Free 1099 Form Date Download: Your Essential Guide to Hassle-Free Tax Filing

Navigating the complexities of tax filing can be daunting, but it doesn’t have to be. With the advent of free 1099 form date downloads, you can simplify the process and ensure accurate and timely submissions. This comprehensive guide will walk you through everything you need to know about accessing, completing, and submitting the 1099 form, empowering you to tackle tax season with confidence.

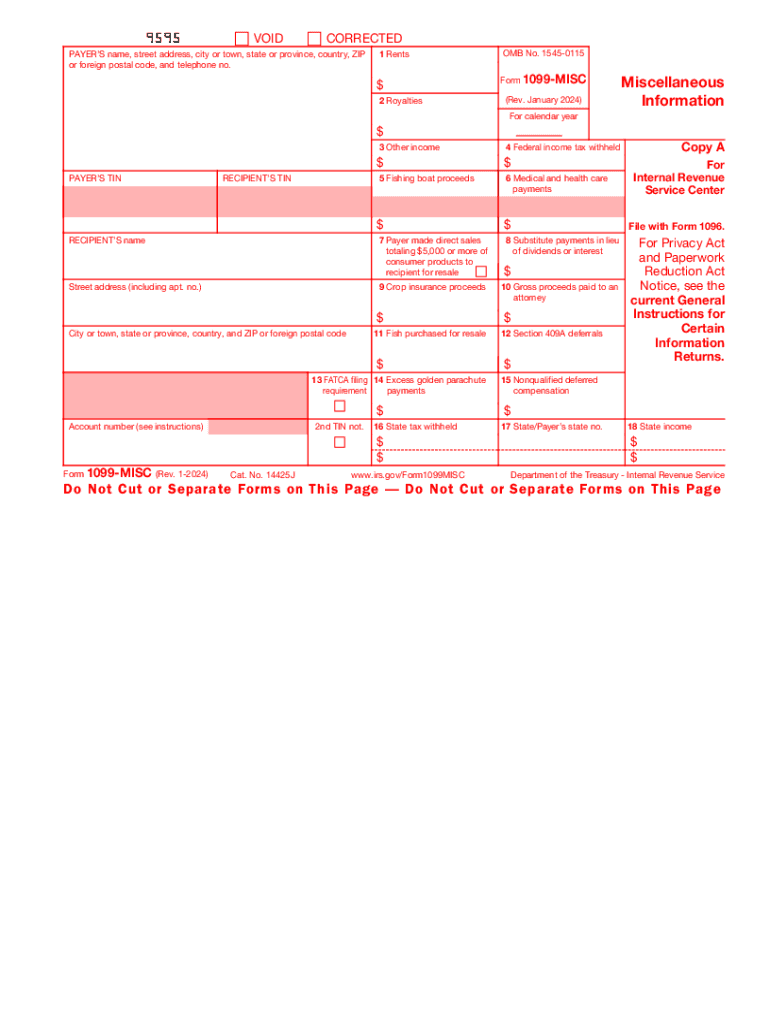

The 1099 form is a crucial document for reporting income earned from non-employee sources, such as self-employment, freelance work, and investments. Understanding its significance and the different types available will lay the groundwork for a successful filing experience.

Understanding the Free 1099 Form Date Download

Yo, the 1099 form is a must-know if you’re a freelancer, contractor, or small biz owner. It’s like a report card that tells the taxman all about your earnings from gigs and side hustles. This form is crucial ’cause it helps Uncle Sam keep tabs on your income and ensures you pay the right amount of tax.

Who Needs to File a 1099 Form?

Listen up, fam. You need to file a 1099 form if:

- You’re self-employed and earned over $400 from a single client or business.

- You’re a contractor or freelancer and received payments from clients or businesses.

- You’re a small business owner and made payments to contractors or freelancers.

Types of 1099 Forms

There are different types of 1099 forms, each with its own purpose:

- 1099-MISC: This is the most common type, used for reporting miscellaneous income, such as payments for services, prizes, or awards.

- 1099-NEC: This form is specifically for reporting nonemployee compensation, such as payments to contractors or freelancers.

- 1099-INT: This form reports interest income, such as earnings from savings accounts or bonds.

- 1099-DIV: This form reports dividend income, such as payments from stocks or mutual funds.

Accessing the Free 1099 Form Date Download

If you’re a bludger on the hunt for the free 1099 form, you’re in the right gaff. We’ll show you where to find it and how to download it in a jiffy.

Official Websites

The official website for downloading the 1099 form is the Internal Revenue Service (IRS) website. You can also find the form on the websites of some tax software providers.

Navigating the Websites

To find the 1099 form on the IRS website, go to the “Forms & Pubs” section and search for “1099.” You can also use the “Browse by Topic” option to find the form.

Downloading the Form

Once you’ve found the 1099 form, you can download it in PDF or Excel format. To download the PDF, click on the “Download PDF” button. To download the Excel file, click on the “Download Excel” button.

Benefits of Using the Free 1099 Form Date Download

Blud, listen up! Using the free 1099 form download is like having a cheat code for your tax filing. It’s gonna save you a right load of hassle and stress.

Firstly, you’ll be chuffed to bits with how much time you save. No more faffing about with pen and paper, trying to decipher those teeny-tiny lines. Just download the form, fill it in, and you’re done in a jiffy.

Accuracy and Reliability

Now, let’s talk about accuracy. These pre-formatted forms are like a boss. They’re designed by the taxman himself, so you can trust that they’re spot on. No more worrying about making mistakes that could cost you a bomb.

FAQ Summary

Can I download the 1099 form in multiple formats?

Yes, most platforms allow you to download the 1099 form in various formats, including PDF, Excel, and fillable online forms.

What information do I need to complete the 1099 form?

You will need the recipient’s name, address, Taxpayer Identification Number (TIN), and the amount of income paid.

Is there a deadline for submitting the 1099 form?

Yes, the deadline for submitting the 1099 form is January 31st for paper filing and March 31st for electronic filing.