Free 1040 V Form 2024 Download: A Comprehensive Guide for Taxpayers

Navigating the complexities of tax filing can be daunting, but the Free 1040 V Form 2024 Download offers a simplified and efficient solution. This comprehensive guide will provide a detailed overview of the form, its benefits, and how to download and use it effectively.

Whether you’re a first-time filer or an experienced taxpayer, understanding the intricacies of tax preparation is crucial. The Free 1040 V Form 2024 is designed to make this process less intimidating and more manageable, empowering you to file your taxes with confidence.

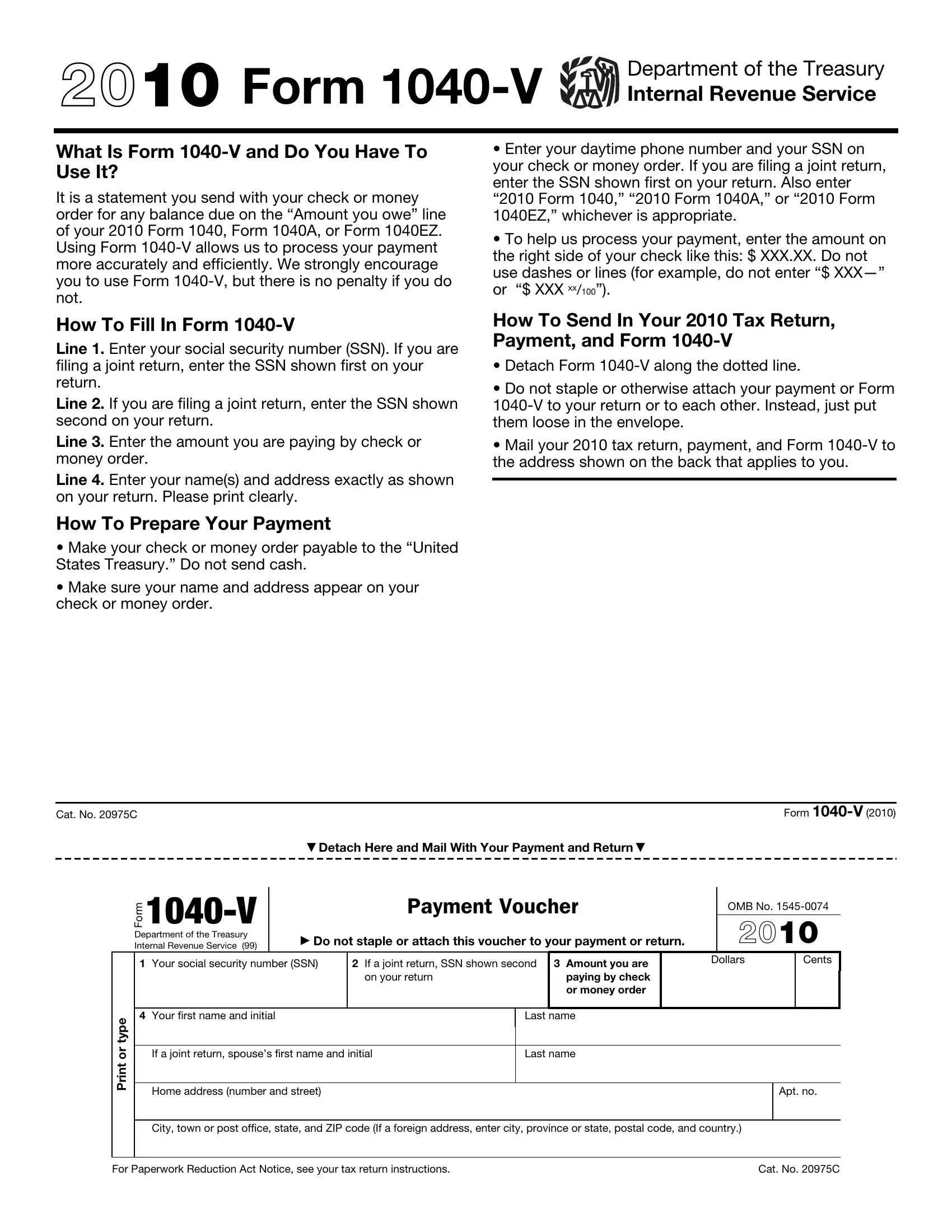

Definition and Purpose of Free 1040 V Form 2024 Download

The Free 1040 V Form 2024 Download is a tax form provided by the Internal Revenue Service (IRS) for eligible taxpayers to file their federal income taxes for the 2024 tax year. It is a simplified version of the traditional 1040 form, designed for individuals with basic tax situations.

