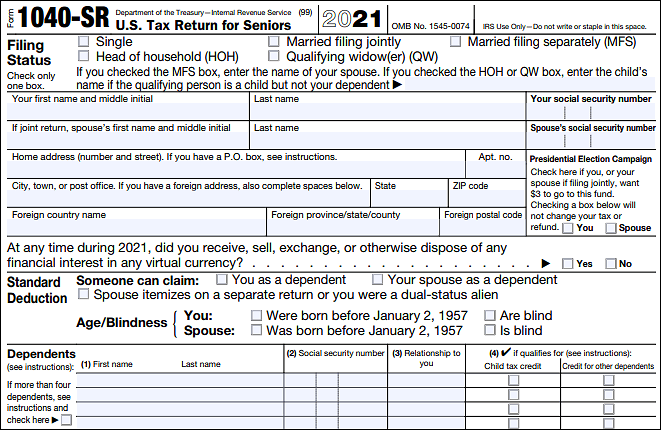

Free 1040-sr 2024 Form Download: A Comprehensive Guide

Filing taxes can be a daunting task, but it doesn’t have to be. With the right tools and resources, you can navigate the process with ease. One essential tool for seniors and retirees is the 1040-SR form. This guide will provide you with everything you need to know about downloading, filling out, and filing the 1040-SR form for 2024.

The 1040-SR form is designed specifically for senior citizens and retirees. It is a simplified version of the standard 1040 form, with larger print and fewer lines. This makes it easier to read and understand, especially for those with vision impairments or limited mobility.

Free 1040-SR 2024 Form Overview

Innit, listen up fam. The 1040-SR form is a wicked way to file your taxes for the year 2024, bruv. It’s a simple and free form that’s perfect for folks who don’t need to itemize their deductions, ya get me? It’s got all the basics, like your income, expenses, and tax calculations, innit.

Now, who should be using this form, you ask? Well, it’s a good choice for anyone who’s single, married filing separately, or head of household, and who doesn’t have any complicated tax situations. It’s also great for students, part-timers, or anyone who doesn’t have a lot of income or deductions.

Key Features

The 1040-SR form has a few key features that make it a breeze to use:

- It’s free: No need to pay any fees to file your taxes with this form.

- It’s simple: The form is designed to be easy to understand and fill out, even if you’re not a tax whizz.

- It’s accurate: The form is based on the latest tax laws, so you can be sure that your taxes are being calculated correctly.

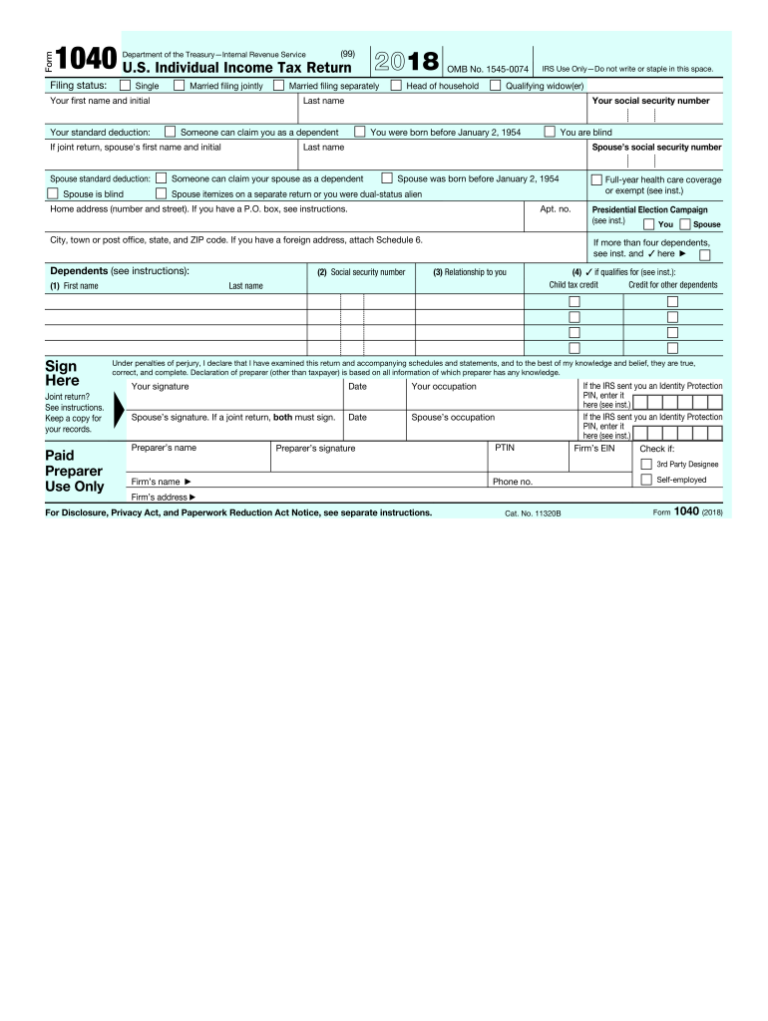

Downloading the 1040-SR Form

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png?w=700)

