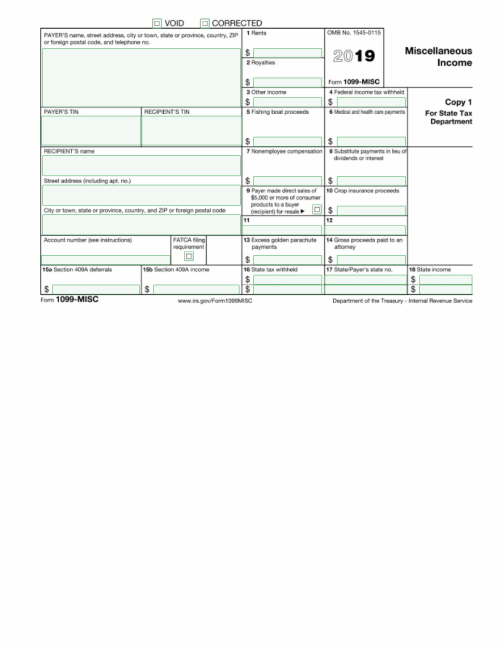

Free 1099 Forms Due Download: A Comprehensive Guide

1099 forms are essential for businesses and individuals to report income earned from non-employee work. Understanding the purpose, types, and due dates of these forms is crucial for accurate tax reporting. This guide will provide you with a comprehensive overview of 1099 forms, where to access free downloadable versions, and how to complete and submit them on time.

1099 forms are used to report various types of income, such as self-employment earnings, freelance work, and payments to independent contractors. Businesses are responsible for issuing 1099 forms to individuals who meet certain criteria. These forms provide valuable information to the IRS and help ensure that all income is properly accounted for.

Downloading 1099 Forms

Downloading free 1099 forms from websites is a quick and easy process. Here are the steps involved:

Locating 1099 Forms Online

- Use a search engine to find websites that offer free 1099 forms.

- Visit the websites and browse their 1099 form library.

- Select the specific 1099 form you need.

Downloading the 1099 Form

- Click on the “Download” button or link.

- Choose the file format you want to download the form in (e.g., PDF, Word, Excel).

- Save the form to your computer or device.

Security Considerations

When downloading forms online, it’s important to take security precautions:

- Only download forms from reputable websites.

- Use a secure internet connection.

- Scan the downloaded form for viruses before opening it.

FAQ

What are the different types of 1099 forms?

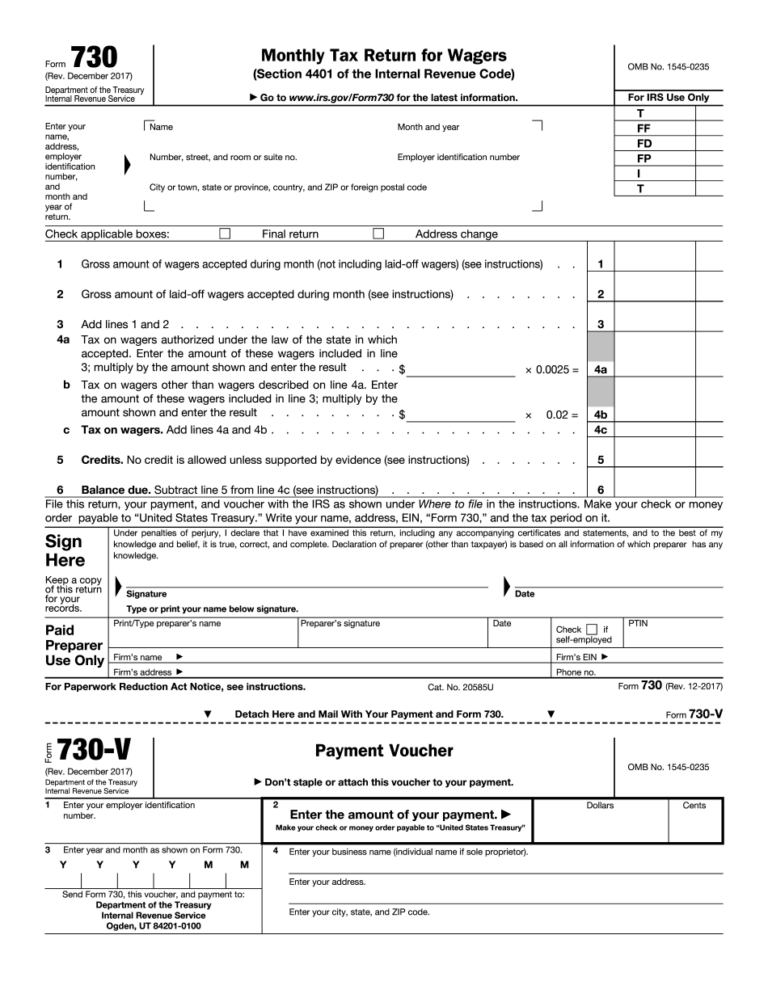

There are several types of 1099 forms, each used for a specific purpose. Some common types include 1099-NEC (Nonemployee Compensation), 1099-MISC (Miscellaneous Income), and 1099-INT (Interest Income).

Who is required to file a 1099 form?

Businesses are required to file 1099 forms for individuals who meet certain criteria. For example, if you pay a nonemployee $600 or more for services performed during the year, you must issue a 1099-NEC form.

What are the due dates for filing 1099 forms?

The due date for filing 1099 forms is generally January 31st. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Where can I download free 1099 forms?

You can download free 1099 forms from the IRS website or from various online resources. Be sure to choose a reputable source to ensure that the forms are accurate and up-to-date.