Free 2018 Taxes Forms Download: Your Guide to Filing Accurately

Tax season is upon us, and it’s time to get your finances in order. The Internal Revenue Service (IRS) provides free 2018 tax forms for download, making it easy to file your taxes accurately and on time. In this guide, we’ll walk you through the process of downloading, printing, and filing your tax forms.

Whether you’re a seasoned tax filer or you’re tackling your taxes for the first time, this guide will provide you with the information you need to file your taxes with confidence.

Forms and s

Innit, if you’re skint and need to do your 2018 taxes, there are bare forms you can download for free, blud.

You can get your mitts on all sorts of forms, from the basic 1040 to the more complicated Schedule C for self-employment. Just make sure you use the right forms for your situation, otherwise you might end up paying more tax than you should, which is a right pain in the backside.

Available Forms

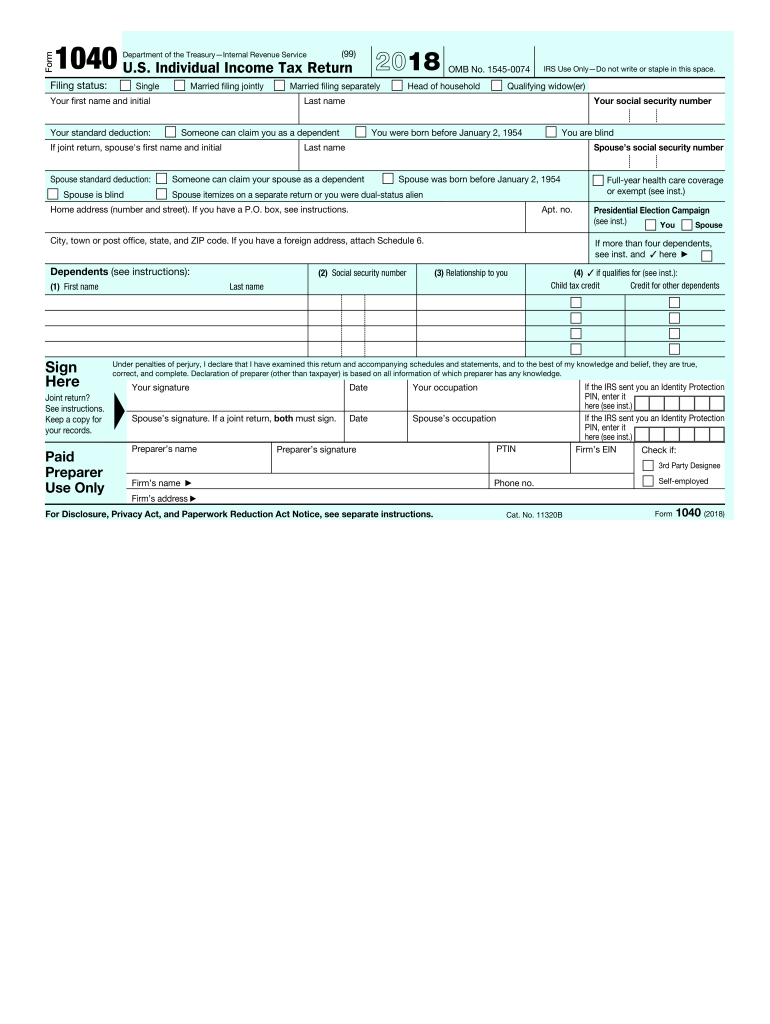

- Form 1040: This is the basic tax form that most people use. It’s used to report your income, deductions, and credits.

- Schedule A: This form is used to itemize your deductions, such as medical expenses, charitable donations, and mortgage interest.

- Schedule B: This form is used to report your interest and dividend income.

- Schedule C: This form is used to report your self-employment income and expenses.

- Schedule D: This form is used to report your capital gains and losses.

- Schedule E: This form is used to report your wages, salaries, and tips.

Download Process

Alright, mate, listen up. Let’s break down how you can get your hands on these free 2018 tax forms, yeah? It’s a doddle.

First off, you’ll want to head over to the official IRS website. It’s like the HQ for all things tax. Once you’re there, look for the “Forms and Publications” tab. It’s usually at the top of the page, just waiting for you to click on it.

Locating Forms

Now, you’ll be faced with a whole bunch of options, but don’t worry. Just type in the form you’re after in the search bar. They’ve got everything from the basic 1040 to the more specific ones. Once you’ve found the form you need, click on it.

File Formats

Before you hit the download button, you’ll need to choose a file format. You’ve got two options: PDF or fillable PDF. PDFs are great if you just want to print out the form, but fillable PDFs let you fill in the details on your computer before you print. It’s up to you, boss.

Printing and Filing Options

Once you’ve downloaded the tax forms you need, you’ll have a few options for printing them out.

