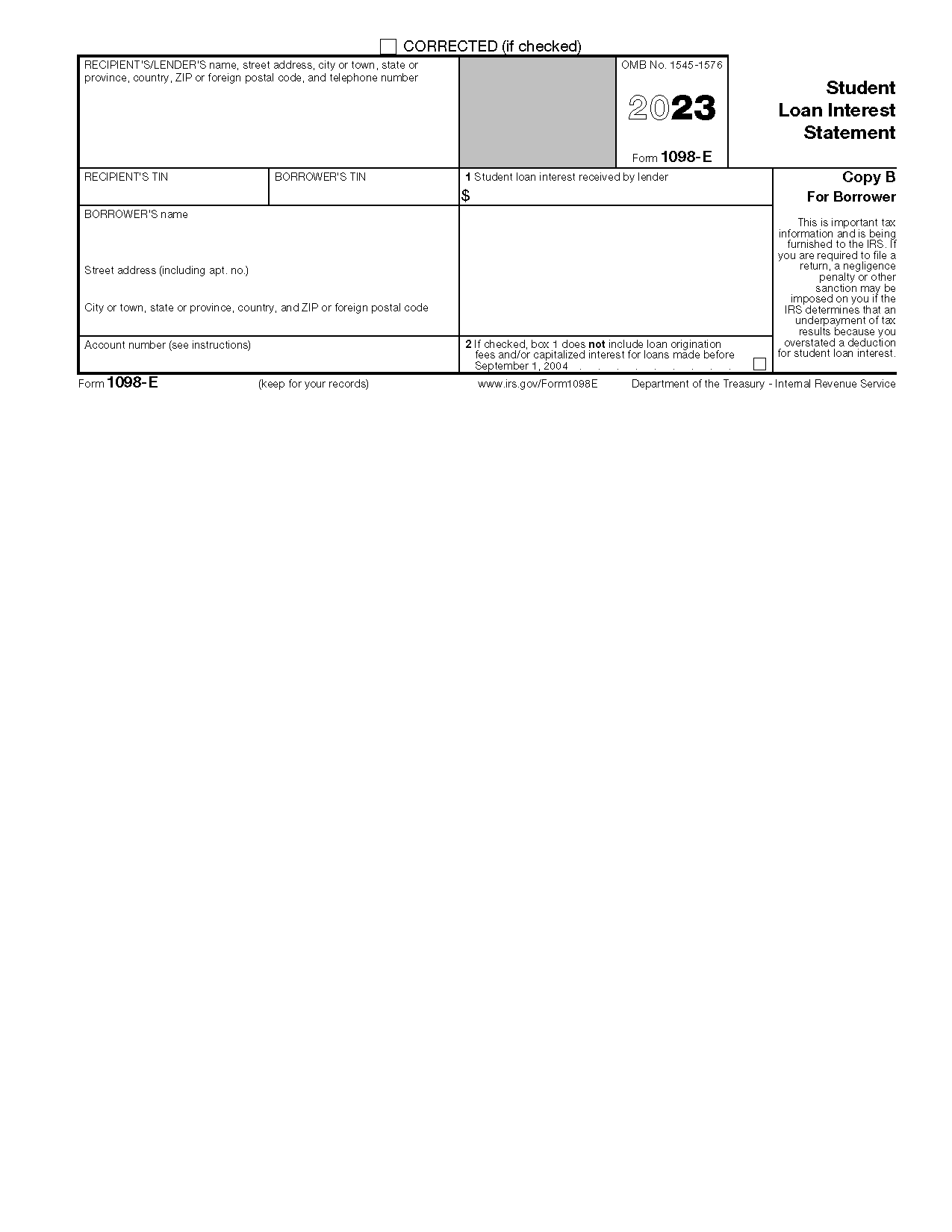

Free 1098 Form Example Download: A Comprehensive Guide

Navigating the complexities of tax forms can be daunting, but understanding the 1098 form is crucial for accurate tax reporting. This comprehensive guide provides a clear overview of the 1098 form, its significance, and where to find free examples for easy completion.

