Free 1099 Forms 2024 Download: Your Comprehensive Guide

Filing taxes can be a daunting task, but it doesn’t have to be. One crucial aspect of tax preparation is Form 1099, which reports income earned from sources other than your primary employer. To simplify the process, the Internal Revenue Service (IRS) provides free downloadable 1099 forms to help you meet your tax obligations effortlessly.

This comprehensive guide will walk you through everything you need to know about Free 1099 Forms 2024 Download, from understanding their purpose and types to downloading, filling out, and submitting them. By leveraging this valuable resource, you can ensure accuracy, save time, and navigate tax season with confidence.

Free 1099 Forms 2024 Download

Yo, listen up! Form 1099 is a bit of a biggie, innit? It’s like a tax report that tells the taxman how much cheddar you’ve earned from side hustles and the like. You know, the dough that’s not coming from your main job.

Now, these 1099s have been around for a hot minute, since the early 1900s. Back then, they were all about reporting income from dividends and interest. But over time, they’ve evolved to cover a whole range of different types of income.

Different Types of Form 1099

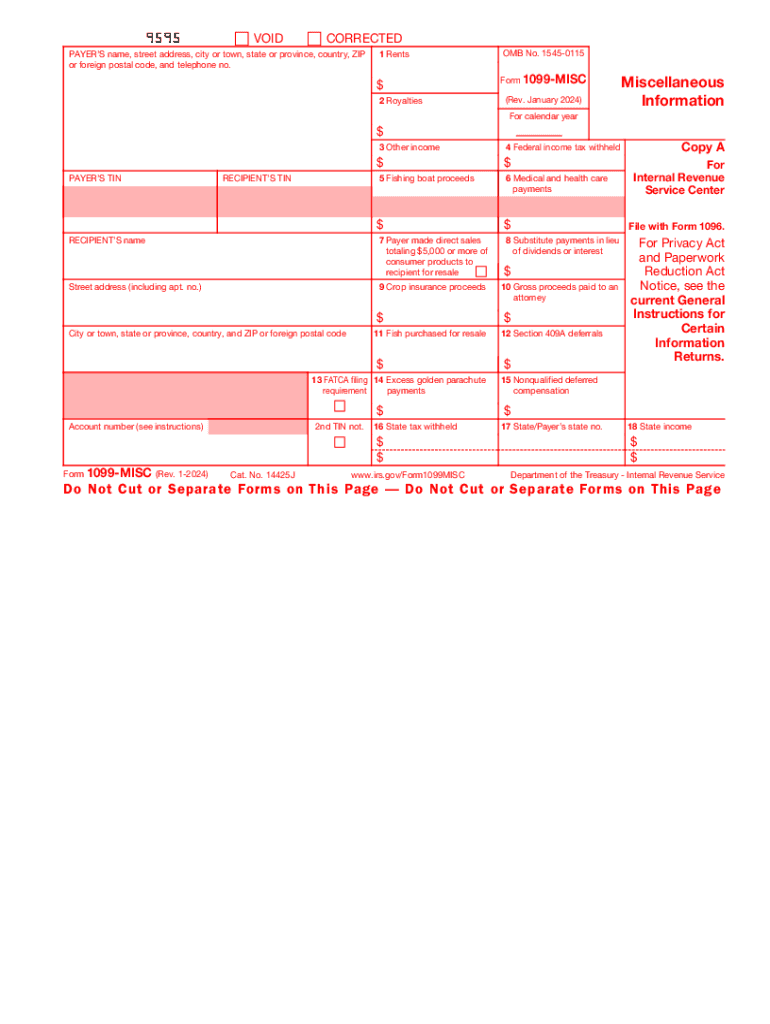

So, let’s break it down. There are a few different types of Form 1099, each one for a specific type of income:

- 1099-NEC: This one’s for nonemployee compensation, like when you’re getting paid as a contractor or freelancer.

- 1099-MISC: This is a catch-all category for income that doesn’t fit into any of the other 1099s. Think rent, prizes, and royalties.

- 1099-DIV: This one’s for dividends, which are like little slices of the profits that companies share with their shareholders.

- 1099-INT: This one’s for interest, which is the money you earn when you lend out your dough.

So, there you have it. Form 1099 is a bit of a snoozefest, but it’s important to make sure you’re using the right one for your income. That way, you can avoid any tax nightmares down the road.

Downloading Free 1099 Forms

Downloading free 1099 forms from the IRS website is a quick and easy process. Follow these steps to get started:

1. Go to the IRS website at www.irs.gov.

2. In the search bar, type “Form 1099.”

3. Click on the “Forms” link in the search results.

4. On the Forms page, scroll down to the “Individual” section and click on the “Form 1099” link.

5. On the Form 1099 page, click on the “Download” link next to the form you need.

Once you have downloaded the form, you can fill it out and submit it electronically or by mail.

