Free 1040 Form Michigan Download: A Comprehensive Guide for Michigan Taxpayers

Navigating the complexities of tax filing can be daunting, but understanding your options and having the right resources can make the process much smoother. For Michigan residents, there are several convenient ways to file your state income taxes, including online, by mail, or through a tax preparer. This guide will provide you with all the essential information you need to file your Michigan taxes accurately and efficiently, including how to obtain a free 1040 form for Michigan.

In addition to providing an overview of the various tax filing options available to Michigan residents, this guide will also delve into the different state income tax forms, deductions, and credits available to taxpayers. We’ll also discuss Michigan tax filing deadlines and extensions and provide a list of resources for tax assistance in Michigan, including free tax preparation services for low-income taxpayers.

Tax Filing Options for Michigan Residents

Tax season is here, and if you’re a resident of Michigan, you have a few options for filing your taxes. You can file online, by mail, or through a tax preparer. Each method has its own advantages and disadvantages, so it’s important to choose the one that’s right for you.

Filing Online

Filing your taxes online is the quickest and easiest way to get your refund. You can file your taxes for free using the IRS Free File program, or you can pay a fee to use a commercial tax software program. If you choose to file online, you’ll need to gather your tax documents, such as your W-2s and 1099s. You’ll also need to create an account with the IRS or the tax software provider.

There are a few advantages to filing your taxes online. First, it’s quick and easy. You can file your taxes in just a few minutes, and you don’t have to worry about mailing in your return. Second, it’s secure. The IRS and commercial tax software providers use encryption to protect your personal information.

However, there are also a few disadvantages to filing your taxes online. First, you may not be able to file your taxes online if you have a complex tax return. Second, you may have to pay a fee to use a commercial tax software program.

Filing by Mail

Filing your taxes by mail is the traditional way to file your taxes. You can download the tax forms from the IRS website or you can order them by mail. Once you have the forms, you’ll need to fill them out and mail them to the IRS. You can also file your taxes by mail through a tax preparer.

There are a few advantages to filing your taxes by mail. First, it’s free. You don’t have to pay a fee to file your taxes by mail. Second, it’s easy. You can fill out the tax forms yourself, or you can hire a tax preparer to do it for you.

However, there are also a few disadvantages to filing your taxes by mail. First, it’s slow. It can take several weeks for the IRS to process your return. Second, it’s not as secure as filing your taxes online. Your personal information is not encrypted when you mail your return.

Filing Through a Tax Preparer

If you have a complex tax return, you may want to consider filing your taxes through a tax preparer. Tax preparers can help you gather your tax documents, fill out the tax forms, and file your return. They can also answer your questions about the tax code.

There are a few advantages to filing your taxes through a tax preparer. First, they can help you avoid making mistakes on your return. Second, they can help you maximize your refund. Third, they can file your return electronically, which can speed up the processing time.

However, there are also a few disadvantages to filing your taxes through a tax preparer. First, it can be expensive. Tax preparers typically charge a fee for their services. Second, they may not be able to answer all of your questions about the tax code. Third, they may not be able to file your return electronically if you have a complex tax return.

Michigan Tax Filing Deadlines and Extensions

Filing your Michigan state income taxes on time is essential to avoid penalties and interest charges. The filing deadline for Michigan state income taxes is typically April 15th, the same as the federal filing deadline. However, if you need more time to file your taxes, you can request an extension.

To request an extension, you must file Form MI-1040X, Michigan Individual Income Tax Extension. This form can be downloaded from the Michigan Department of Treasury website. You must file Form MI-1040X by April 15th to receive an automatic six-month extension. This means that your new filing deadline will be October 15th.

Filing for an Extension

When filing for an extension, you do not need to provide a reason for needing more time. However, you must still pay any taxes that you owe by April 15th. If you do not pay your taxes by April 15th, you will be charged interest and penalties on the unpaid amount.

If you need more than a six-month extension, you can request an additional extension by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This form can be downloaded from the IRS website. You must file Form 4868 by the original filing deadline, which is April 15th. If you file Form 4868, you will receive an automatic five-month extension. This means that your new filing deadline will be October 15th.

Resources for Tax Assistance in Michigan

Residents of Michigan who require assistance with tax filing have access to a range of resources.

The Michigan Department of Treasury offers a variety of services, including free tax preparation assistance for low-income taxpayers.

Contact Information

- Michigan Department of Treasury: (517) 636-4486

- Website: www.michigan.gov/taxes

Free Tax Preparation Services

The Michigan Department of Treasury partners with various organizations to provide free tax preparation services to low-income taxpayers.

