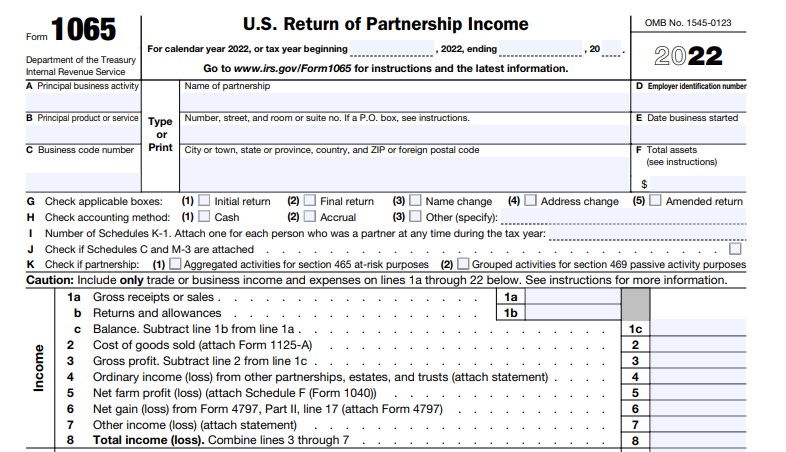

Free 1065 Form 2024 Download: A Comprehensive Guide for Partnerships

Navigating the complexities of partnership tax reporting can be a daunting task. However, with the availability of the free 1065 form, individuals can efficiently calculate and report their partnership income and deductions. This comprehensive guide will provide a thorough overview of the 1065 form, its purpose, and the benefits of utilizing it. Additionally, we will explore the key sections and fields of the form, emphasizing the importance of accuracy and highlighting common errors to avoid. To simplify the process, we will present a step-by-step guide with screenshots to demonstrate the seamless download of the 1065 form from the IRS website or other reliable sources.

Furthermore, we will delve into the effective use of the 1065 form, explaining how to organize and prepare supporting documentation. We will also discuss the potential consequences of filing an incorrect or incomplete 1065 form, ensuring that partnerships are well-informed and compliant with tax regulations. To address common queries, we have compiled a list of frequently asked questions and their concise answers, providing clarity on various aspects of the 1065 form.

Step-by-Step Guide to Downloading the 1065 Form

Downloading the 1065 form is a straightforward process that can be completed in a few simple steps. Whether you need the form for tax preparation or other purposes, there are several convenient ways to obtain it. This guide will provide you with a detailed walkthrough of how to download the 1065 form, including screenshots and comparisons of different methods.

Navigating the IRS Website

The official website of the Internal Revenue Service (IRS) is the most reliable source for downloading the 1065 form. Here’s how to navigate the website to find the form:

- Visit the IRS website at www.irs.gov.

- In the search bar at the top right corner, type “Form 1065” and press enter.

- From the search results, select “Form 1065, U.S. Return of Partnership Income.”

- On the 1065 form page, scroll down to the “Forms and Publications” section and click on “Download PDF.”

Downloading from Other Sources

In addition to the IRS website, there are other reliable sources from which you can download the 1065 form. These include:

- Tax software providers: Many tax software providers offer free downloads of tax forms, including the 1065 form.

- Tax preparation services: Some tax preparation services provide free access to tax forms as part of their services.

- Libraries and community centers: Public libraries and community centers often have copies of tax forms available for download or printing.

Comparison of Downloading Methods

The following table compares the different methods of downloading the 1065 form in terms of convenience, reliability, and cost:

| Method | Convenience | Reliability | Cost |

|---|---|---|---|

| IRS website | High | Very high | Free |

| Tax software providers | Medium | High | May vary |

| Tax preparation services | Low | Medium | May vary |

| Libraries and community centers | Low | Medium | Free |

Using the 1065 Form Effectively

The 1065 form is an essential tool for partnerships to calculate and report their income and deductions. It’s important to understand how to use the form correctly to avoid any potential issues.

To use the 1065 form effectively, you’ll need to:

- Gather all of your financial information, including income, expenses, and deductions.

- Complete the form accurately and completely.

- File the form on time.

Tips for Organizing and Preparing Supporting Documentation

It’s important to organize your financial information before you start filling out the 1065 form. This will make the process much easier and help you avoid any errors.

Some tips for organizing your financial information include:

- Use a spreadsheet to track your income and expenses.

- Keep all of your receipts and invoices in a safe place.

- Make sure that your financial information is up-to-date.

Once you have organized your financial information, you can start preparing your supporting documentation. This documentation will include things like your bank statements, invoices, and receipts.

It’s important to make sure that your supporting documentation is complete and accurate. This will help the IRS verify the information on your 1065 form.

Potential Consequences of Filing an Incorrect or Incomplete 1065 Form

Filing an incorrect or incomplete 1065 form can have a number of negative consequences. These consequences can include:

- Penalties from the IRS.

- Delays in processing your refund.

- Audits.

It’s important to make sure that you file your 1065 form correctly and completely to avoid any potential issues.

Questions and Answers

What is the purpose of the 1065 form?

The 1065 form is an essential tax document used by partnerships to report their income, deductions, gains, and losses to the Internal Revenue Service (IRS). It serves as the primary means for partnerships to fulfill their tax reporting obligations.

Where can I download the free 1065 form?

The free 1065 form can be conveniently downloaded from the official website of the IRS (www.irs.gov) or through various tax software programs. These platforms provide easy access to the latest version of the form, ensuring that partnerships can stay up-to-date with any revisions or changes.

What are the benefits of using the free 1065 form?

Utilizing the free 1065 form offers several advantages. It eliminates the need for manual calculations and reduces the risk of errors, as the form is designed to guide partnerships through the reporting process. Additionally, it simplifies record-keeping, as the form provides a structured framework for organizing and presenting financial information.