Filling Out and Submitting Form 1099

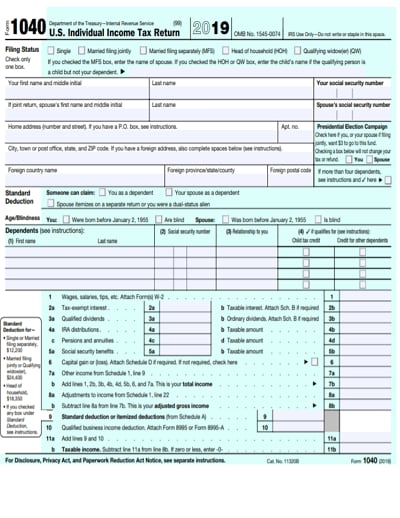

Once you have downloaded the appropriate Form 1099, you will need to fill it out and submit it to the IRS. You can do this electronically or by mail.

Electronically

To file Form 1099 electronically, you will need to use a tax preparation software program. Many different software programs are available, so you can choose one that fits your needs and budget.

Once you have chosen a software program, you will need to enter the information from your Form 1099 into the program. The software will then generate an electronic file that you can submit to the IRS.

By Mail

To file Form 1099 by mail, you will need to print out the form and fill it out by hand. Once you have filled out the form, you will need to mail it to the IRS. The address for mailing Form 1099 is:

Internal Revenue Service

Ogden, UT 84201

Benefits of Using Free 1099 Forms

Free 1099 forms offer a range of advantages, making them an ideal choice for businesses and individuals alike. These forms are available online at no cost, saving you the expense of purchasing pre-printed forms.

The convenience of free 1099 forms is another significant benefit. You can download and print these forms anytime, anywhere, without the need to visit a store or wait for delivery. This flexibility allows you to complete your tax reporting tasks efficiently and on time.

Compliance with Tax Regulations

Using free 1099 forms helps businesses and individuals comply with tax regulations. The forms are designed to meet the specific requirements of the Internal Revenue Service (IRS) and other tax authorities. By using these forms, you can ensure that your tax reporting is accurate and complete, reducing the risk of errors or penalties.

Real-Life Examples

Numerous businesses and individuals have benefited from using free 1099 forms. For example, a small business owner was able to save hundreds of dollars by using free 1099 forms instead of purchasing pre-printed forms. Additionally, a freelance writer found it incredibly convenient to be able to download and print 1099 forms anytime she needed them.

Considerations When Downloading Free 1099 Forms

Be vigilant when downloading free 1099 forms, as there are potential risks and challenges to be aware of.

Identifying Fraudulent or Inaccurate Forms

To avoid falling prey to fraudulent or inaccurate forms, it’s crucial to:

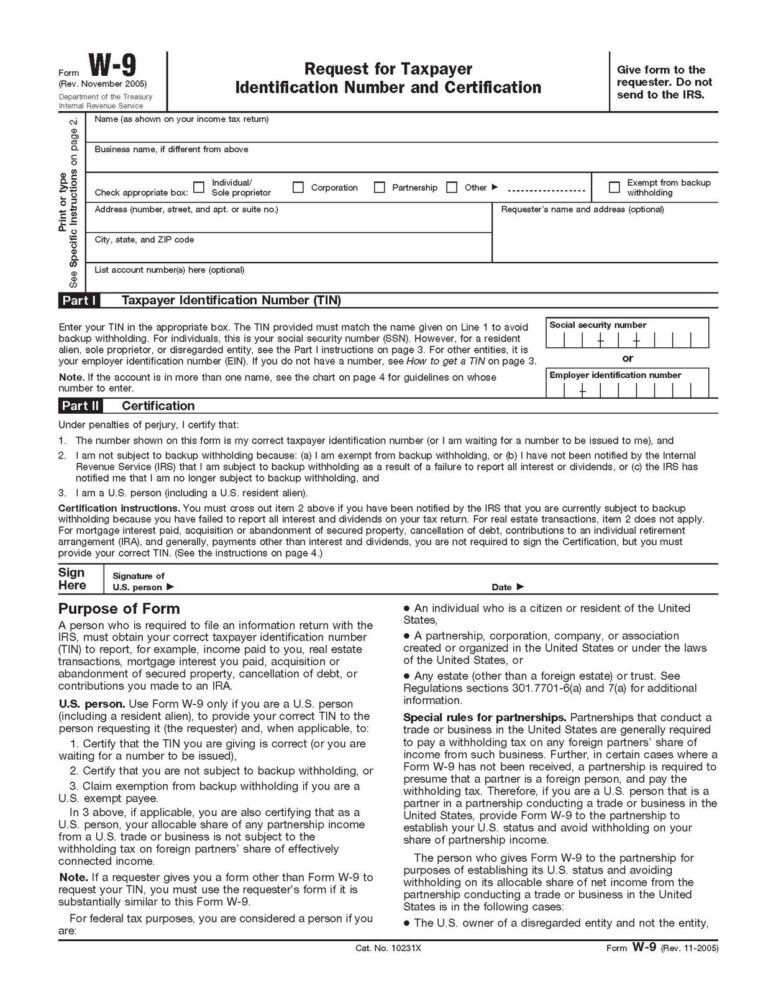

– Check the legitimacy of the website or platform offering the free forms. Look for a secure URL (https://), verify the website’s registration and contact information, and read online reviews to gauge its trustworthiness.

