Free 1041 Extension Form Download: A Comprehensive Guide

Navigating tax season can be a daunting task, but it doesn’t have to be. With the free 1041 Extension Form Download, you can seamlessly extend your tax filing deadline, ensuring you have ample time to gather the necessary documents and complete your return accurately.

In this comprehensive guide, we will delve into the significance of the 1041 Extension Form, its features, and the various download options available. Additionally, we will provide troubleshooting tips, links to official resources, and support channels to assist you throughout the process.

Relevance and Accessibility

Access to the free 1041 Extension Form is crucial for taxpayers, enabling them to file for an extension on their tax returns without incurring additional costs.

Making the form easily downloadable provides numerous benefits. It allows individuals and businesses to:

Convenience

- Obtain the form swiftly and effortlessly, without the need for physical visits to tax offices or reliance on postal services.

- Complete and submit the form electronically, saving time and resources.

Accuracy

- Access the most up-to-date version of the form, ensuring compliance with the latest tax regulations.

- Reduce the risk of errors by using the official form provided by the tax authorities.

Financial Savings

- Avoid late filing penalties by submitting the extension form on time.

- Eliminate the need for paid tax preparation services, empowering taxpayers to handle their tax affairs independently.

Form Features and s

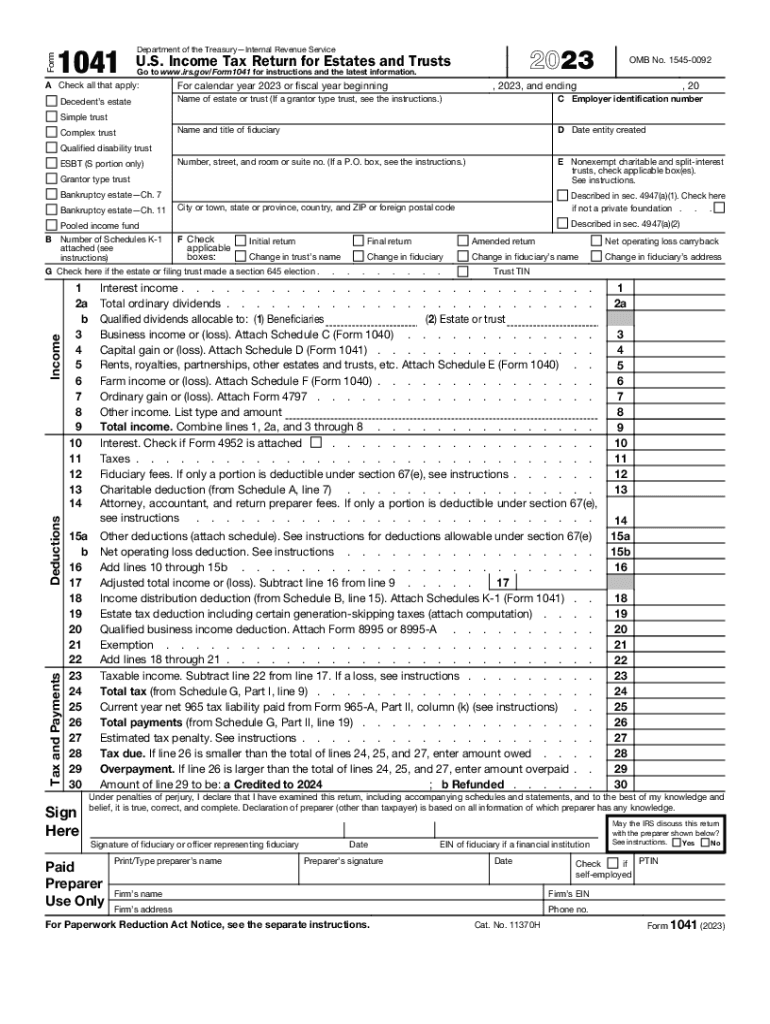

The 1041 Extension Form, also known as the Application for Automatic Extension of Time to File U.S. Income Tax Return, is an official document submitted to the Internal Revenue Service (IRS) to request an extension for filing federal income tax returns beyond the standard April 15th deadline.

This form is essential for taxpayers who anticipate being unable to complete and submit their tax returns on time due to various circumstances, such as incomplete financial records, complex tax situations, or unforeseen events.

Filing Instructions

- Section 1: Taxpayer Information

Provide basic personal information, including name, address, Social Security number, and daytime phone number.

- Section 2: Filing Status

Indicate your filing status, such as single, married filing jointly, or head of household.

- Section 3: Extension Request

Specify the number of additional months you are requesting for the extension, up to a maximum of six months.

- Section 4: Reason for Extension

Briefly explain the reason for requesting the extension, such as incomplete records, illness, or military deployment.

