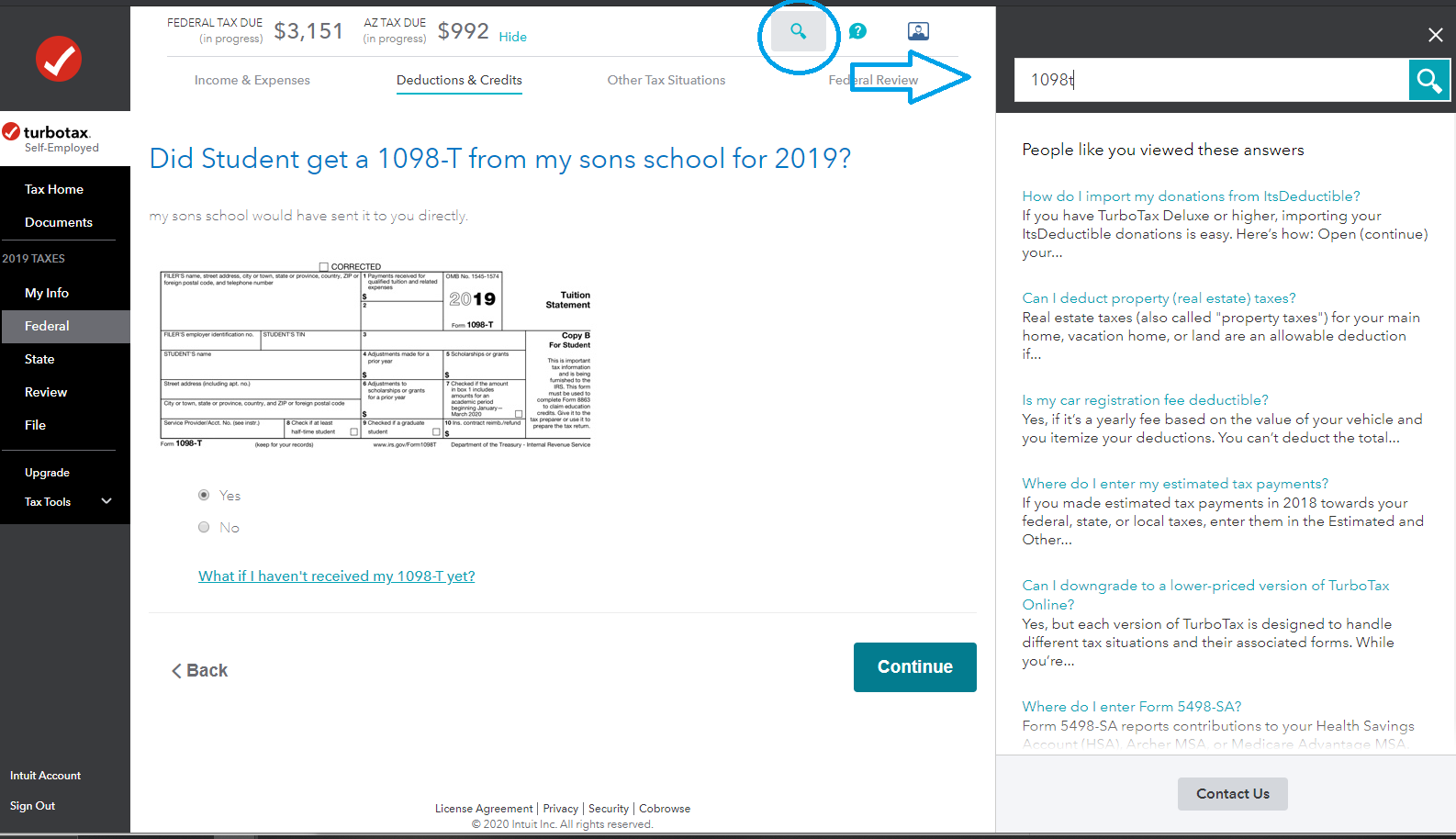

Free 1098 Form TurboTax Download: A Comprehensive Guide to Streamline Your Tax Filing

Preparing your taxes can be a daunting task, but it doesn’t have to be. With TurboTax, you can simplify the process and ensure accuracy with its user-friendly interface and comprehensive features. This guide will provide you with a step-by-step walkthrough of downloading the 1098 form using TurboTax, along with valuable tips and insights to maximize your experience.

TurboTax offers both free and paid versions, catering to different user needs. Whether you’re a first-time filer or a seasoned taxpayer, this guide will help you determine the best version for your requirements and provide a detailed comparison of their features and limitations.

Overview of TurboTax 1098 Form Download

TurboTax is a popular tax preparation software that allows users to easily download and file their 1098 forms. 1098 forms are used to report mortgage interest, which can be a valuable tax deduction. Using TurboTax to download your 1098 form is a convenient and accurate way to ensure that you are claiming all of the deductions that you are entitled to.