The 1098 form serves as a vital document for reporting mortgage interest, property taxes, and other relevant expenses. It plays a pivotal role in ensuring accurate tax calculations and deductions, ultimately helping you optimize your tax returns.

Understanding the 1098 Form

The 1098 form is a tax document that provides information about mortgage interest paid during the year. It’s crucial to understand the various sections of this form to ensure accurate tax reporting.

The 1098 form typically includes the following sections:

Borrower Information

This section contains the names, addresses, and taxpayer identification numbers of the borrowers.

Lender Information

This section contains the name, address, and phone number of the lender.

Mortgage Information

This section provides details about the mortgage, including the loan number, loan amount, and interest rate.

Interest Paid

This section shows the total amount of mortgage interest paid during the year.

Points Paid

This section indicates the amount of points paid on the mortgage during the year.

Private Mortgage Insurance (PMI)

This section shows the amount of PMI paid during the year.

Other

This section provides additional information, such as the property address and the amount of real estate taxes paid.

Using the 1098 Form Example

:max_bytes(150000):strip_icc()/Form1098-5c57730f46e0fb00013a2bee.jpg?w=700)

Once you’ve got the hang of understanding the 1098 form, it’s time to put that knowledge into practice. Here’s a guide to help you use the free 1098 form example to fill out your own form accurately.

Tips for Completing the Form

Follow these tips to make sure your 1098 form is filled out correctly:

- Use the form example as a reference. The example will show you where to find each piece of information on your mortgage statement.

- Be sure to enter all of the information required on the form. If you’re missing any information, your form may be rejected.

- Double-check your work before submitting the form. Make sure all of the information is correct and that you’ve signed the form in the appropriate place.

Common Questions and Troubleshooting

Navigating the complexities of the 1098 form can raise questions and challenges. Here’s a breakdown of common queries and solutions to help you breeze through the process.

If you encounter any roadblocks or discrepancies, don’t fret! Our troubleshooting guide will equip you with the knowledge to resolve them swiftly.

Where can I find my 1098 form?

- Your mortgage lender is obliged to send you a 1098 form annually, typically by the end of January.

- If you’ve misplaced your form, reach out to your lender promptly to request a duplicate.

What if I made a mistake on my 1098 form?

Mistakes happen! If you discover an error on your 1098 form, contact your lender immediately. They can rectify the mistake and issue a corrected form.

I didn’t receive a 1098 form. What should I do?

- Double-check with your lender to ensure they have your current address on file.

- If they confirm your address is correct, request a duplicate form.

- If you still haven’t received the form, contact the IRS for assistance.

What if my mortgage interest is not reflected on my 1098 form?

In certain cases, your mortgage interest may not be fully reported on your 1098 form. This can occur if:

- You made payments to multiple lenders throughout the year.

- You refinanced your mortgage and paid off your previous loan.

If you believe your 1098 form is incomplete, gather supporting documentation (such as mortgage statements) and contact your lender for clarification.

FAQ Summary

What is the purpose of the 1098 form?

The 1098 form is used to report mortgage interest, property taxes, and other relevant expenses to the Internal Revenue Service (IRS) and the taxpayer.

Where can I find a free 1098 form example?

Free 1098 form examples can be downloaded from the IRS website, tax preparation software providers, and various online resources.

What information is typically included on a 1098 form?

A 1098 form typically includes information such as the borrower’s name and address, lender’s name and address, loan amount, interest paid, property taxes paid, and other relevant expenses.

How can I use a free 1098 form example to fill out my own form?

You can use a free 1098 form example as a template to fill out your own form by matching the corresponding information from your mortgage statement or other relevant documents.

What should I do if I have questions or need assistance completing my 1098 form?

If you have any questions or need assistance completing your 1098 form, you can consult a tax professional or refer to the IRS website for guidance.