Free 1065 Form Instructions Download: A Comprehensive Guide

Navigating the complexities of tax forms can be a daunting task, but with the right resources, it doesn’t have to be. This guide provides a comprehensive overview of the 1065 form, including detailed instructions on how to download it for free. Whether you’re a seasoned tax professional or a first-time filer, this guide will equip you with the knowledge and tools you need to complete the 1065 form accurately and efficiently.

In addition to the step-by-step download process, this guide delves into the purpose and significance of the 1065 form, explaining the different sections and components in detail. We’ll also discuss the structure and organization of the 1065 form’s instructions, providing insights into the information required to complete the form accurately.

Common Issues and Troubleshooting

Using the 1065 form can occasionally present some challenges. Here are some common issues and troubleshooting tips to help you navigate the process smoothly.

Identifying Errors

Before submitting your 1065 form, it’s crucial to check for errors. Some common mistakes include:

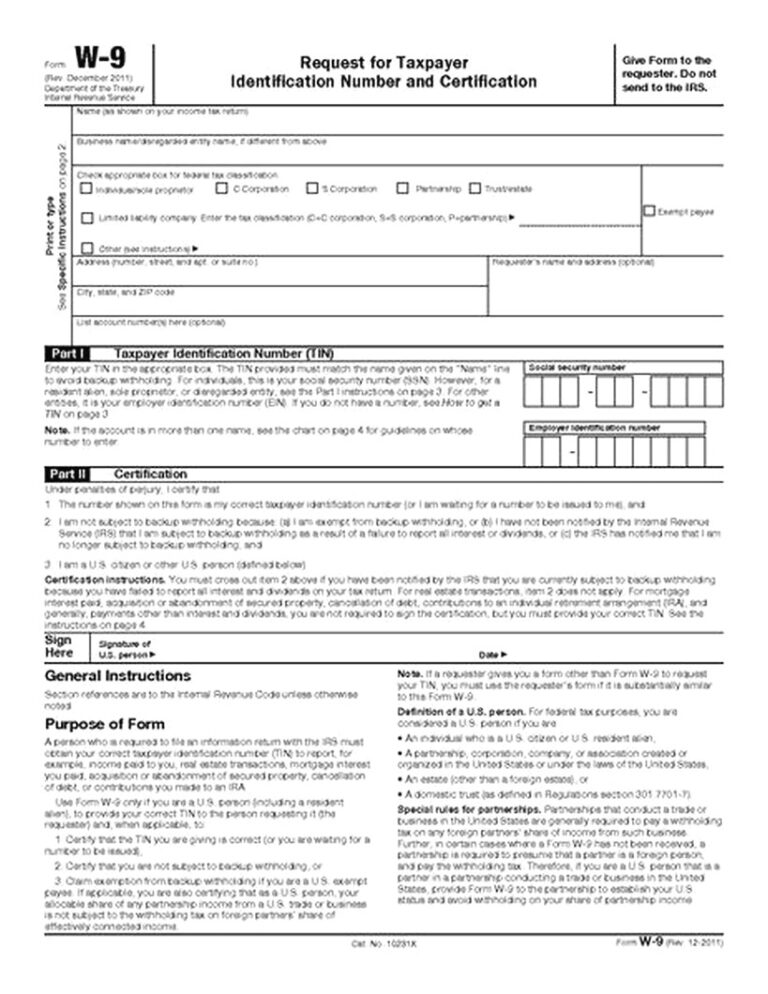

- Incorrect taxpayer identification number (TIN)

- Missing or incomplete information

- Mathematical errors

- Failure to attach required schedules

Troubleshooting Tips

If you encounter any errors while using the 1065 form, follow these troubleshooting tips:

- Verify your TIN: Ensure that the TIN you entered on the form matches the one assigned to your partnership by the IRS.

- Review for missing information: Double-check that all required fields on the form have been filled in accurately and completely.

- Check for mathematical errors: Carefully review your calculations and ensure that all numbers are correct and that the totals match.

- Attach required schedules: Make sure to include any necessary schedules, such as Schedule K-1, with your form.