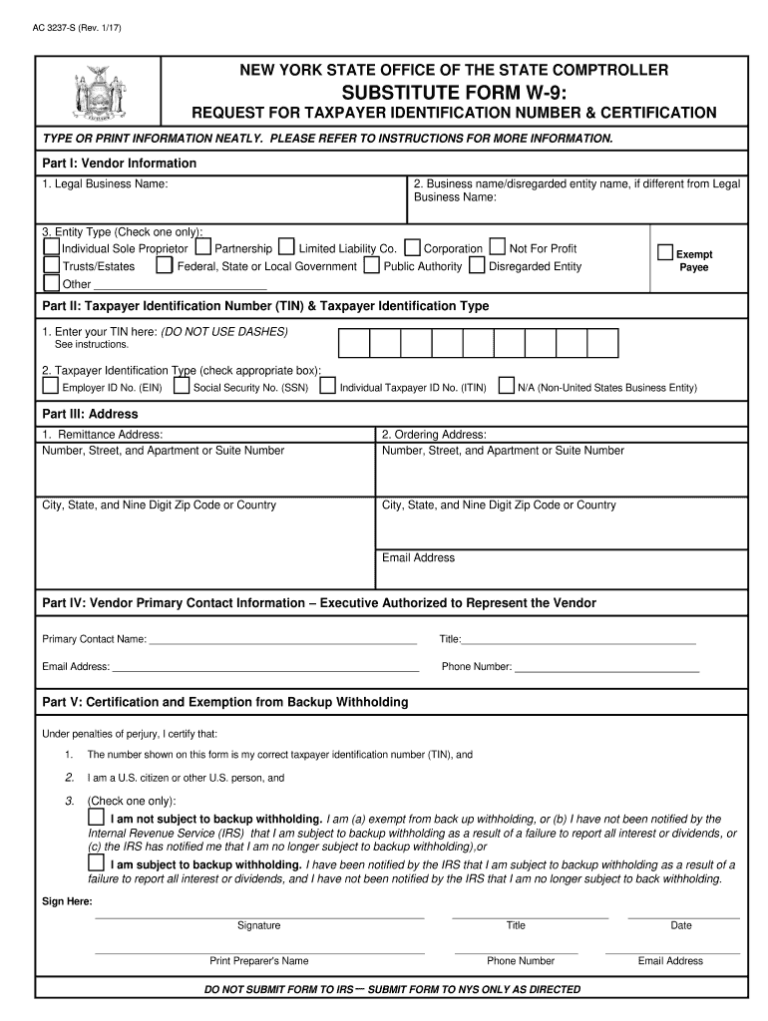

Eligibility Requirements

In order to download your 1098 form using TurboTax, you must meet the following eligibility requirements:

- You must have a valid TurboTax account.

- You must have received a 1098 form from your mortgage lender.

- You must have a computer with an internet connection.

Comparison with Other Software

TurboTax is one of the most popular tax preparation software programs available. It is known for its ease of use and accuracy. However, there are other software programs that can also be used to download 1098 forms. Some of the most popular alternatives to TurboTax include:

- H&R Block

- TaxSlayer

- Jackson Hewitt

When choosing a tax preparation software program, it is important to consider your individual needs and preferences. TurboTax is a good option for users who want a comprehensive and easy-to-use program. However, other software programs may be a better option for users who need specific features or who are on a budget.

