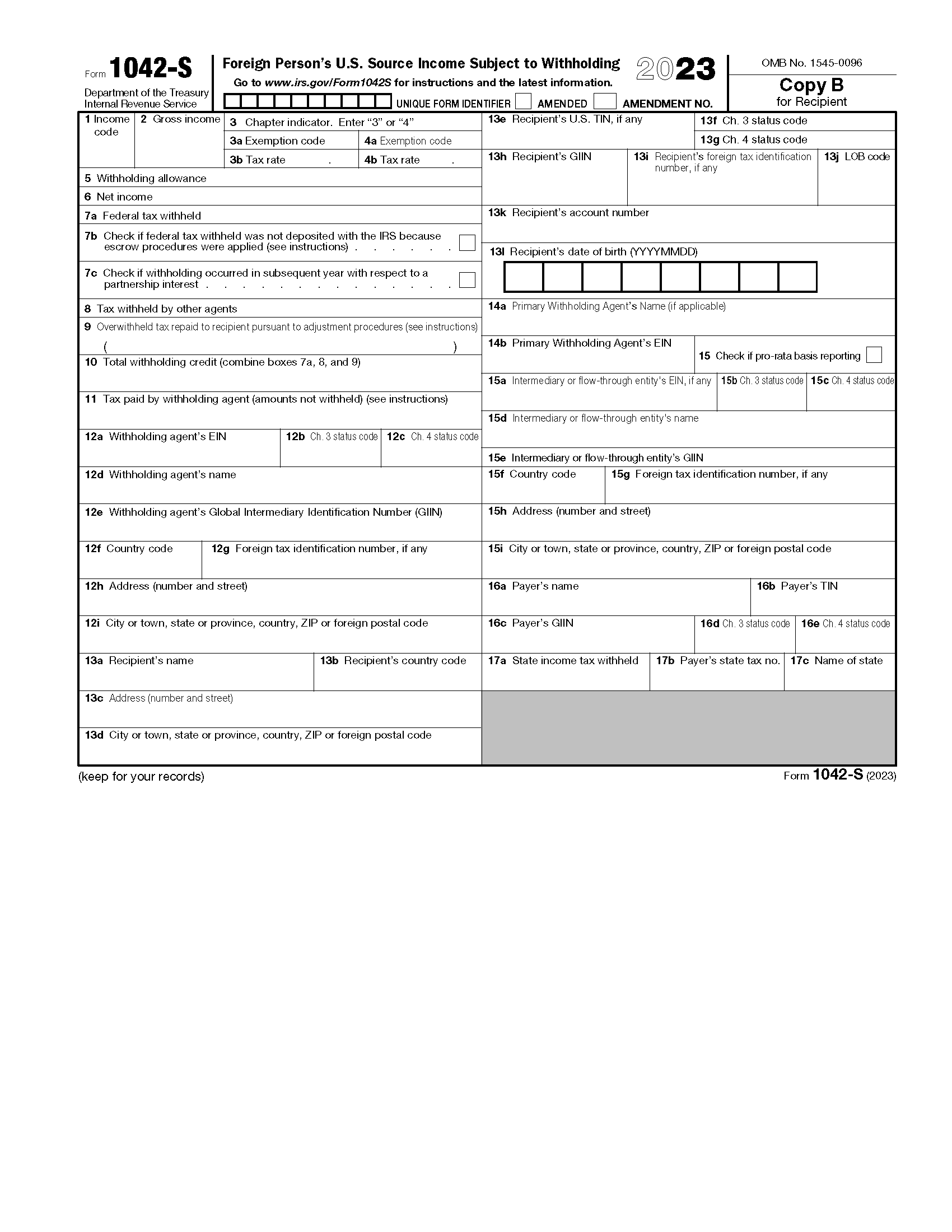

Free 1042s Tax Form Download: A Comprehensive Guide

Filing taxes can be a daunting task, but it doesn’t have to be. With the advent of free 1042s tax form downloads, individuals can now easily access and complete their tax forms without any hassle or cost. In this guide, we will delve into the world of free 1042s tax form downloads, exploring their benefits, providing step-by-step instructions, and addressing common issues you may encounter along the way.

