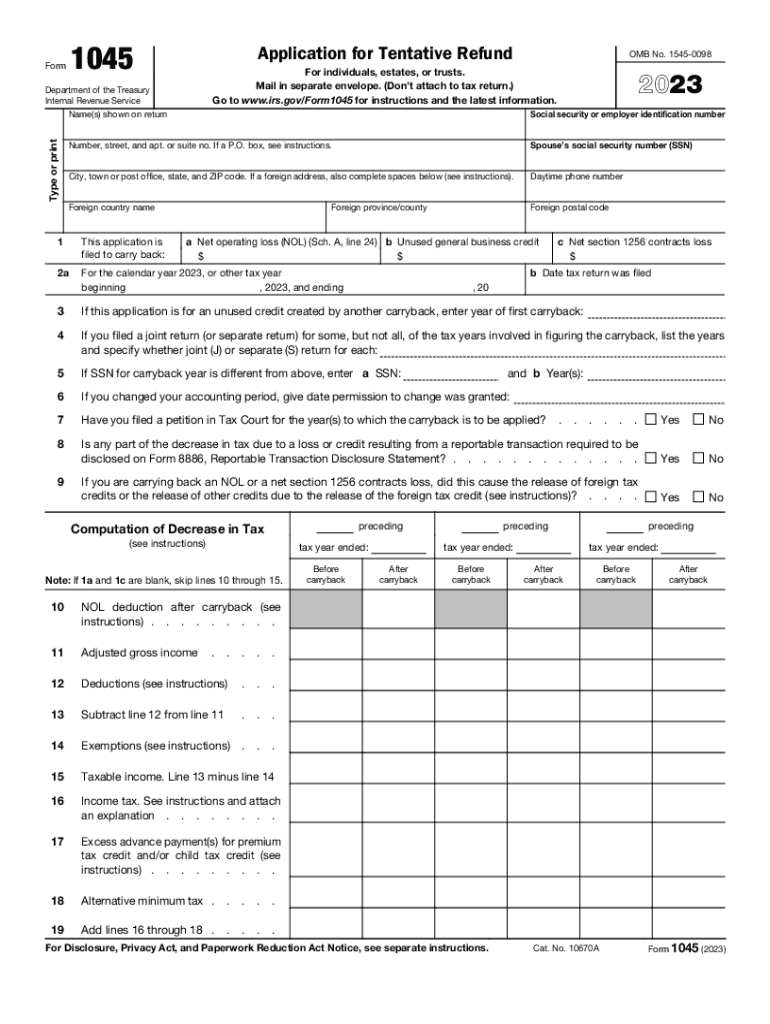

Free 1045 Tax Form Download: A Comprehensive Guide

Navigating the intricacies of the US tax system can be a daunting task, but understanding and utilizing essential forms like the 1045 can significantly simplify the process. This comprehensive guide will provide you with everything you need to know about downloading Form 1045 for free, including the benefits, drawbacks, and step-by-step instructions.

Form 1045, officially known as the Application for Tentative Refund from Carryback of Net Operating Loss, plays a crucial role in the US tax system. It allows eligible entities to claim a refund for overpaid taxes in previous years by carrying back net operating losses to those years. Understanding the purpose and significance of this form is essential for maximizing tax savings and ensuring compliance with tax regulations.

Tax Form 1045 Overview

Form 1045 is a US Internal Revenue Service (IRS) document that applies specifically to US citizens and resident aliens. This form is primarily used to report and pay any applicable application fees associated with the adjustment or change of status for non-immigrant aliens. It is not related to income taxes.

The Application for Adjustment of Status form, also known as Form I-485, is a crucial document submitted to United States Citizenship and Immigration Services (USCIS) by individuals seeking to become lawful permanent residents. Form 1045, on the other hand, is used to pay the associated application fee for Form I-485.

Types of Entities Required to File Form 1045

Form 1045 is required for various types of non-immigrant aliens applying for adjustment of status to become lawful permanent residents. These include individuals who:

- Are in the US on a non-immigrant visa and wish to change their status to lawful permanent resident.

- Have been granted asylum or refugee status and are applying for lawful permanent resident status.

- Are immediate relatives of US citizens or lawful permanent residents and are applying for adjustment of status.

- Are diversity visa lottery winners and are applying for adjustment of status.

Benefits of Downloading Free Form 1045

Bruv, you’re in luck! Snagging Form 1045 for free is a boss move. Not only will you save a pretty penny, but it’s also a doddle to do. No need to waste your hard-earned cash or trek to some stuffy office. Just clickety-click, and bam! You’ve got it sorted.

Potential Drawbacks

Now, hold your horses. While free downloads are wicked, it’s not all sunshine and rainbows. Some dodgy websites might try to sneak in viruses or malware, so make sure you’re downloading from a reputable source, innit?

