Free 1048 Tax Form Download: A Comprehensive Guide

Filing taxes can be a daunting task, but it doesn’t have to be. With the free 1048 tax form download, you can save time, effort, and ensure accuracy when reporting your mortgage interest and points paid. This guide will provide you with a comprehensive overview of Form 1048, its purpose, and how to download and complete it seamlessly.

Form 1048 is an essential document for homeowners who have paid mortgage interest or points during the tax year. It allows you to claim deductions or credits on your federal income tax return, potentially reducing your tax liability. Whether you’re a first-time homebuyer or a seasoned homeowner, understanding Form 1048 is crucial for maximizing your tax savings.

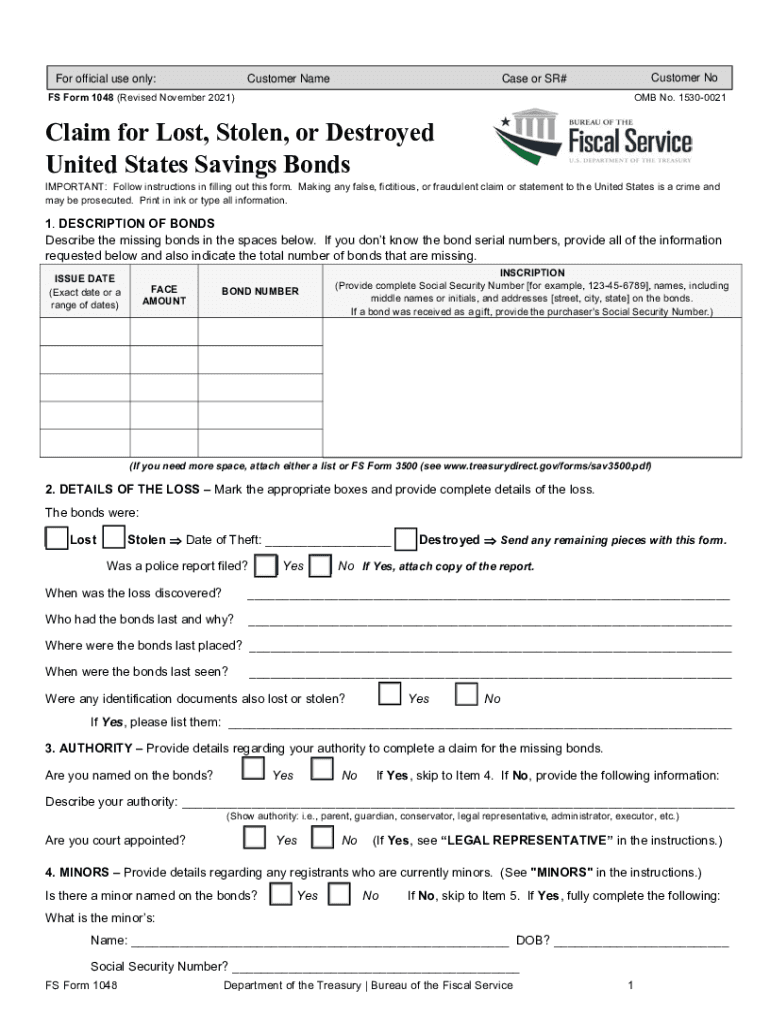

Step-by-Step Guide to Downloading the Free 1048 Tax Form

Downloading the 1048 tax form is a quick and easy process. Here’s a step-by-step guide to help you get started:

You can download the 1048 tax form from the official IRS website. Here’s how:

Step 1: Go to the IRS website

Visit the IRS website at https://www.irs.gov.

Step 2: Search for the 1048 tax form

In the search bar at the top of the page, type “1048 tax form”.

Step 3: Click on the first result

The first result will be a link to the 1048 tax form. Click on the link.

Step 4: Download the form

On the next page, you will see a PDF file of the 1048 tax form. Click on the “Download” button to download the form.

Understanding the Form 1048 Content

Yo, check it, understanding the 1048 Tax Form is like cracking a code. It’s got different bits and bobs, and each one’s important. Let’s break it down, bruv.

