Free 1098 Form Sample Download: A Comprehensive Guide

Navigating the complexities of mortgage can be daunting, but understanding the significance of the 1098 form is crucial. This document holds valuable information that can impact your financial planning and tax obligations. Whether you’re a first-time homebuyer or a seasoned homeowner, accessing a free 1098 form sample can provide clarity and empower you to make informed decisions.

This guide will delve into the purpose and benefits of downloading a free 1098 form sample, highlighting its role in mortgage analysis and tax preparation. We’ll also provide clear instructions on how to obtain a sample form and address common FAQs to ensure you have all the necessary information at your fingertips.

Understanding the Significance of the 1098 Form

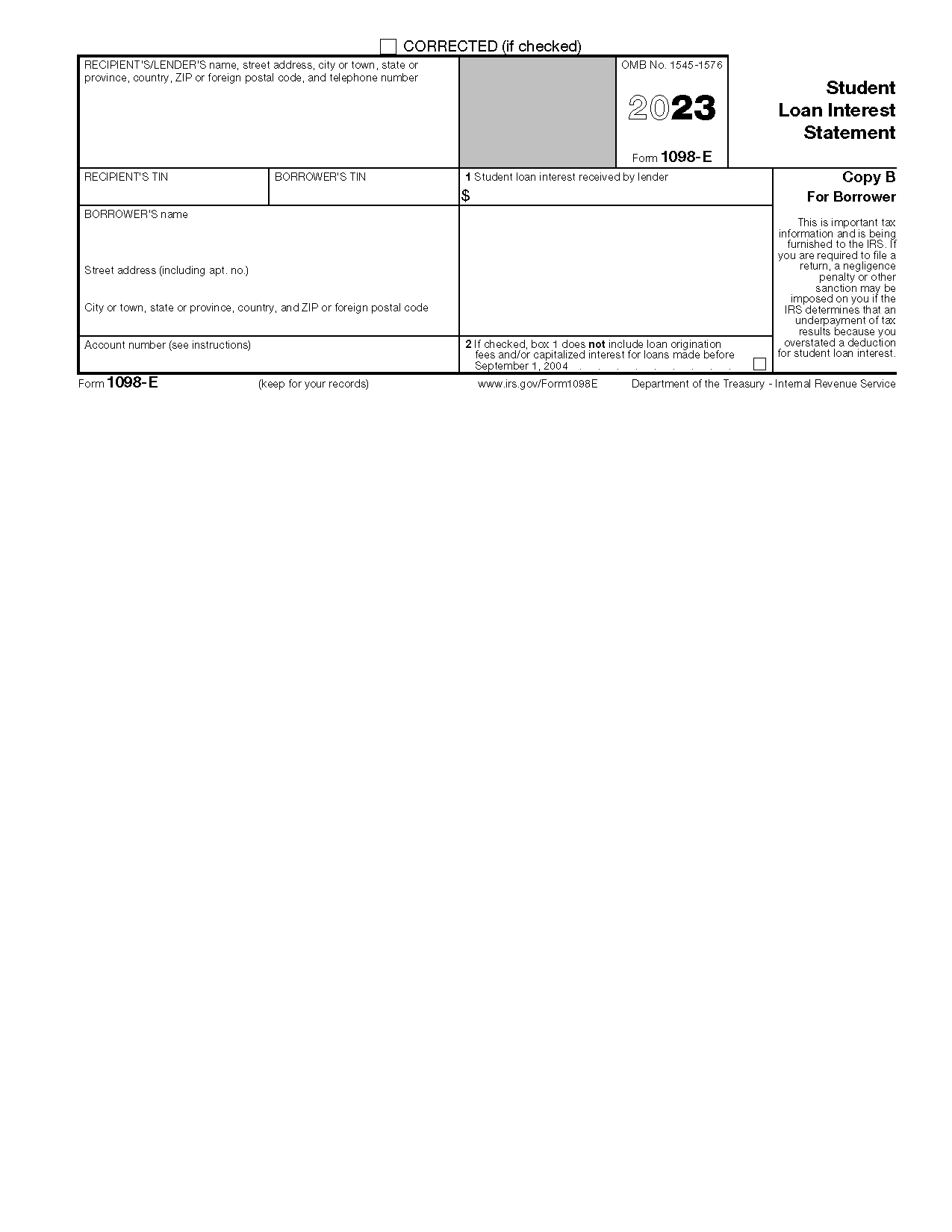

The 1098 Form is a vital document in the mortgage industry, providing a detailed record of the mortgage interest paid by borrowers during a specific tax year. It’s essential for accurate tax filing and claiming mortgage interest deductions.

Legal Requirements

Lenders are legally obligated to issue Form 1098 to borrowers by January 31st of each year. This requirement ensures that borrowers have ample time to prepare and file their tax returns.

Key Information Contained in the 1098 Form

The 1098 Form is a crucial document for borrowers as it provides essential information about their mortgage payments for tax purposes. It includes details such as the amount of interest paid, the property address, and the lender’s contact information.

Understanding the key information contained in the 1098 Form empowers borrowers to make informed decisions about their finances and ensures accurate tax filing.

Loan Details

The 1098 Form provides information about the mortgage loan, including the loan number, the lender’s name and address, and the property address. This information is important for tracking loan payments and ensuring that the correct property is being reported for tax purposes.

Interest Paid

One of the most important pieces of information on the 1098 Form is the amount of interest paid during the tax year. This information is used to calculate the mortgage interest deduction, which can significantly reduce a borrower’s taxable income.

The 1098 Form also includes information about any points paid during the tax year. Points are prepaid interest, and they can also be deducted from taxable income in some cases.

