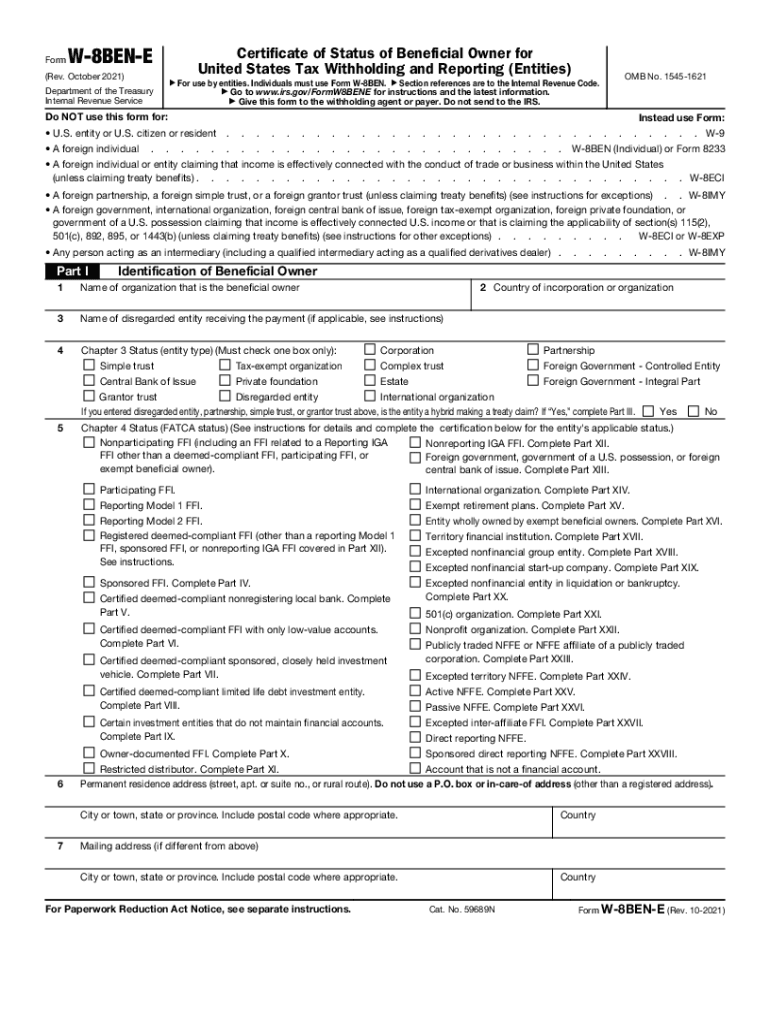

Free W-8BEN-E Form 2024 Download: A Comprehensive Guide

Navigating the complexities of international tax regulations can be daunting, but understanding and utilizing the W-8BEN-E form is crucial for non-US citizens and entities seeking to claim reduced withholding rates on their US-sourced income. This comprehensive guide will provide a clear understanding of the W-8BEN-E form, its purpose, and how to complete it accurately, ensuring compliance and minimizing tax liabilities.

The W-8BEN-E form, also known as the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding, plays a vital role in certifying the foreign status of non-US taxpayers. By completing this form, individuals and entities can claim exemption from US withholding tax or reduced withholding rates based on applicable tax treaties between the US and their country of residence.

Additional Resources

If you need further assistance with the W-8BEN-E form, there are several resources available to you.

The IRS provides a number of publications that can help you understand the W-8BEN-E form and its requirements. These publications are available on the IRS website at https://www.irs.gov/forms-pubs/about-form-w-8-ben-e.

Tax Websites

There are also a number of tax websites that provide information about the W-8BEN-E form. These websites can be a helpful resource if you have specific questions about the form or its requirements.

Professional Services

If you need more personalized assistance, you can also contact a professional service that offers assistance with the W-8BEN-E form. These services can help you complete the form correctly and ensure that it is filed with the IRS in a timely manner.

Q&A

Where can I download the official W-8BEN-E form?

The official W-8BEN-E form can be downloaded from the Internal Revenue Service (IRS) website at irs.gov.

What information is required to complete the W-8BEN-E form?

To complete the W-8BEN-E form, you will need to provide your personal or entity information, including name, address, tax identification number, and country of residence. You may also need to provide additional information, such as your treaty benefits and withholding rate.

How do I certify my foreign status on the W-8BEN-E form?

To certify your foreign status on the W-8BEN-E form, you must sign and date the form under penalty of perjury. You must also provide documentation to support your claim of foreign status, such as a passport or government-issued identification card.

What are the consequences of providing false or incomplete information on the W-8BEN-E form?

Providing false or incomplete information on the W-8BEN-E form can result in penalties and additional taxes. You may also be subject to backup withholding at a rate of 24%.

When should I file the W-8BEN-E form?

The W-8BEN-E form should be filed with the withholding agent, such as a bank or investment firm, when you open an account or receive US-sourced income. You should also file a new W-8BEN-E form if your circumstances change, such as your name, address, or tax identification number.