Free 2018 W9 Form Download: A Comprehensive Guide

Navigating the complexities of tax filing can be a daunting task, but understanding the 2018 W9 form is a crucial step towards ensuring accuracy and avoiding potential pitfalls. This comprehensive guide will provide you with a clear overview of the W9 form, its significance, and where to find reputable free download options.

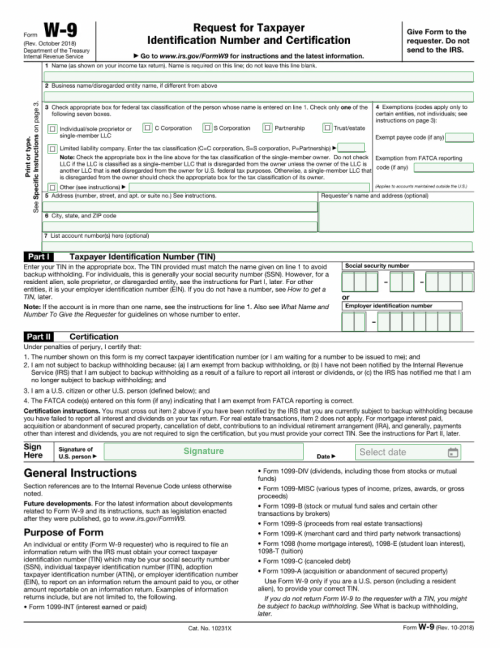

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is an essential document for independent contractors, freelancers, and other non-employees. It serves as a way for you to provide your tax identification information to the person or entity that is paying you. By understanding the form’s purpose and the information it requires, you can ensure that you are fulfilling your tax obligations accurately and efficiently.

2018 W9 Form Overview

The 2018 W9 form is an Internal Revenue Service (IRS) tax document used by businesses to collect taxpayer identification information from individuals or entities who are not employees but are receiving payments for services rendered. It is essential for accurate tax reporting and helps prevent fraud and identity theft.

The W9 form gathers crucial information such as the taxpayer’s name, address, taxpayer identification number (TIN), and certification. This information is used to determine the correct tax withholding and reporting requirements for the payments made. By completing and submitting the W9 form, taxpayers authorize the business to report the payments to the IRS and issue the appropriate tax forms, such as the 1099-MISC.

Free Download Options

Yo, grab your free 2018 W9 forms from the net without shelling out any dough.

Head over to legit websites like the Internal Revenue Service (IRS) or Adobe Acrobat Reader to snag the form for nada.

IRS Website

- Hit up the IRS website and search for “Form W-9.”

- Click on the link to the form and select “Download” or “Print.”

- The form will be saved to your computer or device.

Adobe Acrobat Reader

- Open Adobe Acrobat Reader and go to “File” > “Create” > “From File.”

- Select the IRS W-9 form template and click “Open.”

- The form will open in Adobe Acrobat Reader, where you can fill it out and save it as a PDF.

Common Errors and Pitfalls

Filling out the W9 form accurately is essential to avoid delays in tax refunds or payments. Common errors and pitfalls that taxpayers should be aware of include:

Incorrect or Incomplete Information

- Missing or incorrect taxpayer identification number (TIN): The TIN is the most important piece of information on the W9 form, and it must be accurate. If the TIN is incorrect or missing, the IRS may not be able to process the form and the taxpayer may not receive their tax refund or payment.

- Incorrect name and address: The name and address on the W9 form must match the name and address on the taxpayer’s tax return. If the name or address is incorrect, the IRS may not be able to process the form and the taxpayer may not receive their tax refund or payment.

- Missing or incorrect certification: The certification on the W9 form must be signed and dated by the taxpayer. If the certification is missing or incorrect, the IRS may not be able to process the form and the taxpayer may not receive their tax refund or payment.

Consequences of Submitting an Incorrect W9 Form

Submitting an incorrect W9 form can have a number of consequences, including:

- Delays in tax refunds or payments: If the IRS is unable to process the W9 form due to an error, it may delay the taxpayer’s tax refund or payment.

- Penalties: The IRS may impose penalties on taxpayers who submit incorrect W9 forms.

- Withholding of taxes: The IRS may withhold taxes from the taxpayer’s payments if the W9 form is incorrect.

Additional Resources

Seeking additional guidance on the 2018 W9 form? Explore these reputable sources for further assistance:

Official Websites

– [IRS Website](https://www.irs.gov/forms-pubs/about-form-w-9): Provides comprehensive information, including instructions and downloadable forms.

– [Department of the Treasury](https://www.treasury.gov/tigta/auditreports/2019reports/201920061fr.pdf): Offers insights into W9 form usage and compliance.

IRS Publications

– [Publication 1220, Specifications for Filing Forms W-9 and W-8](https://www.irs.gov/pub/irs-pdf/p1220.pdf): Artikels technical requirements for completing and submitting W9 forms.

– [Publication 519, U.S. Tax Guide for Aliens](https://www.irs.gov/pub/irs-pdf/p519.pdf): Includes information relevant to non-U.S. citizens and residents.

Other Relevant Materials

– [W9 Form Helper](https://www.w9formhelper.com/): Online tool that assists in completing W9 forms accurately.

– [W9 Form Guide](https://www.taxformguide.com/w9/): Comprehensive guide with detailed instructions and examples.

Q&A

What is the purpose of the 2018 W9 form?

The 2018 W9 form is used to collect your tax identification information, including your Social Security number or Employer Identification Number, so that the person or entity paying you can report your earnings to the IRS.

Where can I find free download options for the 2018 W9 form?

You can find free download options for the 2018 W9 form on the IRS website, as well as on reputable websites such as H&R Block and TaxAct.

What information do I need to provide on the W9 form?

You will need to provide your name, address, tax identification number, and signature on the W9 form.

What are some common mistakes to avoid when filling out the W9 form?

Some common mistakes to avoid when filling out the W9 form include entering incorrect or incomplete information, failing to sign the form, and providing an incorrect tax identification number.