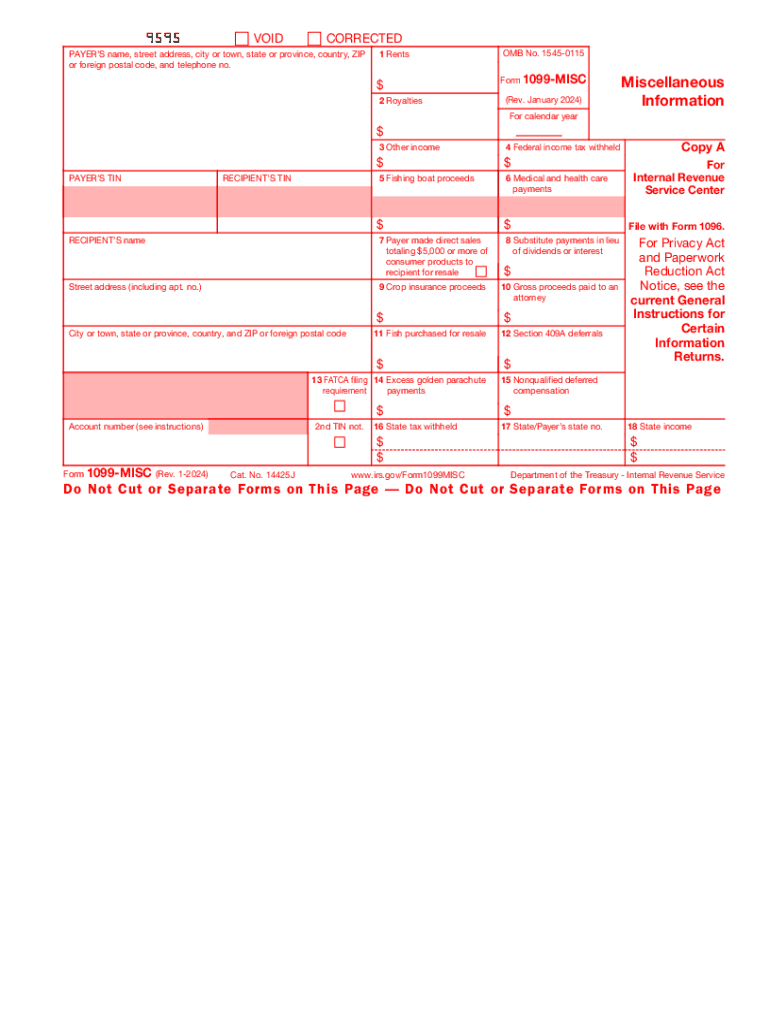

Free 1099 Form Due Date 2024: Download, Complete, and File

The 1099 form is a crucial document for taxpayers and businesses, reporting income earned from non-employee sources. Understanding the 1099 form due date and the process of completing and filing it accurately is essential to avoid penalties and ensure compliance with tax regulations. This comprehensive guide provides all the necessary information and resources to help you navigate the 1099 form process efficiently and effectively.

The 1099 form is used to report various types of income, such as freelance work, self-employment earnings, and payments to independent contractors. The due date for filing 1099 forms varies depending on the type of form, but generally falls around the end of January or February each year. It’s important to note that late filing or incorrect completion of 1099 forms can result in penalties, so it’s crucial to stay informed and file your forms on time and accurately.

Filing the 1099 Form

Filing the 1099 form is a crucial task for businesses and individuals alike. This form reports income earned from non-employee sources, such as self-employment, freelance work, or dividends. Understanding the different methods of filing the 1099 form is essential to ensure timely and accurate submission.

There are two primary methods for filing the 1099 form: mailing the form or e-filing the form. Each method has its own set of advantages and disadvantages, so it’s important to choose the method that best suits your needs.

Mailing the Form

Mailing the 1099 form is a traditional method that involves sending the physical form to the IRS via postal mail. This method is straightforward and doesn’t require any special software or equipment. However, it can be time-consuming and there is a risk of the form being lost or delayed in the mail.

Steps to Mail the 1099 Form:

1. Obtain a 1099 form from the IRS website or a tax software provider.

2. Fill out the form accurately and completely.

3. Mail the form to the IRS address provided on the form.

4. Keep a copy of the form for your records.

E-filing the Form

E-filing the 1099 form is a more modern method that involves submitting the form electronically to the IRS. This method is faster and more efficient than mailing the form, and it also reduces the risk of errors. However, e-filing requires you to have access to a computer and an internet connection.