The 1040-SR form is available for download from the IRS website. To download the form, follow these steps:

1. Go to the IRS website at www.irs.gov.

2. Click on the “Forms” tab.

3. Scroll down to the “Individual Income Tax Returns” section.

4. Click on the “1040-SR” link.

5. Click on the “Download PDF” button.

Once you have downloaded the form, you can print it out and fill it out by hand. You can also use tax software to fill out the form electronically.

Filling Out the 1040-SR Form

Filling out the 1040-SR form is a breeze if you follow these simple steps. Just be sure to have all your necessary documents on hand, like your Social Security number, income statements, and any relevant tax forms.

The form is divided into several sections, so take it one step at a time. Start by filling out your personal information, like your name, address, and Social Security number. Then, move on to the income section, where you’ll report your wages, salaries, tips, and other income.

Deductions and Credits

Next, you’ll need to calculate your deductions and credits. Deductions reduce your taxable income, while credits directly reduce your tax bill. There are many different types of deductions and credits available, so be sure to research which ones you qualify for.

Once you’ve filled out all the sections, review your form carefully for any errors. Then, sign and date the form and mail it to the IRS. You can also file your taxes electronically, which is faster and more convenient.

Filing the 1040-SR Form

Filing your 1040-SR form is a crucial step in completing your tax return. There are several options available for filing, each with its own advantages and requirements. Let’s break down the options and guide you through the process.

Mailing the Form

The traditional method of filing is by mailing the completed form to the IRS. Ensure you have the correct address and include all necessary supporting documents. Deadlines and addresses may vary depending on your location, so check the IRS website for specific instructions.

Electronic Filing

Electronic filing offers a convenient and secure alternative to mailing. You can use tax software or online platforms to prepare and submit your return electronically. This method allows for faster processing and reduces the risk of errors.

Tax Preparers

If you prefer professional assistance, you can hire a tax preparer to help you file your 1040-SR form. They can guide you through the process, ensure accuracy, and maximize your deductions and credits.

Resources and Support

Navigating tax forms can be challenging, but you don’t have to go it alone. Here are some resources and support options to help you with the 1040-SR form:

IRS Website

- The IRS website has a wealth of information on the 1040-SR form, including instructions, forms, and FAQs. You can also access online tools like the Interactive Tax Assistant to get personalized help.

- Link: IRS 1040-SR Page

Tax Professionals

- If you need more personalized assistance, consider consulting a tax professional. They can help you prepare your return accurately and ensure you claim all eligible deductions and credits.

- You can find a list of tax professionals in your area on the IRS website or through professional organizations like the National Association of Tax Professionals.

Online Forums

- Online forums can be a great way to connect with other taxpayers and get answers to your questions. There are many forums dedicated to tax-related topics, including the 1040-SR form.

- Remember to approach these forums with caution and always verify the accuracy of the information you receive.

FAQ Section

What is the purpose of the 1040-SR form?

The 1040-SR form is a simplified version of the standard 1040 form, designed specifically for senior citizens and retirees. It is easier to read and understand, with larger print and fewer lines.

Who should use the 1040-SR form?

The 1040-SR form is intended for senior citizens and retirees who meet certain criteria, such as age and income limits. You can find more information on the IRS website.

Where can I download the 1040-SR form?

You can download the official 1040-SR form for 2024 from the IRS website. The link to the download page is provided in this guide.

How do I fill out the 1040-SR form?

This guide provides step-by-step instructions on how to fill out the 1040-SR form accurately and completely. Be sure to follow the instructions carefully and refer to the IRS website for additional guidance if needed.

What are the filing options for the 1040-SR form?

You can file the 1040-SR form by mail, electronically, or through a tax preparer. This guide provides more information on each filing option, including where to send the completed form and any deadlines or requirements.