The Free 1040 V Form 2024 Download is specifically intended for taxpayers who meet certain criteria, such as having a low to moderate income, limited deductions and credits, and no dependents. It is a convenient and user-friendly option for those who do not require the complexities of the standard 1040 form.

s for Downloading the Free 1040 V Form 2024

Downloading the Free 1040 V Form 2024 is a breeze, innit? Let’s break it down into a few simple steps to make it a doddle for you.

First off, you’ll need a computer or laptop with an internet connection. Make sure you’ve got a PDF reader installed, like Adobe Acrobat Reader, to open the form once you’ve downloaded it.

Step 1: Visit the IRS Website

Head over to the official IRS website at www.irs.gov.

Step 2: Navigate to the Forms Section

Once you’re on the IRS website, click on the “Forms” tab at the top of the page.

Step 3: Search for Form 1040-V

In the search bar, type in “Form 1040-V” and hit enter.

Step 4: Select the Correct Form

You’ll see a list of results. Click on the link for “Form 1040-V, U.S. Individual Income Tax Return.”

Step 5: Download the Form

On the Form 1040-V page, click on the “Download” button. The form will be downloaded as a PDF file.

Features and Benefits of Using the Free 1040 V Form 2024

Blud, listen up. The Free 1040 V Form 2024 is the slickest way to file your taxes. It’s like having a tax pro in your pocket, innit?

This form is the real deal, designed to make your tax filing a breeze. It’s like having a cheat code for doing your taxes. Let’s dive into why you need this form in your life:

It’s a Piece of Cake to Use

Filing your taxes with the Free 1040 V Form 2024 is like a walk in the park. It’s so user-friendly, even your nan could do it. The form guides you through every step, so you don’t have to worry about making any cock-ups.

Reduces the Risk of Errors

Mistakes are for chumps, and with the Free 1040 V Form 2024, you can avoid them like the plague. The form does all the calculations for you, so you don’t have to sweat about getting your sums wrong. It’s like having a calculator on steroids.

Unique Features Galore

This form is not just your average tax form. It’s packed with features that make filing your taxes a doddle. From auto-fill options to error checks, it’s got everything you need to get the job done.

Eligibility Requirements for the Free 1040 V Form 2024

To qualify for the Free 1040 V Form 2024, individuals must meet certain eligibility criteria set by the Internal Revenue Service (IRS). These criteria include income limits and specific tax situations.

The Free 1040 V Form 2024 is primarily designed for taxpayers with simple tax returns. Individuals who have more complex tax situations, such as those with self-employment income, itemized deductions, or certain types of credits, may not be eligible to use this form.

Income Limits

The income limits for eligibility to use the Free 1040 V Form 2024 vary depending on the taxpayer’s filing status.

- Single: AGI of $73,000 or less

- Married filing jointly: AGI of $150,000 or less

- Married filing separately: AGI of $75,000 or less

- Head of household: AGI of $118,000 or less

AGI stands for adjusted gross income. It is calculated by taking the taxpayer’s total income and subtracting certain deductions and adjustments.

Other Qualifications

In addition to meeting the income limits, taxpayers must also meet certain other qualifications to use the Free 1040 V Form 2024. These qualifications include:

- Cannot be claimed as a dependent on someone else’s tax return

- Must not have any dependents

- Cannot have any self-employment income

- Cannot have any itemized deductions

- Cannot claim certain types of credits, such as the Earned Income Tax Credit or the Child Tax Credit

Exceptions

There are a few exceptions to the eligibility requirements for the Free 1040 V Form 2024. These exceptions include:

- Taxpayers who are eligible for the Earned Income Tax Credit but do not meet the other eligibility requirements may still be able to use the Free 1040 V Form 2024.

