Free 1099 Forms For 2024 Download: Your Guide to Easy Tax Reporting

As a business owner or independent contractor, navigating the complexities of tax reporting can be a daunting task. However, when it comes to 1099 forms, understanding their significance and accessing free resources can simplify the process. This comprehensive guide will provide you with everything you need to know about free 1099 forms for 2024, empowering you to fulfill your tax obligations with ease and accuracy.

1099 forms serve as crucial documents for reporting non-employee income to the Internal Revenue Service (IRS). Whether you’re a freelancer, gig worker, or contractor, obtaining the correct 1099 form is essential for proper tax filing. By leveraging free 1099 forms, you can save time, money, and ensure compliance with tax regulations.

Types of 1099 Forms

Different types of 1099 forms exist, each serving a specific purpose. Understanding the purpose of each type is crucial for accurate tax reporting.

The following table provides an overview of the most common types of 1099 forms, along with their respective purposes:

| 1099 Form | Purpose |

|---|---|

| 1099-NEC | Nonemployee compensation (self-employment income) |

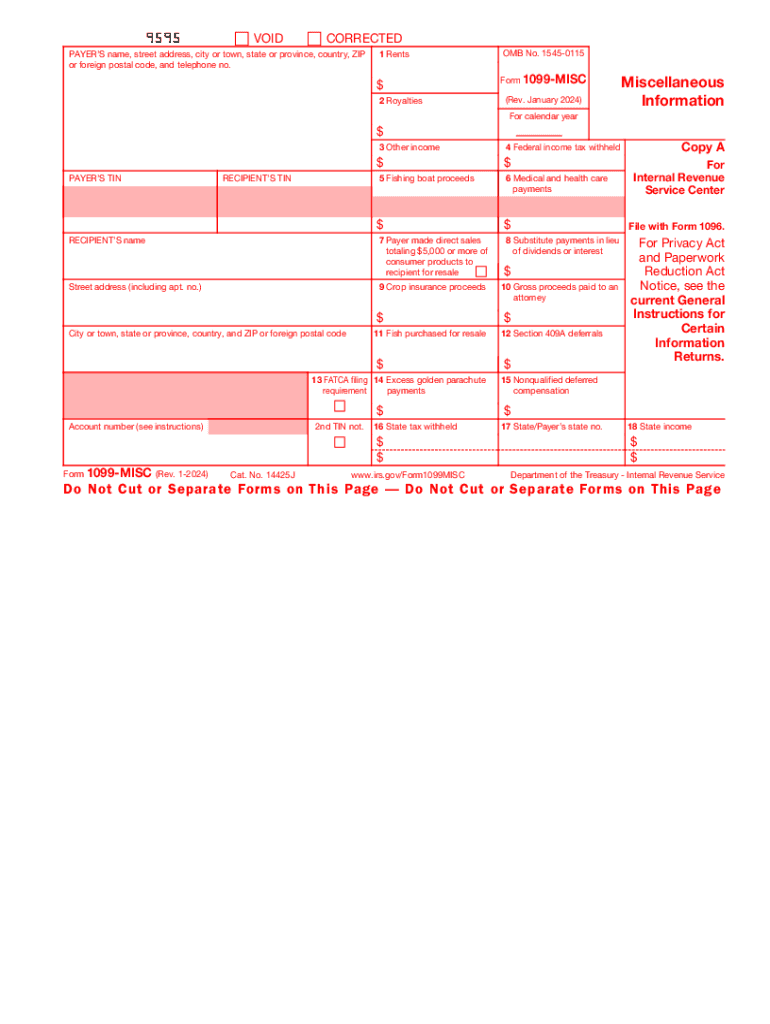

| 1099-MISC | Miscellaneous income (such as rent, prizes, and awards) |

| 1099-INT | Interest income (such as from savings accounts and bonds) |

| 1099-DIV | Dividend income (such as from stocks and mutual funds) |

| 1099-B | Proceeds from broker and barter exchange transactions |

| 1099-K | Merchant card and third-party network transactions |

| 1099-S | Proceeds from real estate transactions |

| 1099-R | Distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts |

| 1099-C | Cancellation of debt |

It’s important to note that this list is not exhaustive, and other types of 1099 forms may exist for specific situations or industries.

Benefits of Downloading Free 1099 Forms

Free 1099 forms offer several advantages that can simplify your tax filing process. By downloading these forms at no cost, you can save money and gain convenient access to the necessary documents.

Cost Savings

One of the most significant benefits of downloading free 1099 forms is the cost savings. Unlike purchasing pre-printed forms, which can be expensive, downloading digital versions allows you to print only the forms you need, saving you money on printing and shipping costs.