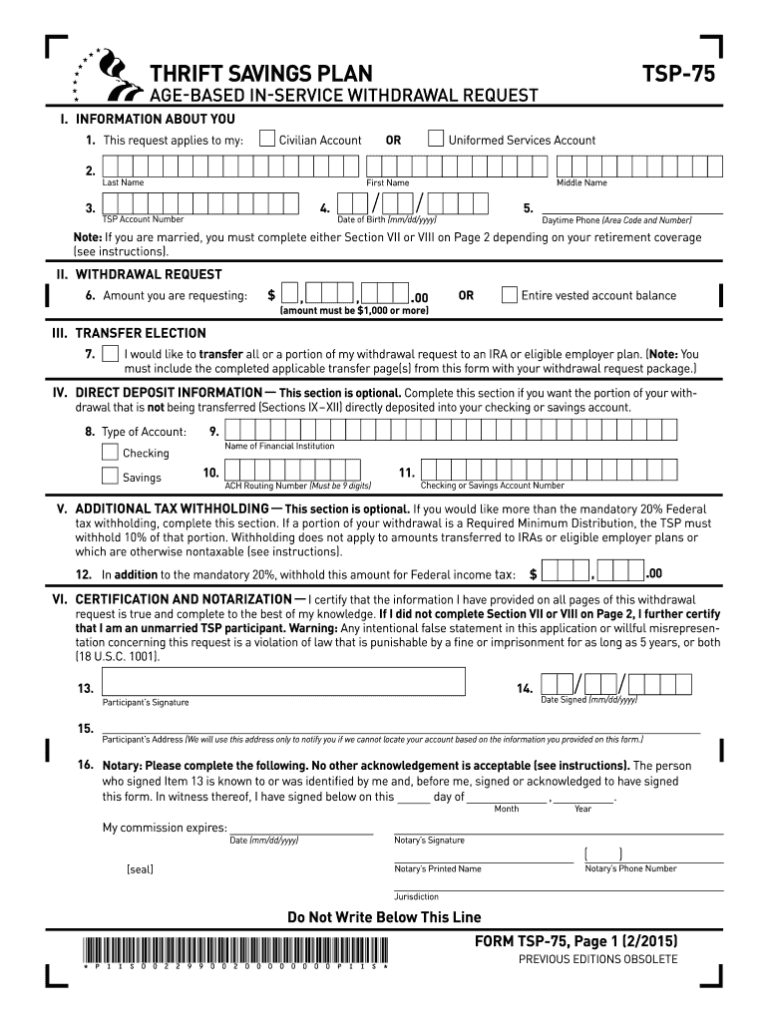

Comparison of Free and Paid Versions of TurboTax for 1098 Form Download

TurboTax offers both free and paid versions for downloading 1098 forms. The free version, TurboTax Free Edition, provides basic tax preparation features, while the paid versions, TurboTax Deluxe, Premier, and Self-Employed, offer additional features and support.

Key Differences

The following table compares the key features and limitations of the free and paid versions of TurboTax for 1098 form download:

| Feature | Free Edition | Deluxe | Premier | Self-Employed |

|---|---|---|---|---|

| 1098 Form Download | Yes | Yes | Yes | Yes |

| Import Previous Year’s Return | No | Yes | Yes | Yes |

| Itemized Deductions | No | Yes | Yes | Yes |

| Schedule C (Self-Employment) | No | No | Yes | Yes |

| Schedule SE (Self-Employment Tax) | No | No | No | Yes |

| Audit Support | No | Yes | Yes | Yes |

| Live Expert Help | No | Yes | Yes | Yes |

| Price | Free | $60 | $100 | $150 |

Recommendations

The best version of TurboTax for 1098 form download depends on your individual needs. If you have a simple tax return and don’t need any additional features, the TurboTax Free Edition is a good option. If you need to itemize deductions, import your previous year’s return, or get audit support, you’ll need to upgrade to a paid version. The TurboTax Deluxe version is a good option for most taxpayers, while the Premier and Self-Employed versions are best for more complex tax returns.

Tips for Maximizing the Use of TurboTax for 1098 Form Download

To make the most of TurboTax for 1098 form download, it’s crucial to adopt effective strategies and avoid common pitfalls. Here are some practical tips to help you navigate the process seamlessly:

Organizing Multiple 1098 Forms

Managing multiple 1098 forms can be a breeze with TurboTax. Simply create a dedicated folder on your computer to store all the downloaded forms in one place. This organization will save you time and hassle when it comes to accessing them for tax preparation.

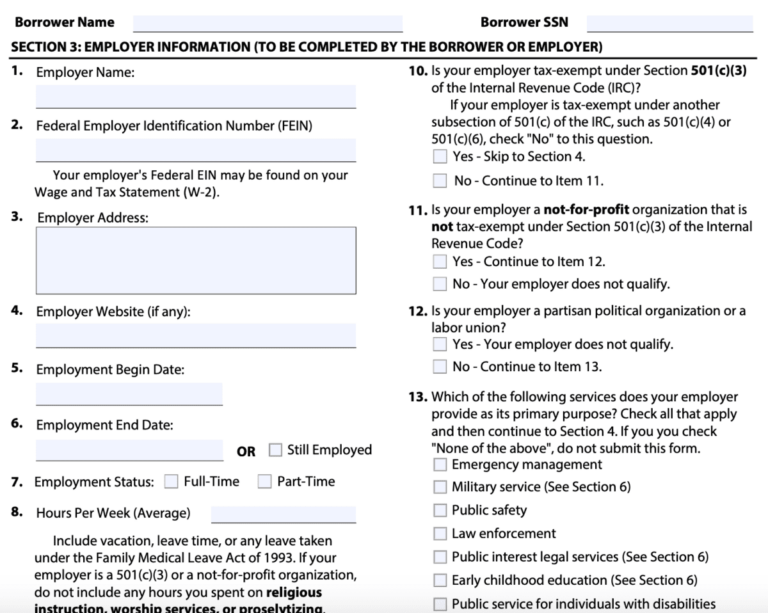

Ensuring Accuracy

Accuracy is paramount when dealing with tax forms. To ensure the accuracy of your 1098 form downloads, double-check the information provided by your employer or payer against the downloaded form. If you notice any discrepancies, reach out to the issuer for clarification before proceeding.

Avoiding Common Pitfalls

One common pitfall to watch out for is potential errors during the download process. To minimize the risk of mistakes, make sure you have a stable internet connection and that you’re using the latest version of TurboTax. Additionally, be cautious of phishing scams and only download 1098 forms from trusted sources.

Q&A

Is TurboTax free for downloading 1098 forms?

Yes, TurboTax offers a free version that allows you to download 1098 forms.

What are the eligibility requirements for downloading 1098 forms using TurboTax?

To download 1098 forms using TurboTax, you need to have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

How do I troubleshoot common errors encountered while downloading 1098 forms using TurboTax?

If you encounter errors while downloading 1098 forms using TurboTax, try refreshing the page, checking your internet connection, or contacting TurboTax support for assistance.