Free 1099 Editable Form Download: A Comprehensive Guide to Simplify Your Tax Filing

In the realm of taxation, navigating the complexities of Form 1099 can be a daunting task. Fortunately, free 1099 editable forms have emerged as a savior, offering a user-friendly and cost-effective solution. This comprehensive guide will delve into the world of free 1099 editable forms, exploring their benefits, features, and effective utilization.

Free 1099 editable forms empower individuals and businesses alike to streamline their tax filing process. With customizable fields, auto-calculations, and error-checking capabilities, these forms simplify data entry, minimize errors, and ensure compliance with tax regulations. Whether you’re a seasoned tax professional or a first-time filer, this guide will equip you with the knowledge and resources to harness the power of free 1099 editable forms.

Free 1099 Editable Form Overview

Using a free 1099 editable form is a right laugh for self-employed peeps and small businesses. It’s like having a cheat code for tax season, innit? These forms let you report income from gigs and side hustles to the taxman, without any hassle.

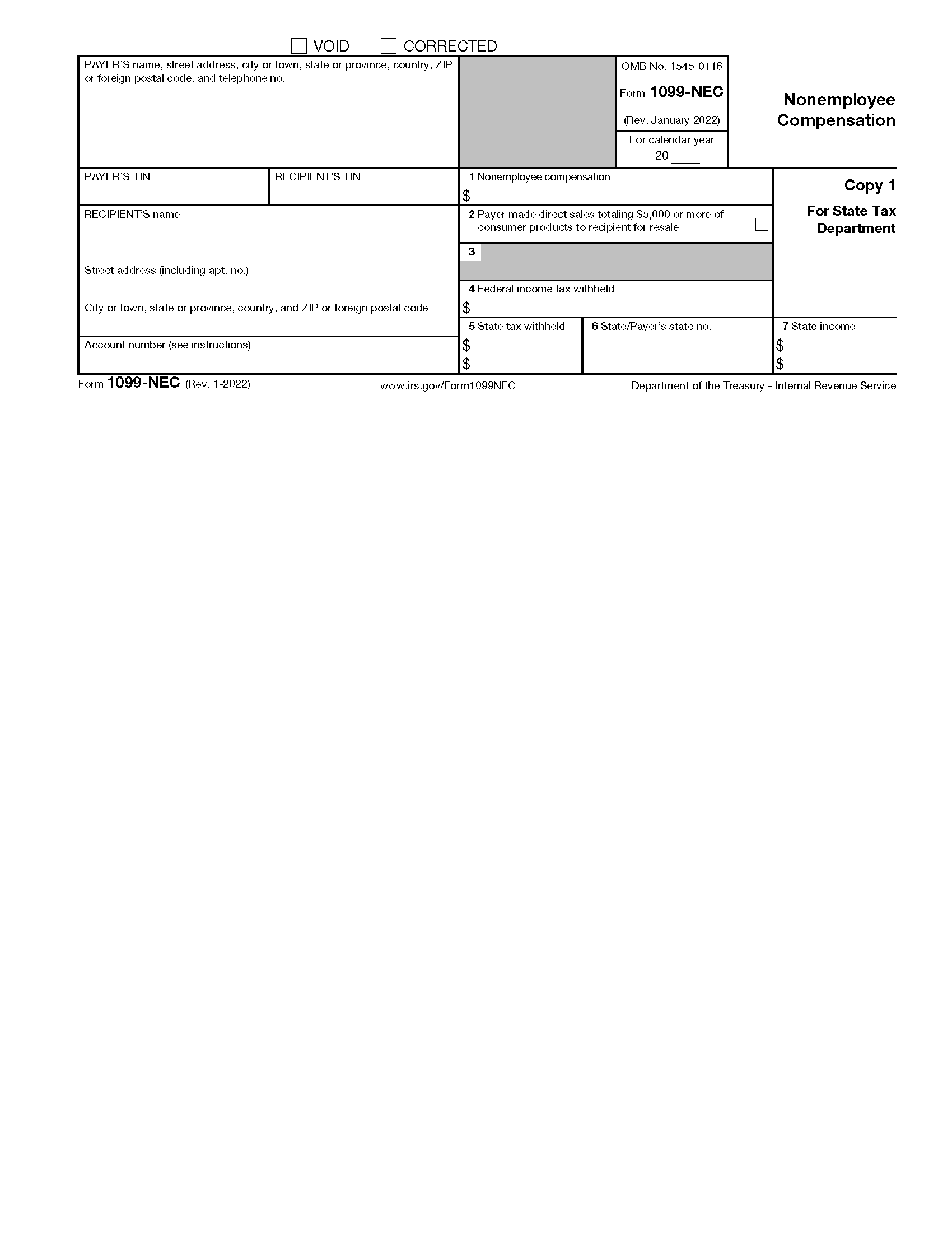

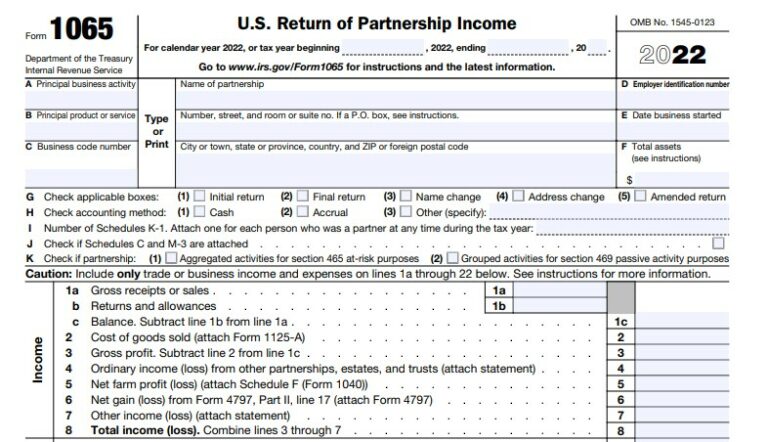

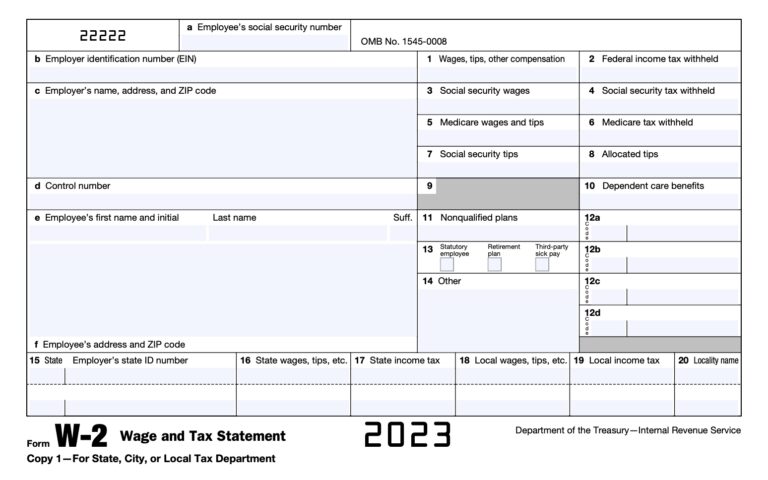

There’s a whole crew of different 1099 forms out there, each one tailored to a specific type of income. Like, if you’re a freelance writer, you’ll need a 1099-MISC. Or if you’re driving for Uber, you’ll need a 1099-K.

Benefits of Using a Free 1099 Editable Form

- It’s free! You can save some serious dough compared to using paid software or hiring an accountant.

- It’s easy to use. Even if you’re not a tax whizz, you can fill out these forms without too much head-scratching.

- It’s customizable. You can tailor the form to your specific needs, so you’re only reporting the income that you need to.

Features of a Comprehensive Free 1099 Editable Form

When selecting a free 1099 editable form, consider these essential features for an efficient and accurate tax filing experience.

Customizable fields allow you to tailor the form to your specific needs, ensuring all relevant information is captured. Auto-calculations streamline the process by automating calculations, reducing errors and saving time. Error-checking capabilities identify potential mistakes, ensuring the accuracy of your submissions.

Customizable Fields

- Ability to add or remove fields to suit your specific business requirements.

- Option to customize field labels and data formats to match your internal systems.

- Support for importing data from other sources, such as accounting software or spreadsheets.

Auto-Calculations

- Automated calculations for common tax-related formulas, such as gross income and deductions.

- Ability to create custom formulas to meet your specific needs.

- Real-time updates to calculations as you enter data, providing immediate feedback on your progress.

Error-Checking Capabilities

- Identification of missing or invalid data entries.

- Validation of data against predefined rules, such as date formats and numerical ranges.

