Free 1040 Form Instructions 2018 Download: A Comprehensive Guide

Navigating the complexities of tax preparation can be daunting, but it doesn’t have to be. The 1040 form is a crucial document that plays a pivotal role in filing your taxes accurately and efficiently. In this guide, we will provide you with comprehensive instructions on how to access, understand, and utilize the Free 1040 Form Instructions for 2018, empowering you to tackle your tax preparation with confidence.

Whether you’re a seasoned tax filer or a first-timer, this guide will equip you with the knowledge and resources you need to navigate the 1040 form seamlessly. We will delve into the structure of the form, provide tips for understanding complex tax concepts, and highlight the importance of following the instructions carefully to avoid errors and maximize deductions.

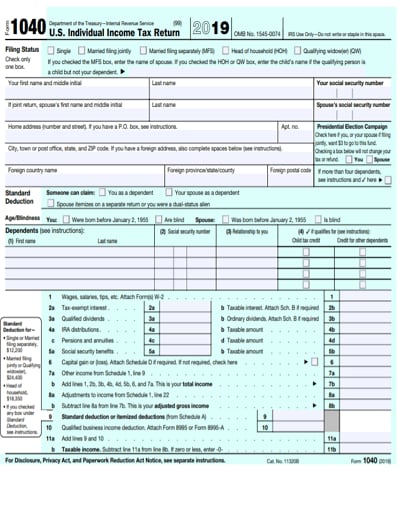

Free 1040 Form s 2018 Overview

The Free 1040 Form s 2018 is a tax form used to file individual income taxes in the United Kingdom. It is designed for individuals with simple tax situations, such as those who have only wages, salaries, and other common types of income. The form is free to download and can be completed by hand or using tax software.

The 1040 form has been used for many years to file individual income taxes. It was first introduced in 1913 and has been revised several times since then. The current version of the form is the 1040 form s, which was introduced in 2018.

Accessing and Downloading the s

Get your mitts on the official 2018 1040 form s and crack on with your taxes. We’ll show you how to bag ’em from the taxman’s gaff or other trusty sources.

Follow these bants to snag the s from the Inland Revenue Service (IRS) website:

From the IRS Website

- Hit up the IRS website: www.irs.gov.

- Cruise on over to the “Forms & Pubs” tab.

- Type “1040” into the search bar and press enter.

- Click on the “2018 Form 1040” link.

- Choose your preferred file format (PDF, HTML, or fillable).

- Download and save the form.

Understanding the s

Yo, let’s get clued up on the 1040 forms, bruv. These bad boys are like the cheat codes for smashin’ your taxes. We’ll show you how to navigate them like a boss, find the juicy bits, and make sense of the tax jargon.

The 1040 forms are split into three main sections:

- Personal Info: This is where you drop your deets, like your name, addy, and social security number.

- Income: Here’s where you list all the dough you’ve raked in from work, investments, and other sources.

- Adjustments, Deductions, and Credits: This is where you get to claim back some of your hard-earned cash. You can deduct expenses like mortgage interest and charitable donations, and claim credits for things like education and child care.

Once you’ve filled in the basics, there are a few key sections to watch out for:

Line-by-Line Instructions

The 1040 forms come with handy line-by-line instructions. These are like your personal tax advisor, giving you the lowdown on what to put in each box.

Tax Tables

If you don’t fancy doing the math yourself, the forms have built-in tax tables. Just find your income and filing status, and the table will tell you how much tax you owe.

Glossary

Tax forms can be a minefield of jargon. If you’re stuck, check out the glossary at the back of the form. It’s like a dictionary for tax nerds.

Using the s for Tax Preparation

The s provide comprehensive instructions that guide taxpayers through the process of preparing and filing their tax returns. It is essential to follow these instructions carefully to ensure accuracy and maximize deductions.

The s can help taxpayers avoid errors by providing clear and concise instructions on how to complete each section of the tax return. They also provide examples and explanations to help taxpayers understand complex tax laws and regulations.

For example, the s include instructions on how to calculate deductions for charitable contributions, mortgage interest, and medical expenses. They also provide guidance on how to claim credits for child care expenses, education expenses, and the earned income tax credit.

By following the s, taxpayers can be confident that they are preparing their tax returns correctly and maximizing their deductions and credits.

Additional Resources and Support

Filing taxes can be daunting, especially if you’re not familiar with the 1040 form. That’s why it’s important to know about the resources available to help you.

There are many helpful websites, phone numbers, and software tools that can assist you with understanding the 1040 form and completing your taxes. You can also seek guidance from tax professionals who can provide personalized advice and support.

Helpful Websites

- Internal Revenue Service (IRS) website: https://www.irs.gov/

- United Way’s MyFreeTaxes: https://myfreetaxes.com/

- TurboTax: https://turbotax.intuit.com/

- H&R Block: https://www.hrblock.com/

- TaxAct: https://www.taxact.com/

Phone Numbers

- IRS Helpline: 1-800-829-1040

- United Way’s MyFreeTaxes Helpline: 1-800-906-9887

- TurboTax Support: 1-800-446-8848

- H&R Block Support: 1-800-472-5625

- TaxAct Support: 1-800-294-0855

Software Tools

- TurboTax

- H&R Block

- TaxAct

- Credit Karma Tax

- FreeTaxUSA

Tax Professionals

If you need personalized guidance and support, you can consider seeking the services of a tax professional. Tax professionals can help you understand the 1040 form, complete your taxes accurately, and maximize your refund. They can also provide advice on tax planning and other financial matters.

When choosing a tax professional, it’s important to do your research and find someone who is qualified and experienced. You should also make sure that you feel comfortable working with them and that you can trust them to provide you with accurate and reliable advice.

Frequently Asked Questions

Where can I download the Free 1040 Form Instructions for 2018?

You can download the Free 1040 Form Instructions for 2018 from the official IRS website (www.irs.gov) or through tax software providers.

How do I navigate the 1040 form effectively?

The 1040 form is organized into sections. Start by identifying the sections that apply to your tax situation. Refer to the instructions for each section to understand what information is required.

What are some tips for understanding complex tax concepts?

Don’t hesitate to seek clarification. Consult the IRS website, tax software help sections, or a tax professional if you encounter unfamiliar terms or concepts.

How can I avoid errors when preparing my tax return?

Follow the instructions carefully and double-check your entries. Use tax software or consult a tax professional to minimize the risk of errors.

What additional resources are available to assist me with tax preparation?

The IRS website provides a wealth of information, including publications, FAQs, and online tools. You can also consult tax software providers or seek guidance from a tax professional.