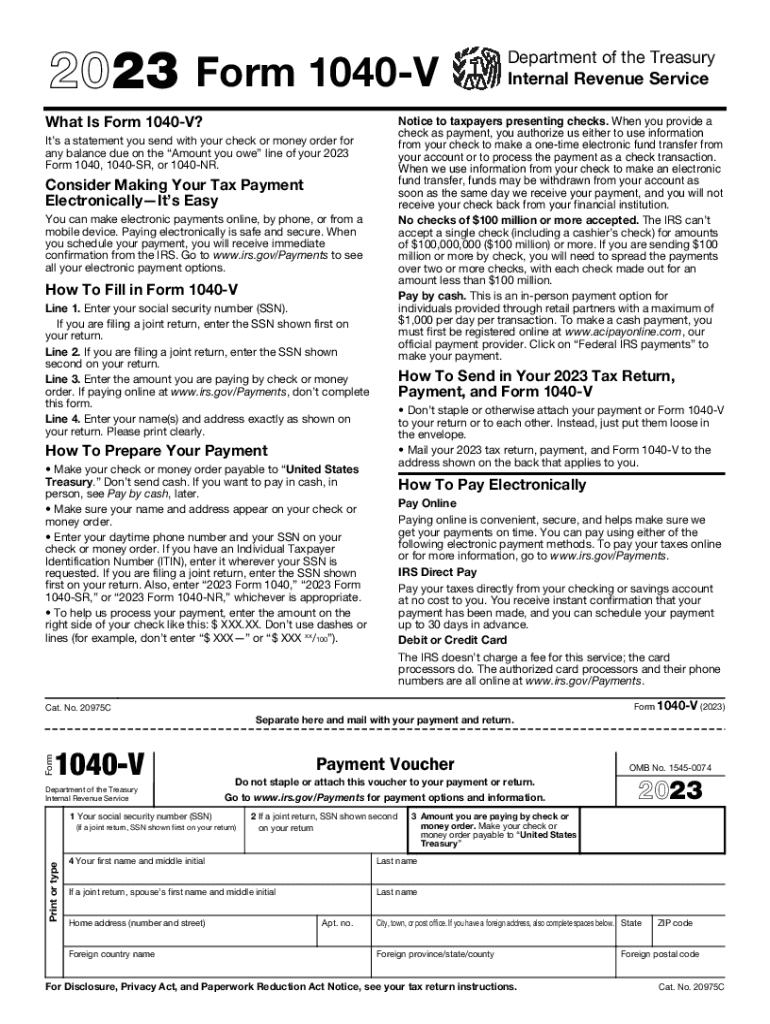

Free 1040-v Form 2024 Download: A Comprehensive Guide

Preparing your taxes can be a daunting task, but with the right tools, it doesn’t have to be. The Free 1040-v Form 2024 is an essential resource for taxpayers, providing a user-friendly and comprehensive way to file your taxes accurately and efficiently.

This guide will provide you with everything you need to know about the Free 1040-v Form 2024, including its availability, features, eligibility requirements, filing options, and common errors to avoid. We’ll also share additional resources to help you with your tax preparation.

Form 1040-v Availability

The 2024 Free 1040-v Form is expected to be released in January 2024. It will be available for download from the IRS website and from tax software providers.

The 1040-v is a simplified version of the 1040 tax form. It is designed for taxpayers who have simple tax returns, such as those who have only wages, salaries, and tips.

Release Date

The 1040-v form is expected to be released in January 2024. The exact release date has not yet been announced.

Where to Download

The 1040-v form can be downloaded from the IRS website or from tax software providers.

- IRS website: https://www.irs.gov/forms-pubs/about-form-1040-v

- Tax software providers: Many tax software providers offer the 1040-v form as part of their software.

Form 1040-v Features

The 2024 Free 1040-v Form offers several key features that streamline the tax-filing process and enhance its accessibility. It incorporates user-friendly enhancements, including simplified language, clear instructions, and a logical layout. Additionally, it introduces new sections and modifies existing ones to accommodate evolving tax regulations and provide filers with comprehensive guidance.

Enhanced Accessibility

The 2024 Free 1040-v Form prioritizes accessibility by utilizing plain language and providing step-by-step instructions. It employs straightforward terminology, avoiding jargon and technical terms, to ensure comprehension for filers of all backgrounds. Furthermore, it includes detailed examples and illustrative charts to clarify complex concepts and provide practical guidance.

Streamlined Layout

The layout of the 2024 Free 1040-v Form has been optimized for ease of use. It features a logical flow of information, with sections arranged in a sequential manner. This user-friendly design allows filers to navigate the form effortlessly, locate specific sections quickly, and complete their tax returns efficiently.

New Sections

The 2024 Free 1040-v Form introduces new sections to address recent tax law changes and provide filers with additional support. These sections include:

- Schedule 1 (Form 1040-v): Additional Income and Adjustments to Income

- Schedule 2 (Form 1040-v): Tax Credits

- Schedule 3 (Form 1040-v): Other Taxes

These new sections provide filers with dedicated spaces to report specific types of income, tax credits, and other taxes, ensuring accuracy and completeness in their tax returns.