Ease of Access

Free 1099 forms are readily available online, making them easy to access and download. You can find these forms on various websites, including government agencies and tax preparation software providers. This convenience saves you the hassle of searching for and purchasing forms at a physical location.

How to Download Free 1099 Forms

Downloading free 1099 forms is a quick and easy process. Here are the steps on how to do it:

- Go to the official website of the Internal Revenue Service (IRS) at www.irs.gov.

- Click on the “Forms & Publications” tab at the top of the page.

- In the search bar, type “1099 forms” and press enter.

- A list of all available 1099 forms will appear. Click on the link for the form you need.

- On the form’s page, click on the “Download” button.

- The form will be downloaded to your computer in PDF format.

Tips for Using Free 1099 Forms

Filling out 1099 forms accurately is crucial to avoid penalties and ensure timely tax filing. Here are some tips to help you navigate the process smoothly:

- Gather accurate information: Collect all necessary data, such as the recipient’s name, address, taxpayer identification number (TIN), and the amount paid. Ensure the information matches the recipient’s records.

- Use the correct form: There are different types of 1099 forms for various income types. Select the appropriate form based on the nature of the payment.

- Complete all sections: Fill out all required fields on the form, including the recipient’s information, payment details, and your business information. Omission of crucial information can delay processing or result in penalties.

- Double-check for errors: Carefully review the completed form for any errors or inconsistencies. Verify the accuracy of the amounts, TINs, and other details before submitting.

- Submit on time: Adhere to the IRS deadlines for filing 1099 forms. Late submissions may attract penalties.

Common Mistakes to Avoid

To ensure accuracy and avoid common pitfalls, steer clear of these mistakes:

- Incorrect recipient information: Verify the recipient’s name, address, and TIN thoroughly. Errors in these details can lead to delayed or rejected payments.

- Mixing up 1099 forms: Use the appropriate 1099 form based on the type of income paid. For instance, 1099-MISC is used for miscellaneous income, while 1099-NEC is specifically for nonemployee compensation.

- Incomplete or missing information: Leaving sections blank or providing incomplete information can result in processing delays or penalties. Ensure all required fields are filled out.

- Late filing: Submitting 1099 forms after the IRS deadline can incur penalties. Mark the deadlines on your calendar to avoid missing them.

Submitting 1099 Forms

There are several ways to submit 1099 forms:

- Electronically: File 1099 forms electronically through the IRS website or authorized e-filing providers. This method is secure, efficient, and allows for easy tracking of submissions.

- By mail: You can mail the completed 1099 forms to the designated IRS address. Ensure you include a self-addressed stamped envelope for the IRS to send you a confirmation of receipt.

- Through a tax professional: If you prefer professional assistance, consider hiring a tax preparer or accountant to handle the 1099 filing process for you.

By following these tips and avoiding common mistakes, you can ensure accurate and timely filing of your 1099 forms, reducing the risk of penalties and maintaining compliance with tax regulations.

Additional Resources

Need more info on 1099 Forms? Check out these helpful resources.

Websites and Articles

- IRS website: https://www.irs.gov/forms-pubs/about-form-1099

- Forbes article: Understanding Form 1099 and Its Importance for Tax Filing

- The Balance Small Business article: What Is a 1099 Form?

Videos

- YouTube video: How to Fill Out a 1099 Form

- LinkedIn Learning video: Understanding Form 1099

Common Queries

What are the different types of 1099 forms?

There are various types of 1099 forms, each designated for specific types of income. Some common forms include 1099-NEC for nonemployee compensation, 1099-MISC for miscellaneous income, 1099-INT for interest income, and 1099-DIV for dividend income.

Where can I find free 1099 forms to download?

You can access free 1099 forms from various sources, including the IRS website, tax software providers, and online resources. Ensure you obtain the most recent version of the forms to align with the latest tax regulations.

What are the benefits of using free 1099 forms?

Free 1099 forms offer several advantages, including cost savings, ease of access, and accuracy. By downloading these forms, you can eliminate expenses associated with purchasing pre-printed forms and gain instant access to printable templates.

How do I fill out a 1099 form accurately?

To ensure accuracy when filling out a 1099 form, carefully follow the instructions provided on the form. Ensure all required fields are completed with the correct information, including the recipient’s name, address, taxpayer identification number, and the amount of income paid.

What is the deadline for submitting 1099 forms?

The deadline for submitting 1099 forms to the IRS and recipients is generally January 31st of the year following the tax year in which the income was earned. However, it’s advisable to consult the IRS website for any updates or changes to the filing deadlines.