Free 1052-s Form Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, especially when dealing with specialized forms like the 1052-S. This form plays a crucial role in reporting the sale or exchange of certain specified property, and understanding its intricacies is essential for accurate and timely filing.

In this comprehensive guide, we will delve into the purpose, significance, and intricacies of the 1052-S form. We will provide a step-by-step guide to help you fill out the form accurately, troubleshoot common errors, and explore the various submission options. Additionally, we will address potential penalties and consequences associated with incorrect or late filing, ensuring that you fulfill your tax obligations with confidence.

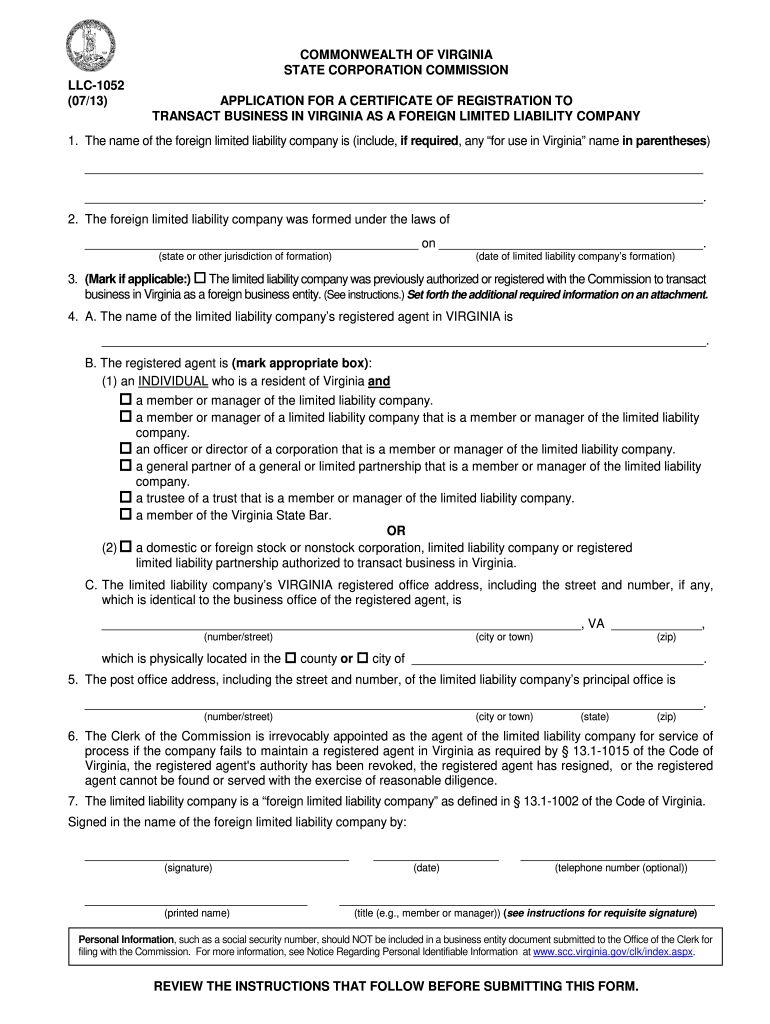

1052-S Form Overview

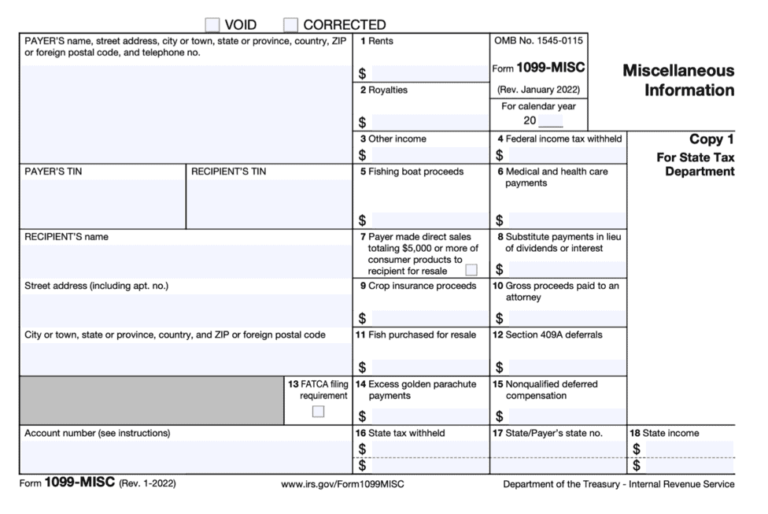

The 1052-S form is an Internal Revenue Service (IRS) tax form used to report the sale or exchange of certain types of property. It is a crucial document for taxpayers who have disposed of real estate, stocks, bonds, or other capital assets during the tax year.

Purpose and Significance

The primary purpose of Form 1052-S is to provide the IRS with information about the proceeds from the sale or exchange of property. This information is used to calculate the taxpayer’s capital gains or losses, which are then reported on their individual income tax return (Form 1040).

Who is Required to File Form 1052-S?