Property Address

The property address is included on the 1098 Form to ensure that the correct property is being reported for tax purposes. This information is especially important for borrowers who own multiple properties.

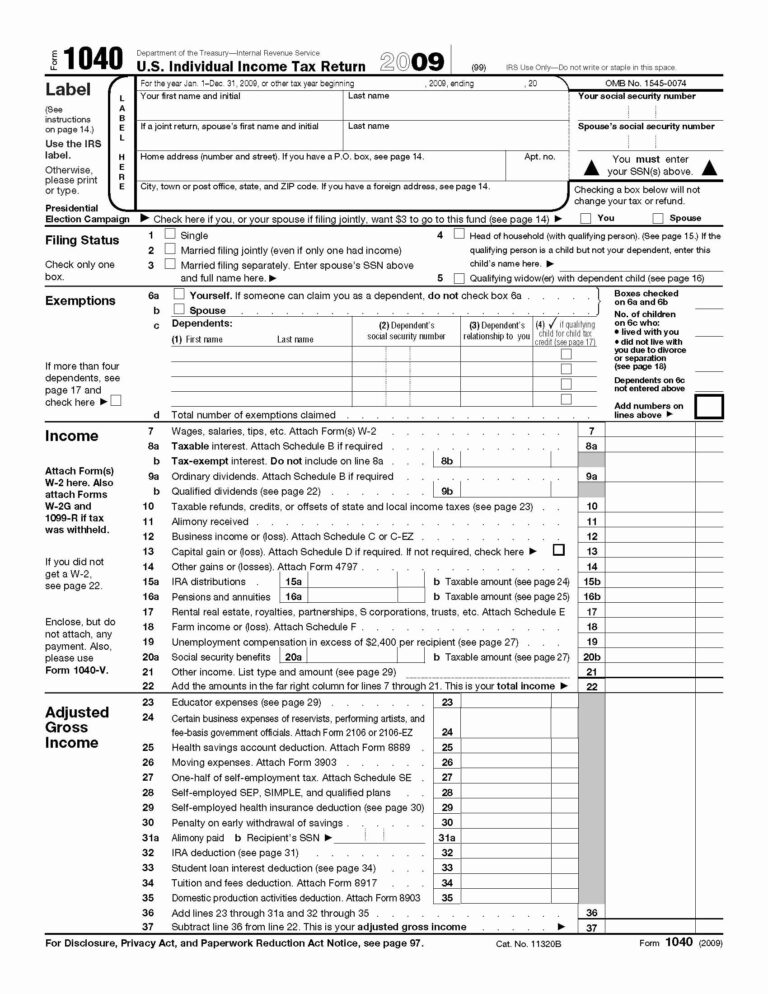

Using the 1098 Form for Tax Purposes

The 1098 Form is used to complete Schedule A of the federal income tax return. Schedule A is used to itemize deductions, and the mortgage interest deduction is one of the most common itemized deductions.

To claim the mortgage interest deduction, borrowers will need to provide the following information from their 1098 Form:

- The amount of interest paid

- The points paid

- The property address

Borrowers can also use the 1098 Form to track their mortgage payments and to make informed decisions about their finances. For example, borrowers can use the 1098 Form to:

- Compare interest rates

- Refinance their mortgage

- Plan for future tax deductions

How to Download a Free 1098 Form Sample

Getting your mitts on a free 1098 form sample is a doddle. There’s loads of reputable websites that offer ’em up for grabs, like the IRS website or some tax software providers.

Just be sure you’re downloading from a secure source, like an official government website or a well-known tax software company. That way, you can avoid any dodgy viruses or malware.

Recommended Sources

- IRS website: https://www.irs.gov/forms-pubs/about-form-1098

- TurboTax: https://turbotax.intuit.com/tax-tools/calculators/mortgage-interest-calculator

- H&R Block: https://www.hrblock.com/tax-center/filing/tax-forms/form-1098

Using the 1098 Form Sample for Mortgage Analysis

Yo, check it, a 1098 form sample is like a cheat code for mortgage analysis. It’s a crib sheet that breaks down all the details of your mortgage payments, including how much you’ve paid in interest. This info is like gold dust for working out your financial game plan.

By crunching the numbers on your 1098 form, you can see exactly how much you’re splashing out on your mortgage each month. This can help you figure out if you’re overpaying or if you can afford to make extra payments to pay off your crib quicker. It’s like having a financial roadmap that shows you where your money’s going and how to make it work harder for you.

Optimizing Your Financial Strategy

Once you’ve got a handle on your mortgage payments, you can start tweaking your financial strategy to make the most of your hard-earned dough. For example, if you see that you’re paying a lot of interest, you might want to consider refinancing your mortgage to get a lower rate. Or, if you’re able to make extra payments, you can put that money towards your principal balance and pay off your mortgage even faster.

The 1098 form sample is like a secret weapon for taking control of your mortgage and making it work for you. It’s a tool that can help you save money, pay off your mortgage faster, and reach your financial goals.

FAQ Corner

What is the purpose of the 1098 form?

The 1098 form is a tax document that provides a record of mortgage interest paid to lenders. It’s essential for tax preparation, as the information reported on the form can be used to claim mortgage interest deductions.

Where can I download a free 1098 form sample?

Numerous reputable websites offer free 1098 form samples for download. Ensure you’re obtaining the sample from a secure and reliable source.

How can I use a 1098 form sample to analyze my mortgage?

By reviewing a 1098 form sample, you can gain insights into your mortgage payments, interest deductions, and property details. This information can assist you in evaluating your financial situation and making informed decisions.