Free 1099 Form Exemptions Download: Your Guide to Tax Savings

Navigating the world of 1099 forms can be daunting, especially when it comes to understanding exemptions. But fear not! This comprehensive guide will provide you with all the essential information you need to download and utilize free 1099 form exemptions, empowering you to save time, effort, and money during tax season.

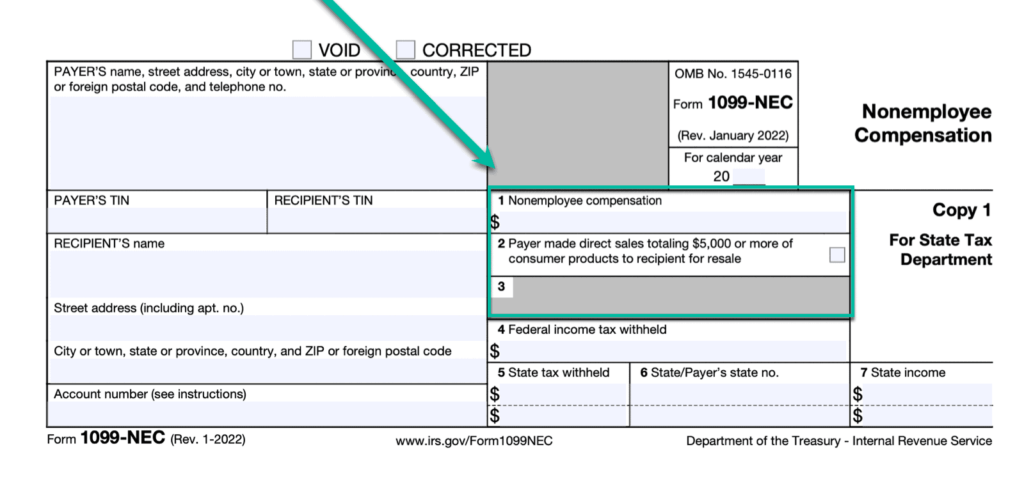

1099 forms are used to report income earned by independent contractors and freelancers. By claiming eligible exemptions, you can reduce your taxable income, resulting in potential tax savings. Downloading free 1099 form exemptions is a convenient and cost-effective way to streamline your tax preparation process.

Methods for Downloading Free 1099 Form Exemptions

Obtaining free 1099 form exemptions is crucial for self-employed individuals and businesses to avoid unnecessary tax burdens. There are various reputable websites and resources that offer these forms for free download. Let’s explore the process of downloading these forms and the importance of ensuring their accuracy and currency.

Reputable Websites for Free 1099 Form Exemptions

Numerous websites provide free 1099 form exemptions, including:

- Internal Revenue Service (IRS): The official website of the IRS offers a comprehensive collection of tax forms and instructions, including 1099 form exemptions.

- State Tax Agencies: Many state tax agencies provide downloadable 1099 form exemptions specific to their state regulations.

- Tax Preparation Software Providers: Companies like TurboTax and H&R Block often offer free 1099 form exemptions as part of their tax preparation services.

Process of Downloading 1099 Form Exemptions

Downloading 1099 form exemptions is a straightforward process:

- Visit the website of the IRS or a reputable tax preparation software provider.

- Locate the section or page dedicated to 1099 form exemptions.

- Select the appropriate exemption form for your specific situation.

- Download the form in a suitable format (e.g., PDF, DOCX).

Importance of Accuracy and Currency

It is crucial to ensure that the downloaded 1099 form exemptions are up-to-date and accurate. Tax laws and regulations can change over time, so using outdated forms may result in incorrect tax calculations or penalties. Always check the website or contact the tax agency to confirm that the forms you are downloading are the most recent versions.

How to Use Free 1099 Form Exemptions

Properly filling out and submitting free 1099 form exemptions ensures accurate tax reporting and avoids penalties. Here’s a step-by-step guide:

Locate the necessary information on the forms, such as your name, address, taxpayer identification number (TIN), and the type of exemption you’re claiming.

Follow the instructions on the form carefully. Each exemption has specific requirements and deadlines.

Provide complete and accurate information. Errors or omissions can delay processing or result in penalties.

Tips for Avoiding Common Mistakes

– Check for accuracy: Double-check all information before submitting.

– File on time: Meet the deadlines to avoid late filing penalties.

– Keep a copy: Retain a copy of your exemption for your records.

Examples of Free 1099 Form Exemptions

Below is a table presenting various examples of free 1099 form exemptions, along with their eligibility criteria and potential tax savings.

These exemptions can help you reduce your tax liability if you meet the specific requirements.

| Exemption | Eligibility Criteria | Potential Tax Savings |

|---|---|---|

| Direct Sellers | Earn income from the sale of products or services through a direct selling company | Deduct expenses related to your direct selling business |

| Independent Contractors | Provide services to clients as an independent business owner | Deduct expenses related to your independent contracting work |

| Sole Proprietors | Operate a business as the sole owner | Deduct expenses related to your sole proprietorship |

| Real Estate Professionals | Earn income from the sale or rental of real estate | Deduct expenses related to your real estate business |

| Farmers | Earn income from farming or agricultural activities | Deduct expenses related to your farming or agricultural activities |

Common Questions and Considerations

Understand the key points to consider when utilising free 1099 form exemptions.

It’s essential to be aware of the potential pitfalls and challenges you might face when using these exemptions. We’ll guide you through common issues and provide tips on resolving them.

Eligibility Requirements

Confirm if you meet the eligibility criteria for using free 1099 form exemptions. Factors like income level, business expenses, and tax filing status play a role in determining your eligibility.

Record-Keeping

Understand the importance of accurate record-keeping when using free 1099 form exemptions. Keep track of your income, expenses, and any other relevant documentation to support your exemption claims.

Potential Audits

Be aware that you may face audits by tax authorities when using free 1099 form exemptions. Ensure you have proper documentation to support your exemption claims and be prepared to provide explanations if necessary.

Seeking Professional Assistance

Consider seeking professional assistance from a tax advisor or accountant if you have complex tax situations or need guidance on using free 1099 form exemptions. They can provide tailored advice and help you navigate the complexities of tax regulations.

Q&A

Q: What is the purpose of a 1099 form?

A: A 1099 form is used to report income earned by individuals who are not employees, such as independent contractors and freelancers.

Q: What are exemptions in the context of 1099 forms?

A: Exemptions are deductions that can be applied to 1099 income to reduce taxable income.

Q: Where can I find free 1099 form exemptions?

A: You can download free 1099 form exemptions from reputable websites such as the IRS website or tax preparation software providers.

Q: How do I know if I qualify for a 1099 form exemption?

A: The eligibility criteria for 1099 form exemptions vary depending on the type of exemption. It’s important to carefully review the requirements to determine if you qualify.

Q: What are some common mistakes to avoid when filling out 1099 form exemptions?

A: Common mistakes include using outdated forms, making errors in calculations, and failing to provide all necessary information. Double-checking your information and seeking professional assistance if needed can help prevent these mistakes.