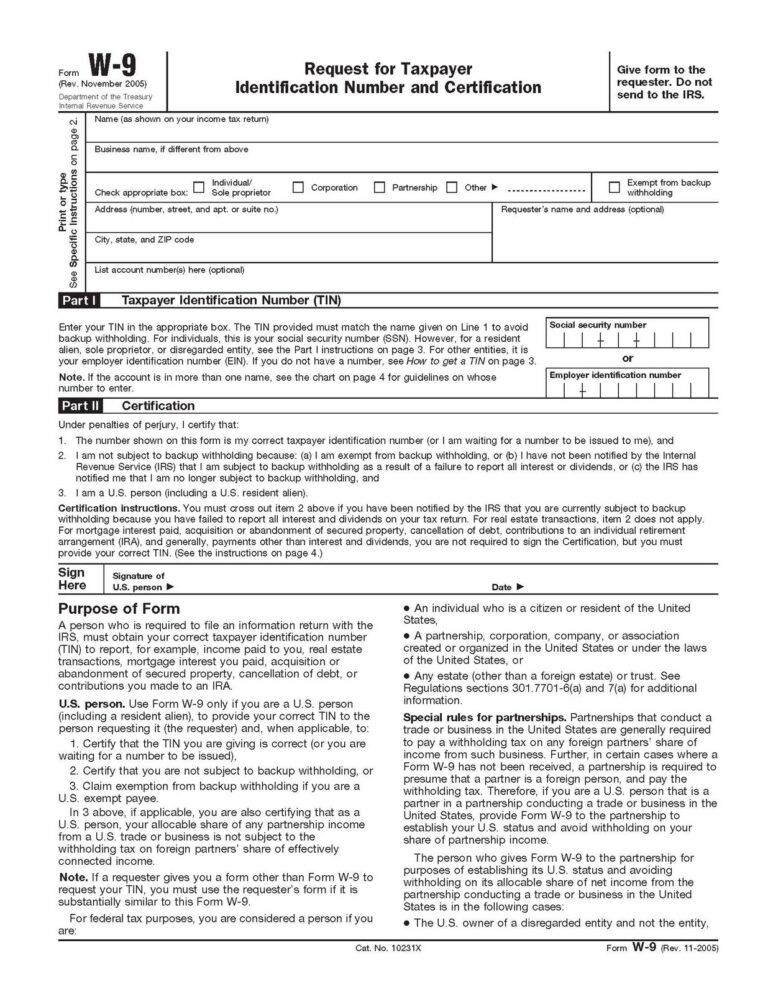

Individuals or entities that receive proceeds from the sale or exchange of property are generally required to file Form 1052-S. This includes:

- Individuals who sell real estate or other capital assets.

- Brokers or other intermediaries who facilitate the sale or exchange of property.

- Corporations or partnerships that dispose of property.

Common Errors and Troubleshooting

Filling out the 1052-S form can be tricky, and even the most careful people can make mistakes. Here are some common errors to watch out for and troubleshooting tips to help you resolve them.

Incorrect or Missing Information

One of the most common errors is entering incorrect or missing information. Make sure to double-check all the information you enter, especially your personal information and the details of your sale.

Using the Wrong Form

There are different versions of the 1052-S form for different types of sales. Make sure you’re using the correct form for your situation. If you’re not sure which form to use, consult the IRS website or contact the IRS for assistance.

Mathematical Errors

Another common error is making mathematical errors when calculating your gain or loss. Be sure to carefully review your calculations and make sure they’re accurate.

Filing Late

Filing your 1052-S form late can result in penalties. Make sure to file your form by the due date, which is generally April 15th.

Resolving Errors

If you make a mistake on your 1052-S form, you can file an amended return using Form 1040X. You can also contact the IRS for assistance with resolving errors.

Submission and Filing Options

Filing your 1052-S form is a breeze, bruv. You’ve got a couple of slick options to choose from. Let’s dive in, innit?

Electronic Filing

If you’re all about the digital life, electronic filing is your jam. It’s quick, easy, and you can do it from the comfort of your own gaff. Plus, you’ll get instant confirmation that your form has been received. Sweet, right?

Mail-in Options

If you prefer the old-school approach, you can always post your 1052-S form to the address provided on the form. Just make sure you pop it in the postbox before the deadline. No messing about, yeah?

Deadlines and Requirements

The deadline for filing your 1052-S form is typically around the 15th of March. But don’t cut it too fine, make sure you give yourself plenty of time to get it sorted. And remember, you’ll need to include all the necessary documentation, like your recipient’s Social Security number. Easy peasy, lemon squeezy!

Penalties and Consequences

Failing to file the 1052-S form correctly or on time can result in severe penalties and consequences. The IRS may impose significant fines, interest charges, and even criminal prosecution in cases of intentional or fraudulent misfiling.

Consequences of Late Filing

Late filing of the 1052-S form can lead to the following consequences:

– Late filing penalties: The IRS may impose a penalty of $50 per day, up to a maximum of $25,000, for each late-filed 1052-S form.

– Interest charges: Interest will accrue on any unpaid taxes from the due date of the return until the date the taxes are paid.

– Loss of refund: If you are due a refund, late filing may result in the loss of your refund.

Consequences of Incorrect Filing

Filing an incorrect 1052-S form can also lead to penalties and consequences, including:

– Penalties for incorrect information: The IRS may impose penalties for providing incorrect information on the 1052-S form, such as incorrect payee information or incorrect amounts reported.

– Disallowance of deductions: The IRS may disallow deductions or credits claimed on the 1052-S form if the information provided is incorrect.

– Criminal prosecution: In cases of intentional or fraudulent misfiling, the IRS may pursue criminal prosecution, which can result in fines and imprisonment.

FAQ Corner

Can I download the 1052-S form online?

Yes, you can download the 1052-S form from the official IRS website or other authorized sources.

What information do I need to provide on the 1052-S form?

You will need to provide details about the property sold or exchanged, including its description, acquisition date, and cost or other basis.

What are the consequences of filing the 1052-S form late or incorrectly?

Late or incorrect filing may result in penalties and interest charges imposed by the IRS.