Steps to E-file the 1099 Form:

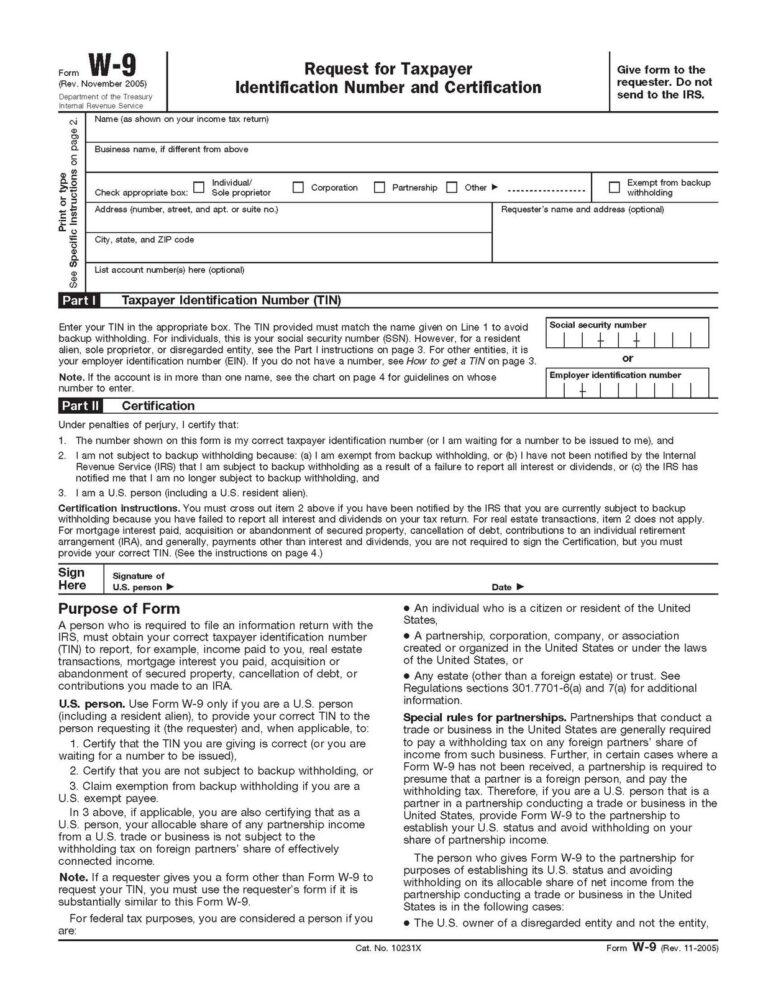

1. Obtain an IRS-approved e-filing software provider.

2. Create an account with the software provider.

3. Import your 1099 data into the software.

4. Review and submit the form electronically.

5. Keep a copy of the e-filed form for your records.

Penalties for Late or Incorrect Filing

Filing your 1099 forms late or incorrectly can lead to hefty penalties from the IRS. Make sure you’re aware of the consequences and take steps to avoid them.

The IRS may impose penalties for:

- Late filing

- Incorrect information

- Missing forms

Late Filing Penalties

If you file your 1099 forms after the due date, you may be charged a penalty of up to £50 per form, with a maximum penalty of £250,000 per year.

Incorrect Information Penalties

If you provide incorrect information on your 1099 forms, you may be charged a penalty of up to £500 per form, with a maximum penalty of £250,000 per year.

Missing Forms Penalties

If you fail to file a 1099 form for a recipient who was paid £600 or more, you may be charged a penalty of up to £500 per form, with a maximum penalty of £250,000 per year.

Avoid Penalties

- File your 1099 forms on time.

- Double-check the information on your forms before filing.

- Keep a record of all 1099 forms you file.

- If you make a mistake, file a corrected 1099 form as soon as possible.

Frequently Asked Questions (FAQs)

This section addresses common questions and concerns related to the 1099 form. Find answers to queries about due dates, filing methods, and potential penalties for incorrect or late submissions.

Due Dates

When is the 1099 form due?

- For most taxpayers, the 1099 form is due on January 31st.

- For paper filers, the due date is February 28th.

Filing Methods

How can I file the 1099 form?

- Electronically through the IRS website or authorized e-file providers.

- By mail using the paper forms provided by the IRS.

Penalties

What are the penalties for late or incorrect filing of the 1099 form?

- Late filing penalty: Up to $280 per form.

- Incorrect filing penalty: Up to $550 per form.

FAQ Section

What is the exact due date for 1099 forms in 2024?

For most types of 1099 forms, the due date in 2024 is February 28, 2025. However, 1099-MISC forms have a due date of March 31, 2025.

Can I file my 1099 forms electronically?

Yes, you can e-file your 1099 forms through the IRS website or using a tax software program. E-filing is a convenient and secure way to file your forms, and it can help you avoid errors and ensure timely delivery.

What are the penalties for filing 1099 forms late or incorrectly?

The IRS may impose penalties for late or incorrect filing of 1099 forms. Penalties can range from $50 to $250 per form, depending on the severity of the error and the length of the delay.

Where can I find the official 1099 form for 2024?

You can download the official 1099 form for 2024 from the IRS website.