- Section 5: Signature and Date

The form must be signed and dated by the taxpayer or an authorized representative.

Download Options and Compatibility

Fam, downloading the 1041 Extension Form is a doddle. You can grab it from the IRS website on your laptop, tablet, or even your blower. Just make sure you’ve got a decent internet connection and a PDF reader like Adobe Acrobat or Foxit Reader.

If you’re having a mare downloading the form, check your internet connection or try using a different browser. You can also give the IRS a bell on 1-800-829-1040, and they’ll be happy to help you out.

Additional Resources and Support

If you’re still feeling lost, don’t fret! There’s a bunch of resources out there to help you get your head around the 1041 Extension Form.

Official Websites and Resources

– HMRC’s official website has a treasure trove of info on the form: https://www.gov.uk/hmrc-internal-manuals/inheritance-tax-manual/ihtm040150

– You can also check out GOV.UK for more general info on inheritance tax: https://www.gov.uk/inheritance-tax

Support Options

– If you’re still struggling, don’t be shy to reach out to HMRC for help. You can give ’em a bell on 0300 123 1072.

– You can also drop ’em an email at [email protected].

– Or, if you prefer a face-to-face chat, you can book an appointment at your local HMRC office.

FAQ

What are the benefits of using the free 1041 Extension Form Download?

The free 1041 Extension Form Download offers several benefits, including:

- Convenience: Easily accessible and downloadable from various platforms and devices.

- Cost savings: No need to purchase the form, resulting in financial savings.

- Time efficiency: Allows for a quick and effortless extension request process.

- Accuracy: Ensures the form is filled out correctly, reducing the risk of errors.

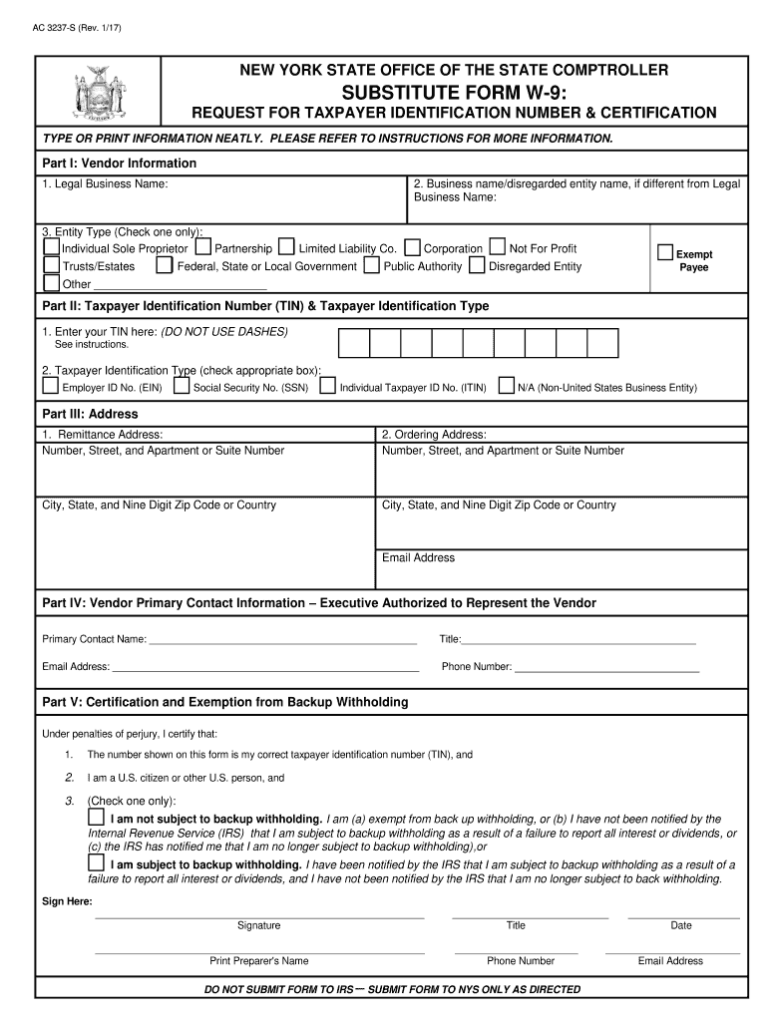

What information is required on the 1041 Extension Form?

The 1041 Extension Form requires the following information:

- Name and address of the estate or trust

- Employer Identification Number (EIN)

- Tax year for which the extension is requested

- Signature of the fiduciary

Where can I find additional support if I have questions about the 1041 Extension Form?

If you have any questions or require additional support, you can refer to the following resources:

- IRS website: https://www.irs.gov/forms-pubs/about-form-1041

- IRS helpline: 1-800-829-1040

- Tax professionals: Consider consulting with a tax accountant or enrolled agent for personalized guidance.