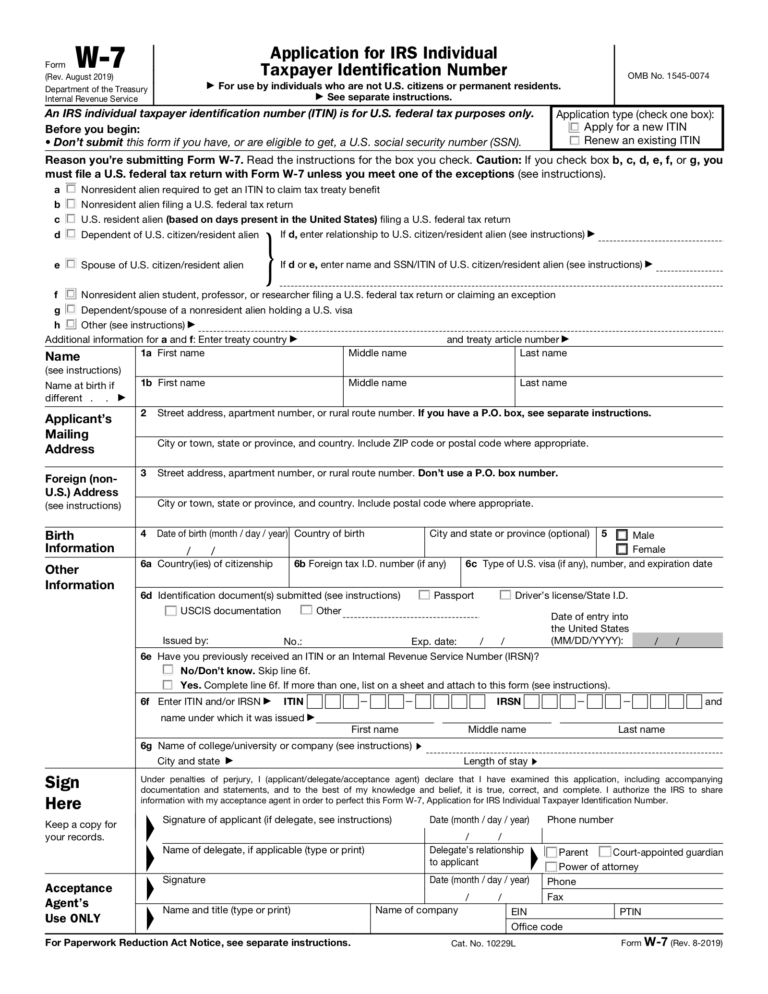

- Complex Tax Situations: Paid forms often provide support for complex tax situations, such as non-resident aliens or multiple businesses.

- Electronic Filing: Paid forms typically offer electronic filing capabilities, which can save time and ensure timely submission.

Conclusion

In summary, obtaining free 1099s forms is a simple and straightforward process that can be done through various methods. By following the steps Artikeld in this article, you can ensure that you have the necessary forms to accurately report your income and avoid any potential penalties.

It’s always advisable to seek professional advice from a tax expert if you have any specific questions or concerns regarding your tax situation. They can provide you with personalized guidance and help you navigate the complexities of tax filing.

Remember, using free 1099s forms is a great way to save money on your taxes. However, it’s important to ensure that you are using the correct forms and that you are filling them out accurately. By following the tips provided in this article, you can ensure that you are getting the most out of your free 1099s forms.

Common Queries

Can I use free 1099s forms for both personal and business purposes?

Yes, free 1099s forms can be used for both personal and business purposes, provided that the information reported is accurate and complete.

What are the most common types of 1099 forms?

The most common types of 1099 forms include 1099-NEC (Nonemployee Compensation), 1099-MISC (Miscellaneous Income), 1099-INT (Interest Income), and 1099-DIV (Dividend Income).

Where can I find free 1099s forms online?

Free 1099s forms can be downloaded from the IRS website, as well as from various tax software providers and online resources.