– Scrutinize the forms thoroughly before downloading. Ensure they align with the official IRS guidelines and contain the necessary fields for accurate tax reporting.

– Be wary of forms that appear unprofessional or contain spelling or grammatical errors. These could be red flags indicating the forms may not be reliable.

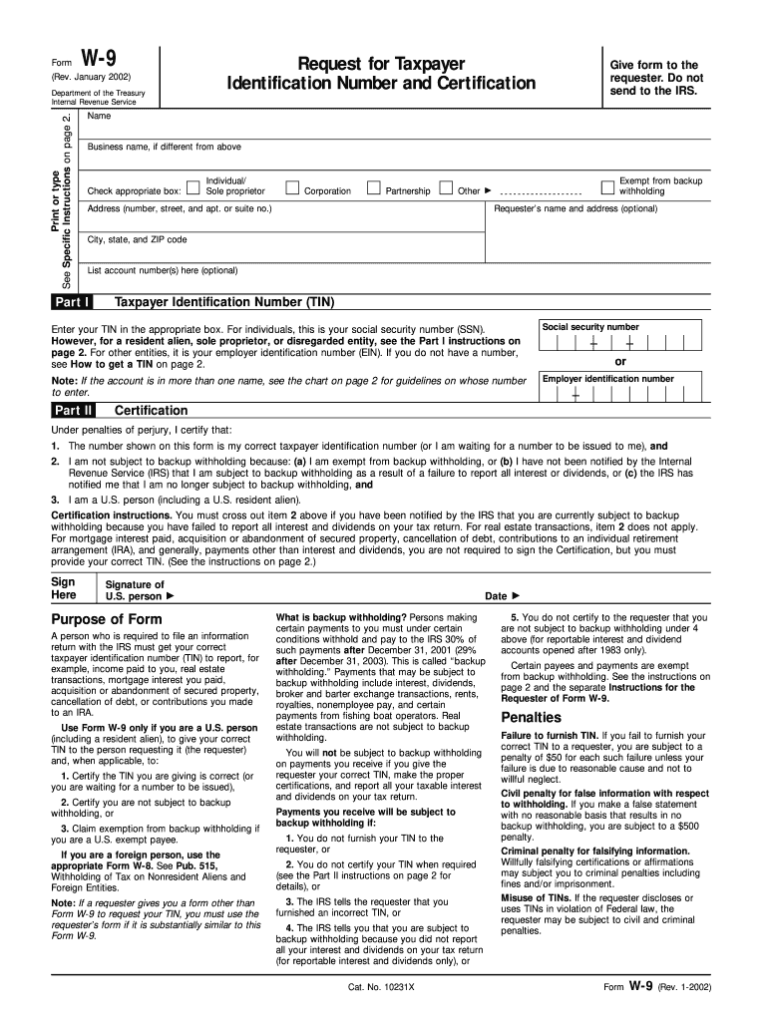

Using the Most Up-to-Date Forms

It’s essential to use the most up-to-date version of Form 1099, as the IRS may make changes to the form from year to year. Using an outdated form could result in errors or penalties.

– Check the IRS website for the latest versions of Form 1099. The IRS regularly updates its website with the most current forms and instructions.

– Download forms directly from the IRS website or from authorized third-party websites that have partnered with the IRS. This ensures you’re getting the most accurate and up-to-date forms.

FAQ Summary

What is the purpose of Form 1099?

Form 1099 is used to report income earned from non-employee sources, such as self-employment, freelance work, or investments.

How many types of Form 1099 are there?

There are several types of Form 1099, each with a specific purpose. Some common types include 1099-NEC for nonemployee compensation, 1099-MISC for miscellaneous income, and 1099-DIV for dividends.

Can I download Form 1099 electronically?

Yes, you can download Form 1099 electronically from the IRS website or through authorized e-filing providers.

Is it safe to download free 1099 forms online?

Yes, it is generally safe to download free 1099 forms from reputable sources, such as the IRS website. However, be cautious of fraudulent or outdated forms.

What are the benefits of using free 1099 forms?

Free 1099 forms offer cost savings, convenience, and accuracy. They eliminate the need for purchasing pre-printed forms and reduce the risk of errors.