- Taxpayers who are eligible for the Child Tax Credit but do not meet the other eligibility requirements may still be able to use the Free 1040 V Form 2024.

- Taxpayers who are eligible for the American Opportunity Tax Credit but do not meet the other eligibility requirements may still be able to use the Free 1040 V Form 2024.

Comparison with Other Tax Filing Options

Filing your taxes can be a daunting task, and choosing the right method is essential for ensuring accuracy and maximizing your refund. The Free 1040 V Form 2024 is just one of several options available to taxpayers. In this section, we’ll compare the Free 1040 V Form 2024 with alternative tax filing methods to help you make an informed decision about which option is best for you.

The main tax filing options available to taxpayers are:

- Do it yourself (DIY) software

- Online tax preparation services

- Hiring a tax professional

- Free 1040 V Form 2024

Each of these options has its own advantages and disadvantages, so it’s important to weigh the pros and cons before making a decision.

DIY Software

DIY software is a popular option for taxpayers who want to save money on tax preparation fees. These programs are typically easy to use and can be purchased for a relatively low cost. However, DIY software can also be complex, and taxpayers who are not familiar with tax laws may make mistakes that could cost them money.

Online Tax Preparation Services

Online tax preparation services offer a more hands-off approach to tax filing. These services typically charge a fee, but they can save taxpayers time and hassle by completing their tax returns for them. However, online tax preparation services can also be expensive, and taxpayers may not be able to get the same level of personalized service as they would from a tax professional.

Hiring a Tax Professional

Hiring a tax professional is the most expensive option, but it can also be the most beneficial. Tax professionals are experts in tax laws and can help taxpayers maximize their refunds and avoid costly mistakes. However, hiring a tax professional can be expensive, and taxpayers may not need the level of service that a tax professional provides.

Free 1040 V Form 2024

The Free 1040 V Form 2024 is a free, fillable PDF form that can be used to file federal income taxes. The form is simple to use and can be completed in minutes. However, the Free 1040 V Form 2024 is only available to taxpayers who meet certain eligibility requirements.

Resources and Support for Using the Free 1040 V Form 2024

If you’re having trouble getting your head around the Free 1040 V Form 2024, don’t stress, mate. There’s a bunch of resources and support out there to help you out.

Contact Details for Assistance

Need to get in touch with someone? Here’s who to call:

- The IRS helpline: 1-800-829-1040

- Your local IRS office: You can find the number on the IRS website

FAQs

Got a burning question? Chances are, someone else has asked it before. Check out the IRS website for a list of frequently asked questions (FAQs) and answers.

Online Forums

Join the tax-savvy community! There are plenty of online forums where you can connect with other taxpayers and tax experts. They’re a great place to ask questions, share tips, and get support.

Training and Educational Materials

Want to brush up on your tax knowledge? The IRS offers a range of training and educational materials, including:

- Webinars

- Online courses

- Publications

FAQ Corner

What are the eligibility requirements for using the Free 1040 V Form 2024?

To be eligible for the Free 1040 V Form 2024, taxpayers must meet certain income limits and other qualifications. These requirements vary depending on factors such as filing status and dependents. It’s recommended to consult the IRS website or a tax professional to determine your eligibility.

How do I download the Free 1040 V Form 2024?

Downloading the Free 1040 V Form 2024 is a straightforward process. Visit the IRS website and navigate to the ‘Forms’ section. Locate the 1040 V form and select the appropriate year. You will need to have Adobe Acrobat Reader or a similar PDF viewer installed on your computer to open and print the form.

What are the benefits of using the Free 1040 V Form 2024?

The Free 1040 V Form 2024 offers several advantages, including its simplicity, accuracy, and cost-effectiveness. It is designed to guide taxpayers through the filing process step-by-step, reducing the risk of errors. Additionally, it is available free of charge, eliminating the need for expensive tax software or professional assistance.