Modified Sections

Several existing sections in the 2024 Free 1040-v Form have been modified to reflect changes in tax regulations and provide filers with updated guidance. These modifications include:

- Line 10: Adjusted Gross Income (AGI)

- Line 12: Standard Deduction or Itemized Deductions

- Line 15: Taxable Income

These modifications ensure that the 2024 Free 1040-v Form aligns with the latest tax laws and provides filers with the most up-to-date information for accurate tax calculations.

s and Guidance

Get ready to conquer your taxes with the 2024 Free 1040-v Form. We’ve got your back with a foolproof guide to help you breeze through each section and snag all the deductions and credits you deserve.

Let’s dive into the nitty-gritty and make this tax season a walk in the park.

Completing the Form

Filling out the 1040-v Form is as easy as pie. Just follow these simple steps:

- Gather your documents: Get all your tax documents, like W-2s, 1099s, and any other paperwork that shows your income and expenses.

- Enter your personal info: Start by filling in your name, address, and Social Security number.

- Report your income: List all your income from wages, self-employment, investments, and any other sources.

- Calculate your deductions: Take advantage of deductions to reduce your taxable income. Common deductions include mortgage interest, charitable donations, and student loan interest.

- Claim your credits: Credits are like cash back on your taxes. Make sure to claim all the credits you qualify for, like the child tax credit and the earned income tax credit.

- Calculate your tax: Based on your income and deductions, the form will calculate how much tax you owe.

- Make your payment: If you owe taxes, you can pay them directly through the form or set up a payment plan.

Maximizing Deductions and Credits

Want to pay less in taxes? Here are some insider tips to help you maximize your deductions and credits:

- Itemize your deductions: If your itemized deductions are more than the standard deduction, you can save money by itemizing. Common itemized deductions include mortgage interest, property taxes, and charitable donations.

- Contribute to a retirement account: Contributions to traditional IRAs and 401(k) plans are tax-deductible. This means you can reduce your taxable income by saving for the future.

- Claim the child tax credit: This credit can reduce your tax bill by up to $2,000 per qualifying child.

- Claim the earned income tax credit: This credit is available to low- and moderate-income working individuals and families. It can reduce your tax bill or even give you a refund.

Common Errors and Troubleshooting

The 2024 Free 1040-v Form is a complex document, and errors can be made. Here are some of the most common errors taxpayers make, and how to avoid them.

Entering incorrect information

One of the most common errors taxpayers make is entering incorrect information on the 1040-v form. This can include errors in your personal information, such as your name, address, or Social Security number. It can also include errors in your income and deduction information. To avoid these errors, be sure to carefully review all of the information you enter on the form before you submit it.

Missing required information

Another common error taxpayers make is missing required information on the 1040-v form. This can include missing information about your income, deductions, or credits. If you miss any required information, the IRS may reject your return or delay your refund. To avoid this error, be sure to carefully review the form and make sure you have completed all of the required fields.

Using the wrong form

There are several different versions of the 1040-v form, and it is important to use the correct one for your situation. If you use the wrong form, the IRS may reject your return or delay your refund. To avoid this error, be sure to carefully review the instructions for the form and make sure you are using the correct one.

Filing late

The 1040-v form is due on April 15th. If you file your return late, you may be subject to penalties and interest. To avoid this error, be sure to file your return on time.

Additional Resources

Find helpful resources to assist with completing the 2024 Free 1040-v Form.

Access reliable information, support channels, and free tax preparation assistance programs.

Websites

- IRS Website: www.irs.gov

- Free File Alliance: www.freefilealliance.org

- United Way: www.unitedway.org

Phone Numbers

- IRS Helpline: 1-800-829-1040

- VITA (Volunteer Income Tax Assistance): 1-800-906-9887

Free Tax Preparation Assistance Programs

- VITA (Volunteer Income Tax Assistance): Free tax preparation assistance for low- to moderate-income taxpayers.

- TCE (Tax Counseling for the Elderly): Free tax preparation assistance for taxpayers age 60 and older.

- Earn It! Keep It! Save It!: Free tax preparation assistance for low-income taxpayers who qualify for the Earned Income Tax Credit.

FAQ Corner

What are the eligibility requirements for using the Free 1040-v Form 2024?

To use the Free 1040-v Form 2024, you must meet certain income limits and other requirements. Generally, the form is suitable for taxpayers with simple tax situations, such as those who earn wages, receive unemployment benefits, or have investment income.

Where can I download the Free 1040-v Form 2024?

You can download the Free 1040-v Form 2024 from the IRS website or through tax preparation software.

What are the different filing options for the Free 1040-v Form 2024?

You can file the Free 1040-v Form 2024 by mail, electronically, or through a tax preparer. Each method has its own advantages and disadvantages, so choose the option that best suits your needs.