1042s tax forms are essential for reporting income from U.S. source payments made to foreign persons. Downloading these forms for free can save you time and money, and it ensures that you have the most up-to-date version of the form.

Troubleshooting Common Issues with Free 1042s Tax Form Downloads

Downloading and using free 1042s tax forms is generally straightforward, but some common issues can arise. This guide provides troubleshooting steps to resolve these problems and ensure a smooth tax preparation process.

Before troubleshooting, ensure you have a stable internet connection and the latest version of your preferred web browser.

Incorrect or Missing Form Version

- Issue: The downloaded 1042s form is not the correct version or is missing essential sections.

- Solution: Check the official IRS website for the most up-to-date version of the 1042s form. Ensure you download the form directly from the IRS website or a reputable source.

File Download Issues

- Issue: The 1042s tax form fails to download or the download process is interrupted.

- Solution: Check your internet connection and try refreshing the download page. If the issue persists, try downloading the form using a different web browser or device.

Form Filling Difficulties

- Issue: You encounter difficulties filling out the 1042s tax form, such as missing instructions or unclear fields.

- Solution: Refer to the official IRS instructions for the 1042s form. You can also seek assistance from a tax professional or use online tax preparation software.

Software Compatibility Problems

- Issue: The downloaded 1042s tax form is not compatible with your tax preparation software.

- Solution: Check the software’s documentation or contact the software provider to ensure compatibility. If necessary, update your software or consider using a different tax preparation software.

FAQ Summary

What is a 1042s tax form?

A 1042s tax form is used to report income from U.S. source payments made to foreign persons. It is required for payments made to non-resident aliens, foreign corporations, and foreign trusts.

Where can I download a free 1042s tax form?

You can download a free 1042s tax form from the IRS website or from a variety of other websites that offer free tax forms.

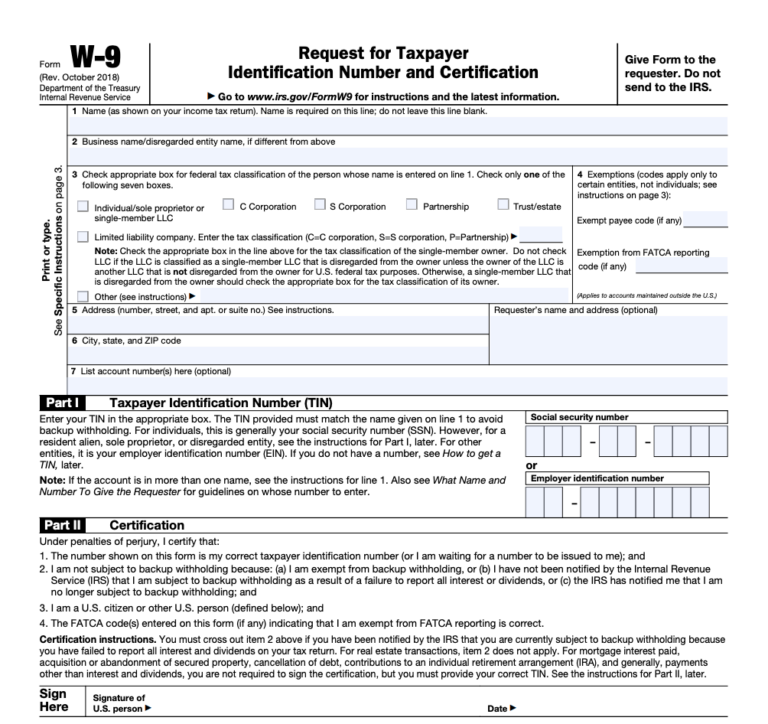

How do I fill out a 1042s tax form?

The 1042s tax form is relatively straightforward to fill out. You will need to provide information about the payer, the recipient, and the income that was paid. The IRS provides detailed instructions on how to fill out the form on their website.

What are some common issues that I may encounter when downloading or using a free 1042s tax form?

Some common issues that you may encounter include:

- The form may not be available in the correct format.

- The form may not be up-to-date.

- You may have difficulty downloading the form.