Free 1099 Form Doordash Download: A Comprehensive Guide

In the realm of freelance work, understanding and managing your finances is crucial. One essential aspect is obtaining and interpreting your 1099 form, a document that reports your earnings from platforms like Doordash. This guide will provide you with a comprehensive overview of the Free 1099 Form Doordash Download process, helping you navigate the complexities of self-employment and tax obligations.

As a Doordash driver, it’s imperative to grasp the significance of your 1099 form. This document serves as an official record of your income, and it plays a vital role in your tax filing. By understanding the purpose and content of the 1099 form, you can ensure accurate reporting and avoid potential tax complications.

Common Questions about 1099 Forms

Many folks have questions about 1099 forms, and it’s only natural to be curious about what they are and how they work. Let’s dive into some of the most common questions and clear up any confusion.

What is a 1099 form?

A 1099 form is a tax document that reports income earned by independent contractors and self-employed individuals. It’s like a pay stub but for folks who aren’t regular employees.

Who needs to file a 1099 form?

If you’re an independent contractor or self-employed and earned more than a certain amount during the year, you’ll need to file a 1099 form.

What types of 1099 forms are there?

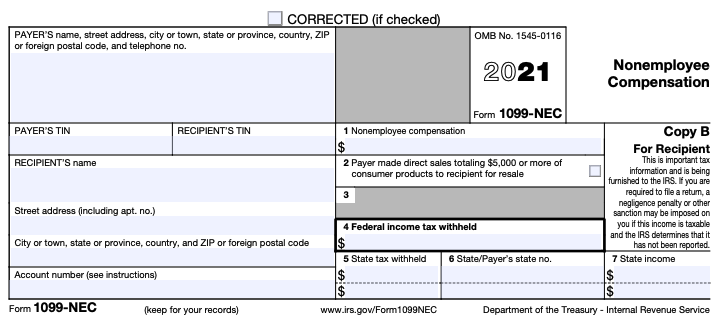

There are different types of 1099 forms, depending on the type of income you earned. Some common types include 1099-NEC, 1099-MISC, and 1099-K.

When are 1099 forms due?

The due date for 1099 forms is typically January 31st, but it can vary depending on the type of form.

What if I don’t receive a 1099 form?

If you don’t receive a 1099 form, you should contact the payer and request one. You can also use your own records to report your income.

FAQ Corner

What is the purpose of a 1099 form?

A 1099 form is an official document issued by companies to independent contractors and self-employed individuals. It reports the total income earned from their services during a specific tax year.

Why is it important to obtain a 1099 form from Doordash?

The 1099 form from Doordash is essential for tax filing purposes. It provides the Internal Revenue Service (IRS) with a record of your earnings, ensuring that you report your income accurately and avoid any discrepancies.

How do I download my 1099 form from Doordash?

To download your 1099 form from Doordash, log into your Dasher account and navigate to the “Taxes” section. You should find a link or button that allows you to download your 1099 form in PDF format.

What are the key sections of a 1099 form?

A 1099 form typically includes sections for the payer’s information, the recipient’s information, the total amount of income earned, and any applicable withholding.

How can I use the information on my 1099 form?

The information on your 1099 form should be used when filing your taxes. You will need to report the total income earned as reported on the form and pay any applicable taxes.