First off, there’s the “General Information” section. This is where you spill the beans on who you are, your addy, and what you’re filing for. Make sure it’s all correct, blud.

Reporting Entity Information

- Enter your business name, address, and employer identification number (EIN).

- Indicate the tax year you’re filing for.

- Check the box that corresponds to your reporting status (e.g., grantor, trustee).

Trust Information

- Provide the trust’s name, address, and EIN.

- Indicate the date the trust was created.

- Identify the trustee(s) responsible for managing the trust.

Beneficiary Information

- List the names, addresses, and tax identification numbers of all beneficiaries who received distributions from the trust.

- Indicate the amount of distributions made to each beneficiary.

- Provide the beneficiary’s relationship to the grantor or trust.

Additional Information

- Provide any additional information that may be relevant to the trust’s activities or distributions.

- Attach supporting documentation, such as copies of trust documents or distribution statements.

- Sign and date the form to certify its accuracy.

Common Questions and Troubleshooting

Navigating Form 1048 can raise questions and potential issues. Here’s a guide to address common queries and provide troubleshooting tips to ensure a smooth process.

Frequently Asked Questions

- What is Form 1048? It’s a tax form used to report the sale or exchange of certain types of property.

- Who needs to file Form 1048? Individuals or entities that have sold or exchanged real estate, stocks, bonds, or other specified assets.

- When is Form 1048 due? It’s generally due on or before the 15th day of the 4th month following the end of the tax year in which the transaction occurred.

- Where can I get Form 1048? It’s available for download from the IRS website or by contacting the IRS directly.

- What information is required on Form 1048? Details about the property sold, the sale proceeds, and any expenses or adjustments.

Troubleshooting Tips

- Difficulty accessing the IRS website: Check your internet connection or try accessing the website during off-peak hours.

- Problems downloading Form 1048: Ensure your browser is up-to-date and try using a different browser or clearing your browser’s cache.

- Errors in filling out the form: Carefully review the instructions provided with the form and consult with a tax professional if needed.

- Missing information on the form: Contact the IRS or the relevant party to obtain the necessary information.

- Late filing: File the form as soon as possible and explain any circumstances that led to the delay.

Additional Resources and Support

Need extra help navigating tax complexities? Here’s your toolkit.

Online Resources

Dive into a world of tax knowledge with these top websites:

– [HMRC](https://www.gov.uk/government/organisations/hm-revenue-customs): The official UK tax authority, your go-to for all things tax-related.

– [TaxAid](https://www.taxaid.org.uk/): A charity offering free tax advice and support to those on low incomes.

– [MoneySavingExpert](https://www.moneysavingexpert.com/tax/): A comprehensive resource for tax-saving tips and tricks.

Forums and Support Groups

Connect with fellow taxpayers and seek advice from experts in online forums:

– [TaxChat](https://www.taxchat.co.uk/): A lively community of tax professionals and individuals sharing insights and experiences.

– [TaxationWeb](https://www.taxationweb.co.uk/forum/): A forum dedicated to discussing UK tax issues, with contributions from industry experts.

Professional Tax Assistance

If you need personalized guidance, consider seeking professional tax assistance:

– [Chartered Institute of Taxation](https://www.tax.org.uk/): Find a qualified tax advisor near you.

– [Association of Taxation Technicians](https://www.att.org.uk/): Connect with tax experts specializing in various areas.

FAQ Section

What is Form 1048 used for?

Form 1048 is used to report mortgage interest and points paid during the tax year. It allows homeowners to claim deductions or credits on their federal income tax return.

Who needs to file Form 1048?

Homeowners who have paid mortgage interest or points during the tax year are required to file Form 1048.

Where can I download the free 1048 tax form?

You can download the free 1048 tax form from the IRS website at www.irs.gov.

How do I complete Form 1048?

Follow the instructions provided in this guide to complete Form 1048 accurately.

What are some common mistakes to avoid when completing Form 1048?

Some common mistakes to avoid include entering incorrect amounts, forgetting to sign the form, and missing deadlines.