- Alerts and error messages to guide you in correcting potential mistakes.

Benefits of Using a Free 1099 Editable Form

Blud, there are mad benefits to using a free 1099 editable form instead of doing it all by hand or splashing out for some fancy software.

Firstly, it’s gonna save you a bomb. These forms are free as a bird, so you can say goodbye to shelling out for expensive software or wasting your hard-earned dough on a pro to do it for you.

Secondly, these forms are designed to make your life easier. They’re like a breeze to fill in, so you can get them done in no time. No more spending hours scratching your head over confusing instructions or trying to decipher your own chicken scratch.

And last but not least, these forms are bang on accurate. They’re checked and double-checked to make sure they’re spot on, so you can rest assured that your 1099s are legit.

Cost Savings

As we said before, using a free 1099 editable form is gonna save you a packet. No need to fork out for pricey software or hire an accountant to do it for you. Just download the form, fill it in, and you’re sorted.

Time Efficiency

These forms are designed to be as quick and easy to fill in as possible. They’re straightforward and user-friendly, so you can get them done in no time. No more wasting hours trying to figure out what goes where.

Accuracy Improvements

These forms are checked and double-checked to make sure they’re 100% accurate. They’re designed to avoid common errors and mistakes, so you can be confident that your 1099s are spot on.

How to Find and Download a Free 1099 Editable Form

Finding and downloading a free 1099 editable form is a quick and easy process. Here’s a step-by-step guide to help you locate and download these forms from reliable sources:

Step 1: Search Online

Begin by using a search engine like Google or Bing to search for “free 1099 editable form.” This will provide you with a list of websites offering these forms.

Step 2: Visit Reputable Websites

When selecting a website to download your form, it’s important to choose a reputable source. Look for websites that are well-established and have a good reputation for providing accurate and reliable tax forms.

Step 3: Select the Right Form

Once you’re on a reputable website, browse the available 1099 forms and select the one that corresponds to the type of income you received. For example, if you received self-employment income, you would need to download a Form 1099-NEC.

Step 4: Download the Form

Once you’ve selected the correct form, click on the “Download” button to save it to your computer. Most websites will offer the form in a PDF format, which can be opened using a PDF reader like Adobe Acrobat Reader.

Recommended Websites for Downloading Free 1099 Editable Forms:

- IRS.gov

- TaxAct.com

- H&R Block.com

- TurboTax.com

- 1099.com

Considerations for Using a Free 1099 Editable Form

Intro Paragraph

While free 1099 editable forms offer several advantages, it’s crucial to be aware of their potential limitations and the importance of verifying their accuracy and legitimacy before using them.

Potential Limitations and Drawbacks

– Free forms may have limited customization options compared to paid or premium versions.

– They may lack certain features or functionalities found in paid forms.

– Some free forms may contain errors or outdated information.

Importance of Verifying Accuracy and Legitimacy

– Ensure the form is up-to-date and complies with current tax regulations.

– Check the form for errors or inconsistencies before submitting it to the IRS.

– Consider using a reputable source or consulting with a tax professional to ensure the form’s validity.

Tips for Using a Free 1099 Editable Form Effectively

Blud, using a free 1099 editable form can be a right faff, but don’t fret. With a few sick tips, you can smash it like a pro and avoid any right cock-ups.

Enter Data with Care

Make sure you’re putting in all the right bits, like the recipient’s name, address, and tax ID. Don’t be a tit and double-check everything before you hit submit.

Avoid Costly Errors

Mistakes can cost you dough, so proofread your form like a boss. Look out for any typos or missing info. If you’re not sure about something, don’t be afraid to ask for help.

Stay Compliant

The taxman ain’t gonna be happy if you’re not following the rules. Make sure your form meets all the legal requirements and file it on time. Don’t be a mug and get caught out.

Questions and Answers

Can I use a free 1099 editable form for all types of 1099 income?

Yes, free 1099 editable forms are available for all types of 1099 income, including nonemployee compensation, dividends, and distributions from retirement plans.

How do I ensure the accuracy of my free 1099 editable form?

Before submitting your free 1099 editable form, carefully review the data you have entered and compare it to your source documents. Additionally, utilize the error-checking capabilities of the form to identify any potential mistakes.

Can I download free 1099 editable forms from any website?

To ensure the legitimacy and accuracy of your free 1099 editable form, it is recommended to download it from reputable sources such as the IRS website or established tax software providers.