Free 1099 Form Copy Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but understanding and utilizing the 1099 form is crucial. This guide provides a comprehensive overview of the 1099 form, highlighting its significance and offering a step-by-step approach to downloading a free copy. By understanding the key features, usage, and considerations of the 1099 form, you can ensure accurate and timely tax filing.

The 1099 form serves as a vital document for reporting income earned from non-employee sources. It plays a significant role in tax compliance and helps individuals and businesses fulfill their tax obligations. With the convenience of free online downloads, obtaining a 1099 form copy has become more accessible than ever.

Methods for Downloading a Free 1099 Form Copy

Downloading a free 1099 form copy is straightforward. Numerous reputable sources provide these forms online, including government websites and tax preparation software.

To download a free 1099 form copy, follow these steps:

From Government Websites

- Visit the official website of the Internal Revenue Service (IRS) or your state’s tax agency.

- Navigate to the section on forms and publications.

- Search for “Form 1099” and select the appropriate form for your needs.

- Click on the “Download” button to save the form to your computer.

From Tax Preparation Software

- Choose a reputable tax preparation software program.

- Install the software on your computer.

- Open the software and create a new tax return.

- The software will typically provide a list of forms, including Form 1099.

- Select the “Download” option to save the form to your computer.

Key Features of a Free 1099 Form Copy

A 1099 form is a vital document used to report income earned by independent contractors, freelancers, and other non-employees. It provides essential information to both the recipient and the Internal Revenue Service (IRS). Understanding the key features of a 1099 form is crucial to ensure accuracy and completeness when filling it out.

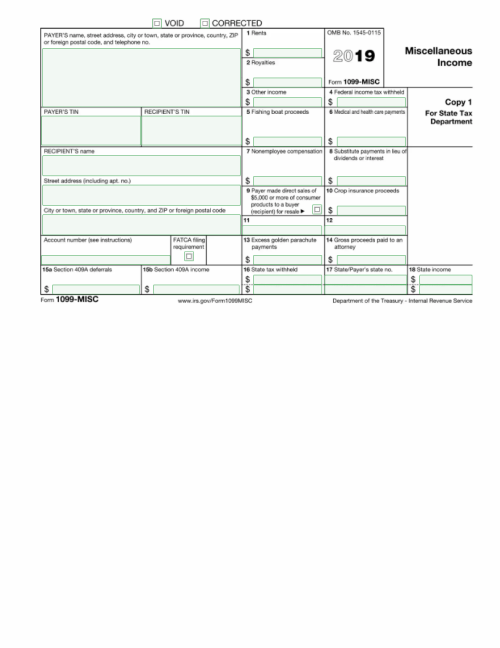

Essential Elements and Sections

A typical 1099 form includes the following sections:

– Recipient Information: This section identifies the individual or business receiving the income. It includes the recipient’s name, address, and Taxpayer Identification Number (TIN).

– Payer Information: This section provides details about the entity making the payment. It includes the payer’s name, address, and TIN.

– Income Details: This section summarizes the income earned by the recipient during the tax year. It typically includes boxes for different types of income, such as nonemployee compensation, dividends, and interest.

– Tax Withholding Information: This section indicates the amount of federal income tax withheld from the recipient’s income. It also includes information about any state or local income tax withheld.

Importance of Accuracy and Completeness

It is essential to fill out a 1099 form accurately and completely. Inaccurate or incomplete information can lead to delays in processing, errors in tax calculations, and potential penalties. Both the recipient and the payer are responsible for ensuring the accuracy of the information provided on the form.

Usage of a Free 1099 Form Copy

Blud, if you’re a freelancer or self-employed, you’re gonna need to get your hands on a 1099 form. This is the form that tells the taxman how much moolah you’ve made over the year. It’s like your report card, but for your bank account.

Now, if you’re on a tight budget, you can get a free 1099 form copy online. It’s like free chips with your takeaway, but for your taxes. To grab one, just head over to the IRS website or your fave tax software and download it for free.

Filling Out Your 1099 Form

Once you’ve got your free 1099 form copy, it’s time to fill it out. Don’t worry, it’s not as hard as doing a sudoku puzzle. Just follow these steps:

- Box 1: Income. This is the total amount of money you’ve earned from your freelancing or self-employment. You can find this info on your invoices or bank statements.

- Box 2: Federal Income Tax Withheld. This is the amount of tax that’s been taken out of your paychecks. You can find this info on your pay stubs.

- Box 3: Social Security Tax Withheld. This is the amount of tax that’s been taken out for Social Security. You can find this info on your pay stubs.

- Box 4: Medicare Tax Withheld. This is the amount of tax that’s been taken out for Medicare. You can find this info on your pay stubs.

Once you’ve filled out all the boxes, sign and date the form. Then, send it to the IRS and your state tax agency. And boom, you’re done with your taxes! It’s like completing a level in Super Mario, but with less mushrooms.

Additional Considerations

It’s blud, keep a firm grip on dem 1099s, innit? Make like a squirrel and stash them records safe. And watch the clock, fam, cos filing deadlines be real. Plus, watch out for dodgy stuff when using free 1099s, yeah?

Record Keeping and Filing Deadlines

Keep a tidy pad of all your 1099s, bruv. Scan ’em, stash ’em in a safe spot, and make digital copies too. It’s like having a secret stash of treasure, innit?

As for filing deadlines, don’t be a numpty and miss ’em. Check with the taxman, but it’s usually April 15th for most folks.

Potential Issues with Free 1099 Form Copies

Yo, free 1099s can be a lifesaver, but watch out for dodgy ones. Make sure they’re from a reputable source, innit? Check if they’re up to date with the latest tax laws, cos you don’t want to end up in the slammer for messing up your taxes, yeah?

FAQ Section

What are the different types of 1099 forms?

There are various types of 1099 forms, each designed for specific income categories. Some common types include 1099-NEC for nonemployee compensation, 1099-MISC for miscellaneous income, and 1099-DIV for dividends.

Where can I find a free 1099 form copy?

Free 1099 form copies can be downloaded from reputable sources online, such as the IRS website, tax preparation software providers, and financial institutions.

How do I fill out a 1099 form accurately?

To fill out a 1099 form accurately, gather the necessary information, including your recipient’s details, income amounts, and tax withholding information. Ensure that all sections are completed thoroughly and legibly.

What are the potential issues when using a free 1099 form copy?

Potential issues may include compatibility with tax preparation software, errors or omissions in the form, and outdated versions. It’s important to obtain a copy from a reliable source and verify its accuracy.