Tips for Completing Form 1045

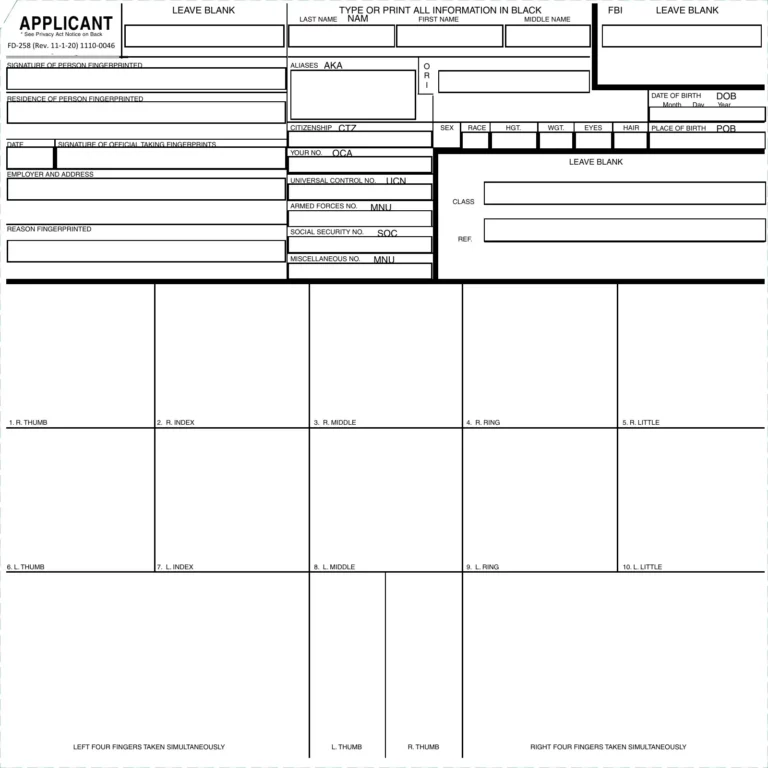

Filling out Form 1045 can be a bit of a headache, but it’s important to get it right to avoid any hassle with the taxman. Here are a few tips to help you breeze through it like a pro:

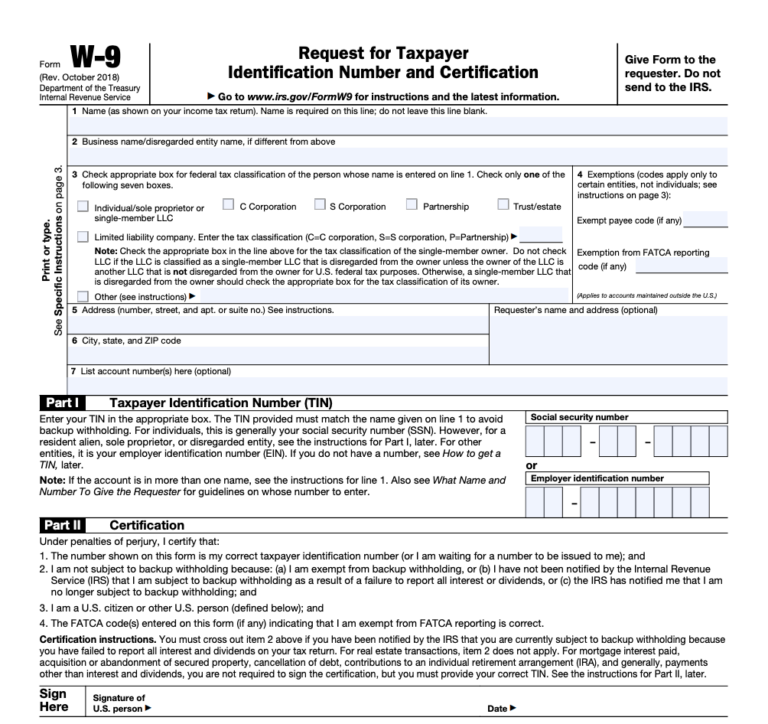

First up, make sure you’ve got all the info you need before you start. This includes your Social Security number, the name and address of your transferee, and the date of the transfer. If you’re not sure about something, don’t guess – check with the IRS or a tax professional.

When you’re filling out the form, be as accurate and complete as possible. Don’t leave any blanks, and make sure your handwriting is legible. If you make a mistake, cross it out neatly and write the correction above it. And don’t forget to sign and date the form before you send it in.

Common Errors to Avoid

Here are a few common errors to watch out for when filling out Form 1045:

- Forgetting to sign and date the form.

- Leaving blanks or filling in the form incompletely.

- Making mistakes in your Social Security number or the transferee’s information.

- Entering incorrect dates or amounts.

- Using illegible handwriting.

Getting Help

If you’re struggling to complete Form 1045, don’t panic. There are plenty of resources available to help you out.

You can find helpful information on the IRS website, or you can call the IRS at 1-800-829-1040. You can also get help from a tax professional, such as an accountant or tax preparer.

Related Resources

If you’re looking for further guidance on Form 1045, check out these helpful resources:

Don’t be a mug! Get the lowdown on Form 1045 from the top dogs at the IRS: www.irs.gov/form1045

Articles and Blog Posts

- Get the inside scoop on Form 1045 with this ace article: www.taxtips.com/form1045

- Brush up on the basics of Form 1045 with this nifty blog post: www.taxbuzz.com/form1045

Online Forums and Discussion Groups

- Join the tax-savvy crew at this online forum: www.taxforum.com

- Get your questions answered by the tax gurus in this discussion group: www.taxchat.com

FAQs

Q: What types of entities are required to file Form 1045?

A: Form 1045 is primarily filed by corporations, but other entities such as trusts and estates may also need to file under certain circumstances.

Q: What are the potential drawbacks of using free downloads?

A: While free downloads offer cost savings, it’s important to be cautious of potential malware or viruses. Always ensure that you’re downloading from reputable sources.

Q: What are some common errors to avoid when completing Form 1045?

A: Common errors include incorrect calculations, missing or incomplete information, and failing to attach supporting documentation. Carefully review your form before submitting it to avoid delays or errors in processing.