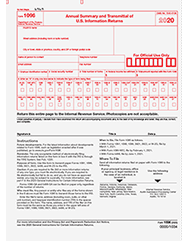

Free 1096 Transmittal Form Download: Your Comprehensive Guide

Navigating the complexities of tax reporting can be daunting, but the 1096 Transmittal Form is here to simplify the process. This essential document serves as a vital bridge between businesses and the IRS, streamlining the submission of 1099 forms. In this comprehensive guide, we’ll delve into the intricacies of the 1096 Transmittal Form, empowering you with the knowledge and resources to download, complete, and utilize it effectively.

Whether you’re a seasoned tax professional or a business owner seeking to fulfill your reporting obligations, this guide will equip you with the necessary tools and insights. We’ll explore the purpose, benefits, and sources for downloading the 1096 Transmittal Form for free, ensuring that you have the most up-to-date and accurate information at your fingertips.

Definition of 1096 Transmittal Form

Yo, the 1096 Transmittal Form is like a paper that goes with your 1099s, innit? It’s basically a cover sheet that tells the IRS who’s sending the 1099s and how many there are.

You need to use it when you’re sending 250 or more 1099s to the IRS. So, if you’re a business that pays a lot of contractors or freelancers, you’ll need to use this form.

Purpose of the 1096 Transmittal Form

The 1096 Transmittal Form is used to:

- Identify the business or individual sending the 1099s.

- Provide the IRS with the total number of 1099s being submitted.

- List the types of 1099s being submitted (e.g., 1099-MISC, 1099-NEC).

- Indicate whether the 1099s are being submitted electronically or by mail.

Benefits of Free 1096 Transmittal Form Download

Innit, bruv, downloading the 1096 Transmittal Form for free is a right result, like, it’s the biz. You’re gonna save yourself a bomb on ink and paper, not to mention the hassle of having to print it out and fill it in by hand. Plus, you can do it all from the comfort of your own crib.

It’s a right time-saver, too. You don’t have to waste your precious time trying to find the right form online or at the library. Just click a button and it’s there, ready to go.

Alternative Options to the 1096 Transmittal Form

Innit, bruv, there are a few other ways you can get your 1096 info to the taxman without using the old-fashioned 1096 Transmittal Form. These options have their own set of pros and cons, so let’s break ’em down.

Electronic Filing

With electronic filing, you can submit your 1096 data directly to the IRS through an approved software provider. This option is quick, easy, and secure. Plus, you can often get a discount on your tax software if you use this method.

However, there are a few things to keep in mind with electronic filing. First, you’ll need to make sure that your software is up-to-date and that it supports the latest version of the 1096 form. Second, you’ll need to be able to provide your data in a format that the IRS can accept. And finally, you’ll need to be prepared to pay a fee for using the software.

Magnetic Media Filing

Magnetic media filing is another option for submitting your 1096 data to the IRS. With this method, you’ll need to create a magnetic tape or diskette that contains your data. You can then mail this tape or diskette to the IRS.

Magnetic media filing is a good option if you have a large number of 1096 forms to submit. However, it can be more expensive and time-consuming than electronic filing.

Paper Filing

If you’re not comfortable with electronic filing or magnetic media filing, you can always file your 1096 forms on paper. However, this is the most time-consuming and error-prone method.

To file your 1096 forms on paper, you’ll need to download the 1096 Transmittal Form from the IRS website. You’ll then need to complete the form and mail it to the IRS along with your 1096 forms.

Answers to Common Questions

What is the purpose of the 1096 Transmittal Form?

The 1096 Transmittal Form is used to accompany 1099 forms when they are submitted to the IRS. It provides essential information about the filer, including the number of 1099 forms being submitted and the total amount of payments reported.

Where can I download the 1096 Transmittal Form for free?

You can download the 1096 Transmittal Form for free from the IRS website or from reputable tax software providers. Direct links to download pages will be provided in the guide.

What are some common mistakes to avoid when filling out the 1096 Transmittal Form?

Common mistakes include incorrect filer information, mismatched totals, and missing or incomplete data. It’s crucial to carefully review the form before submitting it to ensure accuracy.