These organizations include:

- AARP Foundation Tax-Aide

- United Way

- Michigan Community Action Agencies

To find a free tax preparation site near you, visit the Michigan Department of Treasury website.

FAQs

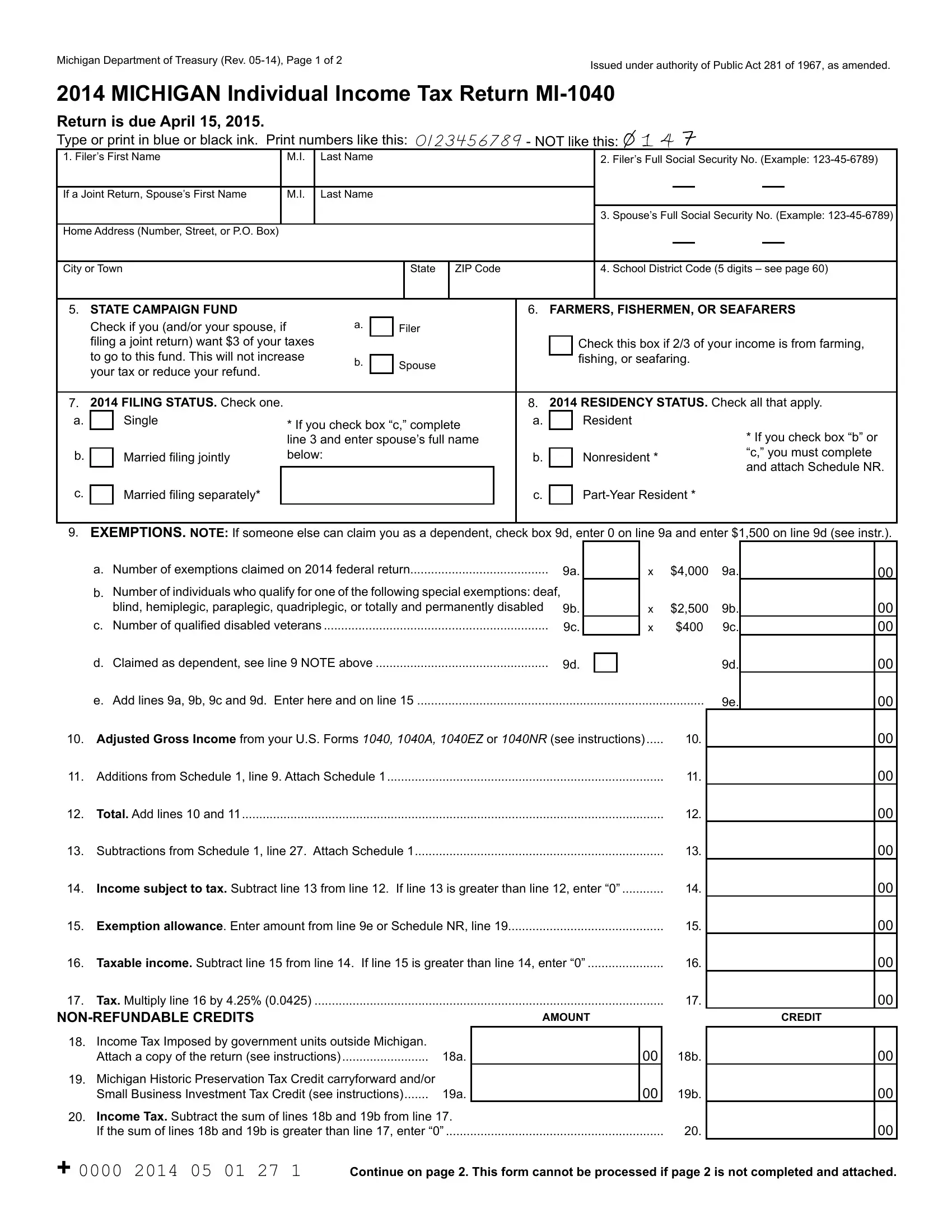

How do I obtain a free 1040 form for Michigan?

You can download a free 1040 form for Michigan from the Michigan Department of Treasury website or by visiting your local library or post office.

What are the different ways to file my Michigan state income taxes?

You can file your Michigan state income taxes online, by mail, or through a tax preparer.

What are the filing deadlines for Michigan state income taxes?

The filing deadline for Michigan state income taxes is April 15th. However, you can request an extension to file until October 15th.

Where can I get free tax preparation assistance in Michigan?

There are several organizations in Michigan that offer free tax preparation assistance to low-income taxpayers. You can find a list of these organizations on the Michigan Department of Treasury website.