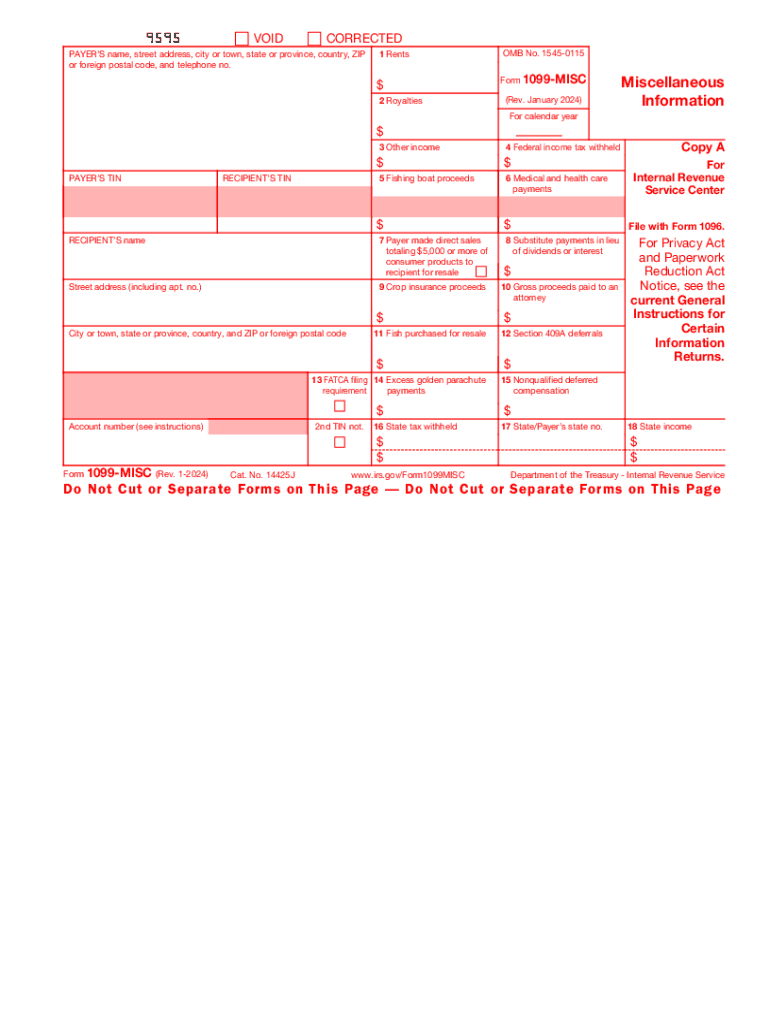

Free 1099 2024 Form Download: A Comprehensive Guide

Navigating the world of taxes can be a daunting task, but understanding the 1099-2024 form is a crucial step in ensuring accurate reporting of your income. This comprehensive guide will provide you with all the essential information you need to download, fill out, and file your 1099-2024 form with confidence. Whether you’re a seasoned freelancer or a first-time independent contractor, this guide will empower you with the knowledge to handle your tax obligations seamlessly.

In this guide, we will delve into the purpose and significance of the 1099-2024 form, explore the eligibility criteria, and provide a step-by-step guide to downloading the form from the IRS website. We will also discuss alternative methods for obtaining the form and present a table summarizing the different download options along with their advantages and disadvantages.