If you’re planning on mailing in your completed forms, you’ll need to print them on high-quality paper. This will help ensure that your forms are legible and easy to process.

You’ll also want to use high-quality ink when printing your forms. This will help prevent your forms from smudging or fading.

Filing Options

Once you’ve printed your forms, you’ll have two options for filing them:

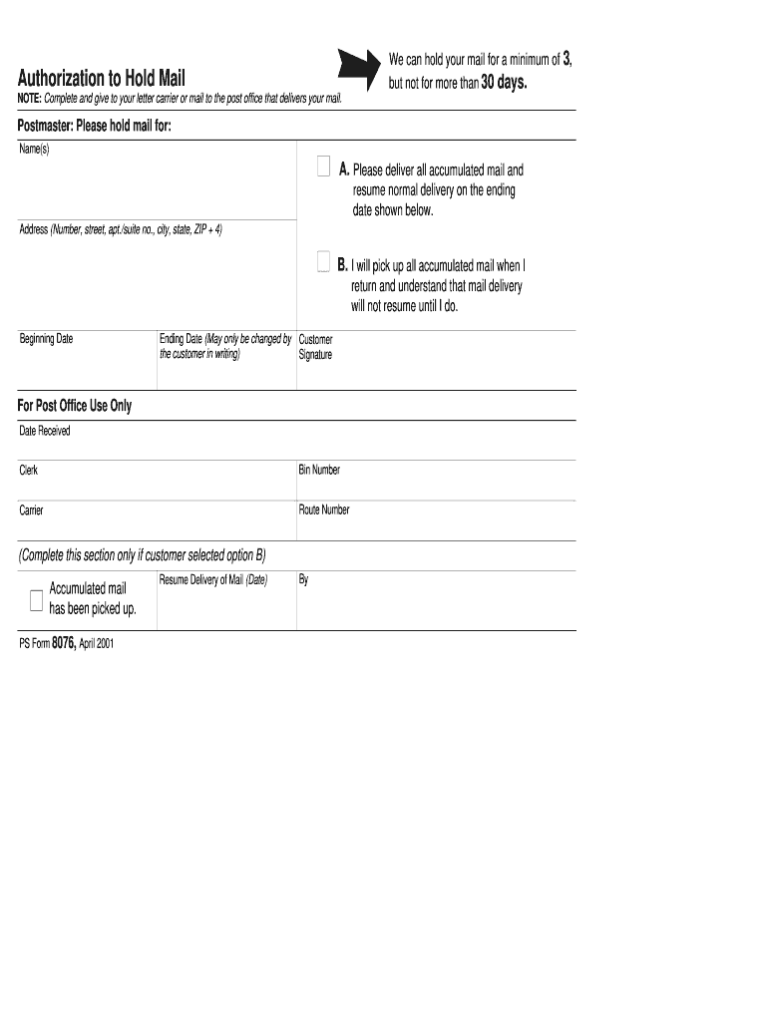

- Mailing: You can mail your completed forms to the IRS. The address will be listed on the forms.

- E-filing: You can e-file your forms using the IRS website. This is the fastest and easiest way to file your taxes.

Additional Resources

Seeking further assistance with your tax filing? We’ve got you covered with these top-notch resources:

The lads and lasses at the IRS have a banging website loaded with all the info you need, from forms to tips and tricks. Check it out at www.irs.gov.

Tax Assistance Programs

Feeling a bit lost in the tax maze? Don’t fret, mate! There are heaps of tax assistance programs out there to lend a helping hand.

- The IRS has got your back with free tax preparation and filing help at their Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs.

- The United Way also offers a sweet deal with their free tax preparation services. Give ’em a bell at 2-1-1 or visit their website at www.unitedway.org.

Software and Online Tools

Not keen on the DIY tax route? No worries! There are plenty of software and online tools that can make filing your taxes a breeze.

- TurboTax is a popular choice, offering both free and paid versions to suit your needs.

- H&R Block is another great option, with a range of tax preparation services to choose from.

- If you’re after a free and easy-to-use option, check out the IRS Free File program at www.irs.gov/freefile.

FAQ

What forms are available for download?

The IRS provides a comprehensive list of all available forms on their website. Some of the most common forms include the 1040, 1040-EZ, and 1040-SR.

How do I download the forms?

You can download the forms from the IRS website. Simply navigate to the “Forms and Publications” section and select the forms you need.

What file formats are available?

The forms are available in PDF, HTML, and text formats. Choose the format that is most compatible with your computer and software.

What are the printing requirements?

The forms should be printed on white paper using black ink. The paper should be at least 20 lb. weight.

How do I file my completed forms?

You can mail your completed forms to the IRS or file them electronically. If you choose to mail your forms, be sure to use the correct address and postage.