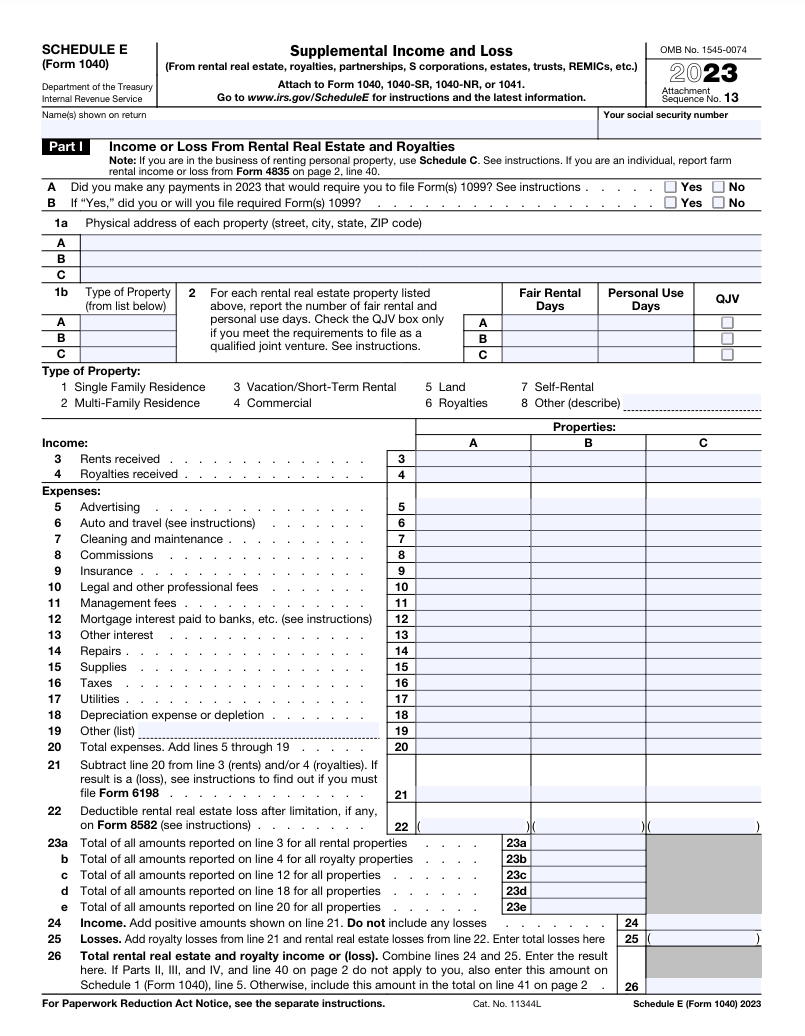

Free 2024 Form 1040 Schedule E Download: A Comprehensive Guide

Navigating the complexities of tax season can be a daunting task, but with the right tools, it doesn’t have to be. The 2024 Form 1040 Schedule E, used to report supplemental income and losses, is a crucial component of the tax filing process. To simplify this task, we present the ‘Free 2024 Form 1040 Schedule E Download,’ a comprehensive guide that empowers you to confidently complete your Schedule E with ease.

This guide provides a step-by-step breakdown of the Schedule E form, making it accessible and understandable for taxpayers of all levels. With its user-friendly format and expert insights, this guide will equip you with the knowledge and resources necessary to accurately report your supplemental income and maximize your tax deductions.

6. : Related Resources

Find helpful links to additional resources that provide guidance on completing the Form 1040 Schedule E.

These resources include official IRS websites, tax preparation software, and helpful articles.

: Links

| Resource Name | Description | Link |

|---|---|---|

| IRS Schedule E Instructions | Official IRS instructions for completing Schedule E | https://www.irs.gov/forms-pubs/about-schedule-e-supplemental-income-and-loss |

| TaxSlayer | Tax preparation software with support for Schedule E | https://www.taxslayer.com/ |

| TurboTax | Tax preparation software with support for Schedule E | https://turbotax.intuit.com/ |

Answers to Common Questions

What is the purpose of the 2024 Form 1040 Schedule E?

The 2024 Form 1040 Schedule E is used to report supplemental income and losses from sources such as rental properties, partnerships, S corporations, and trusts.

Why should I download the ‘Free 2024 Form 1040 Schedule E Download’?

Downloading the free guide provides you with a comprehensive understanding of the Schedule E form, including its sections, fields, and how to accurately report your supplemental income and expenses.

Is the ‘Free 2024 Form 1040 Schedule E Download’ available for both computer and mobile devices?

Yes, the guide is accessible on both computer and mobile devices, making it convenient for you to access the information you need, whenever and wherever you need it.

What are some common errors to avoid when completing the Schedule E form?

Common errors include incorrect calculations, missing or incomplete information, and failing to attach necessary documentation. By carefully following the instructions provided in the guide, you can minimize the risk of errors.