Overview of Free 1099-2024 Form

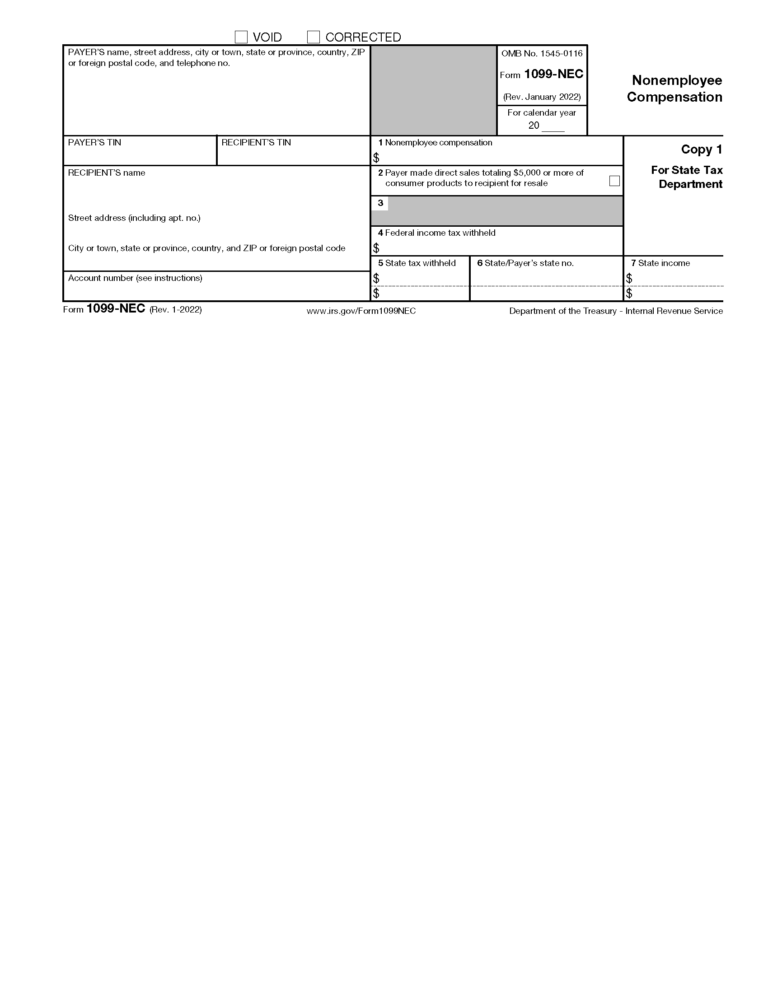

The 1099-2024 form, also known as the Miscellaneous Income form, is a tax document used to report income that is not earned through traditional employment. This form is essential for freelancers, contractors, gig workers, and other self-employed individuals. It helps the Internal Revenue Service (IRS) track income and ensure that taxes are paid accordingly.

To be eligible to use the 1099-2024 form, you must meet certain criteria. Firstly, you must be self-employed and not an employee of a company. Secondly, your income must come from non-employee compensation, such as freelance work, consulting fees, or rental income. Examples of income types that are typically reported on a 1099-2024 form include:

– Freelance writing or editing income

– Consulting fees

– Rental income

– Royalties

– Prizes and awards

– Scholarship and fellowship grants

– Income from self-employment

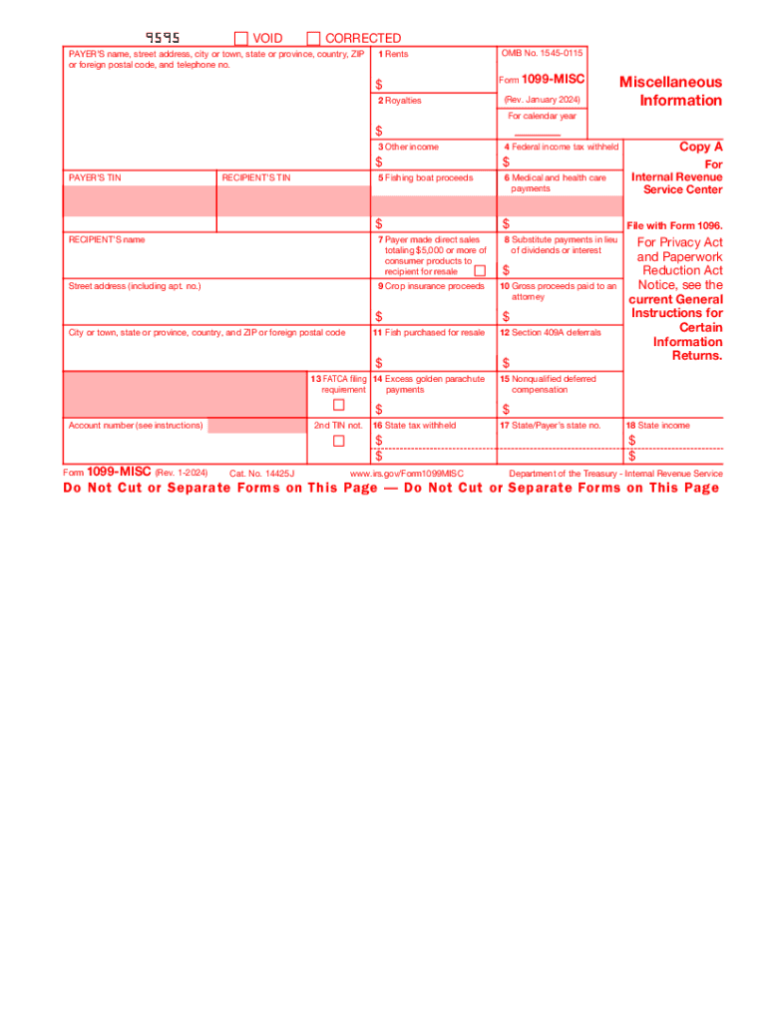

Filing and Deadlines for the 1099-2024 Form

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg?w=700)

Filing the 1099-2024 form on time is crucial to avoid penalties and ensure the smooth processing of your tax returns. The deadlines for filing vary depending on the method you choose, whether electronically or by mail.

Filing Deadlines

- Electronic Filing: January 31, 2025

- Paper Filing (mailed): March 31, 2025

It’s essential to note that these deadlines apply to both the payer (the person or entity making the payment) and the recipient (the person or entity receiving the payment). If you fail to file by the specified deadlines, you may face penalties and interest charges.

Consequences of Late or Incorrect Filing

Filing the 1099-2024 form late or incorrectly can result in several consequences, including:

- Penalties: The IRS may impose penalties for each late or incorrect form filed.

- Delayed Refunds: Late filing can delay the processing of your tax return and the issuance of any refunds due to you.

- Additional Scrutiny: Late or incorrect filings may trigger additional scrutiny from the IRS, which could lead to audits or other inquiries.

Filing Methods

You can file the 1099-2024 form electronically or by mail:

Electronic Filing

Electronic filing is the preferred method as it is faster, more secure, and less prone to errors. To file electronically, you will need to use an IRS-approved software or service provider.

Paper Filing

If you choose to file by mail, you must complete and mail the 1099-2024 form to the IRS address specified in the instructions. Ensure that you provide all the required information accurately and legibly.

Resources for Assistance with the 1099-2024 Form

The 1099-2024 form can be a daunting task, but there are plenty of resources available to help you. The IRS has a dedicated website with information on the form, including instructions, FAQs, and a searchable database of tax professionals. You can also contact the IRS by phone or mail. In addition, there are many private organizations that offer assistance with the 1099-2024 form. These organizations can provide you with tax advice, software, and other resources.

Contact Information for the IRS and Other Organizations

* IRS website: https://www.irs.gov/forms-pubs/about-form-1099-misc

* IRS phone number: 1-800-829-1040

* IRS mailing address: Internal Revenue Service, P.O. Box 2504, Cincinnati, OH 45202

* National Association of Tax Professionals (NATP): https://www.natptax.com/

* American Institute of Certified Public Accountants (AICPA): https://www.aicpa.org/

Frequently Asked Questions (FAQs)

* What is a 1099-2024 form?

A 1099-2024 form is a tax document that reports income that you have received from non-employee sources.

* Who needs to file a 1099-2024 form?

You need to file a 1099-2024 form if you have received $600 or more in income from non-employee sources.

* When is the deadline to file a 1099-2024 form?

The deadline to file a 1099-2024 form is January 31, 2025.

* What are the penalties for not filing a 1099-2024 form?

The penalties for not filing a 1099-2024 form can be significant. You may be subject to a fine of up to $250,000 per form.

Frequently Asked Questions

What is the purpose of the 1099-2024 form?

The 1099-2024 form is used to report income that you have earned as an independent contractor or self-employed individual.

Who is eligible to use the 1099-2024 form?

You are eligible to use the 1099-2024 form if you have earned income from self-employment or as an independent contractor and your total income is at least $600.

What types of income are typically reported on a 1099-2024 form?

Common types of income reported on a 1099-2024 form include payments for services rendered, such as consulting fees, freelance work, and payments to independent contractors.

What is the deadline for filing the 1099-2024 form?

The deadline for filing the 1099-2024 form is January 31st, 2025.

What are the consequences of filing the 1099-2024 form late?

Filing the 1099-2024 form late may result in penalties and interest charges.