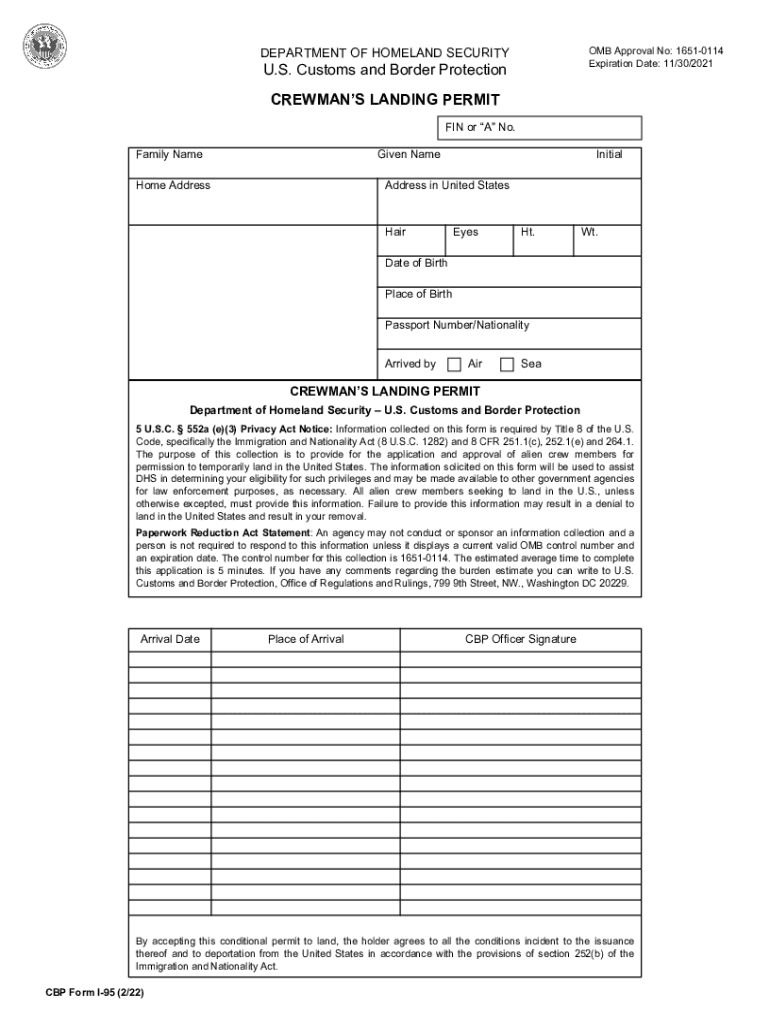

Free 1-95 Form Download: A Comprehensive Guide for Tax Filing

The 1-95 form is a crucial document in the context of tax filing. It serves as a vital tool for individuals to report their income and expenses to the Internal Revenue Service (IRS). By downloading the 1-95 form for free, taxpayers can save time, money, and enjoy the convenience of completing their tax returns efficiently.

This comprehensive guide will provide you with an in-depth understanding of the Free 1-95 Form Download, its benefits, methods for obtaining it, tips for completing it accurately, and answers to frequently asked questions. By leveraging the information provided in this guide, you can navigate the tax filing process with confidence and ensure that your tax return is filed correctly and on time.

Benefits of Downloading the Form

Downloading the 1-95 form for free is a smart move that offers several advantages. It can save you money, provide convenience, and make the form readily accessible whenever you need it.

Cost savings are a significant benefit. By downloading the form for free, you can avoid paying fees or charges associated with obtaining the form from other sources. This can be especially helpful if you need multiple copies of the form.

Convenience is another key advantage. Downloading the form allows you to access it anytime, anywhere, as long as you have an internet connection. This eliminates the need to visit a government office or other location to obtain the form.

Accessibility is also enhanced by downloading the form. You can easily store the form on your computer, smartphone, or other device for future use. This ensures that you always have access to the form when you need it, without having to search for it again.

Methods for Downloading the Form

There are a handful of ways you can get your hands on the 1-95 form online. Whether you’re a whizz at navigating government websites or prefer a more user-friendly approach, we’ve got you covered.

Let’s dive into the nitty-gritty:

Through the USCIS Website

The United States Citizenship and Immigration Services (USCIS) website is the official source for immigration forms. Here’s how to snag the 1-95 form from their site:

- Head over to the USCIS website.

- Type “Form I-95” into the search bar.

- Click on the “Forms” result.

- Find the “Form I-95, Application for a Nonimmigrant Visa” link and click on it.

- On the next page, you’ll find a PDF version of the form. Click on the “Download Form” button to save it to your computer.

Via Third-Party Websites

There are several third-party websites that offer free downloads of immigration forms. While these sites can be convenient, it’s important to make sure you’re using a reputable source. Here’s a step-by-step guide to downloading the 1-95 form from a third-party website:

- Do a quick Google search for “1-95 form download.”

- Choose a website that looks trustworthy and has positive reviews.

- Navigate to the website and find the 1-95 form download link.

- Click on the link and save the PDF file to your computer.

Tips for Completing the Form

Filling out the 1-95 form can be a breeze if you know the tricks. Here are some helpful tips to ensure your form is accurate and error-free:

Firstly, take your time and read the instructions carefully. Don’t rush through it, or you might miss something important.

Double-check your details

Make sure you fill in all the required fields and double-check that the information you provide is correct. Pay special attention to your name, address, and Social Security number.

Use black ink

When filling out the form, use black ink. This will make it easier for the processing system to read your information.

Sign and date the form

Don’t forget to sign and date the form before submitting it. This is essential for the form to be valid.

Common Questions and Answers

Here’s a list of common questions and answers related to the 1-95 form:

What is the 1-95 form used for?

The 1-95 form is used to verify the identity and employment eligibility of new hires in the United States.

Who needs to complete the 1-95 form?

All new hires in the United States must complete the 1-95 form within three days of starting work.

What documents are required to complete the 1-95 form?

To complete the 1-95 form, you will need to provide one document from List A and one document from List B or two documents from List C.

Where can I find more information about the 1-95 form?

You can find more information about the 1-95 form on the website of the United States Citizenship and Immigration Services (USCIS).

Additional Resources

If you need additional support or guidance while using the 1-95 form, there are several resources available.

These resources can provide information, support, and assistance to help you complete the form accurately and efficiently.

Websites

- Citizens Advice: https://www.citizensadvice.org.uk/

- Shelter: https://www.shelter.org.uk/

- National Debtline: https://www.nationaldebtline.org/

Hotlines

- National Debtline: 0808 808 4000

- Citizens Advice: 03444 111 444

- Shelter: 0808 800 4444

FAQ Summary

What is the purpose of the 1-95 form?

The 1-95 form is used to report income and expenses for self-employed individuals and small businesses. It is a vital document for tax filing, as it provides the IRS with the necessary information to calculate tax liability.

How can I download the 1-95 form for free?

There are several methods for downloading the 1-95 form for free. You can access it through the IRS website, use tax preparation software, or obtain it from a local IRS office.

What are some tips for completing the 1-95 form accurately?

To ensure accuracy when completing the 1-95 form, it is essential to gather all necessary documentation, understand the instructions carefully, and double-check your calculations. If you encounter any difficulties, seek professional assistance from a tax advisor.

Where can I find additional support for using the 1-95 form?

If you have further questions or require additional support, you can consult the IRS website, contact the IRS helpline, or seek guidance from a tax professional.