Additional Support

If you need further assistance with the 1065 form, you can access the following resources:

- IRS website: https://www.irs.gov/forms-pubs/about-form-1065

- IRS Helpline: 1-800-829-1040

- Tax professionals: Consult with a certified public accountant (CPA) or enrolled agent (EA) for personalized guidance.

Benefits of Using s

The 1065 form s offers numerous advantages that can significantly enhance the efficiency and accuracy of your tax filing process.

One of the primary benefits of using the s is its ability to save time and effort. By providing a streamlined and user-friendly interface, the s allows you to quickly and easily complete your tax return. The form’s intuitive design guides you through each step of the filing process, ensuring that you can accurately and efficiently provide the necessary information.

Accuracy and Compliance

The s also plays a crucial role in improving the accuracy of your tax return. The form’s built-in validation checks help identify errors and inconsistencies in your data, reducing the risk of mistakes that could lead to costly penalties or delays in processing.

Moreover, the s ensures that your tax return is fully compliant with the latest tax laws and regulations. By incorporating up-to-date information and guidance, the s helps you stay informed of any changes that may affect your tax liability, ensuring that you meet all your tax obligations.

Q&A

How do I download the 1065 form instructions for free?

To download the 1065 form instructions for free, visit the Internal Revenue Service (IRS) website and navigate to the “Forms and Publications” section. Locate the 1065 form and click on the “Instructions” link. The instructions will be available in PDF format, which you can download and save to your computer.

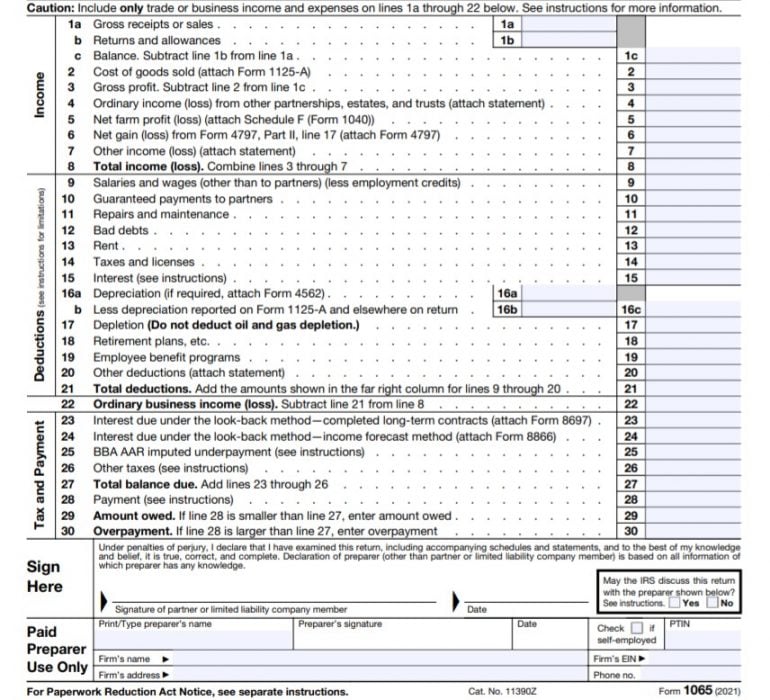

What are the different sections of the 1065 form?

The 1065 form consists of several sections, including:

- Header: This section contains basic information about the partnership, such as its name, address, and taxpayer identification number.

- Income: This section reports the partnership’s income from various sources, such as business operations, investments, and passive activities.

- Deductions: This section lists the partnership’s deductible expenses, such as salaries, rent, and depreciation.

- Credits: This section reports any tax credits that the partnership is eligible for.

- Other Information: This section includes additional information about the partnership, such as its accounting method and the names and addresses of its partners.

What information do I need to complete the 1065 form?

To complete the 1065 form, you will need the following information:

- Basic information about the partnership, such as its name, address, and taxpayer identification number

- Financial information for the partnership, such as its income, deductions, credits, and other expenses

- Information about the partnership’s partners, such as their names, addresses, and ownership percentages