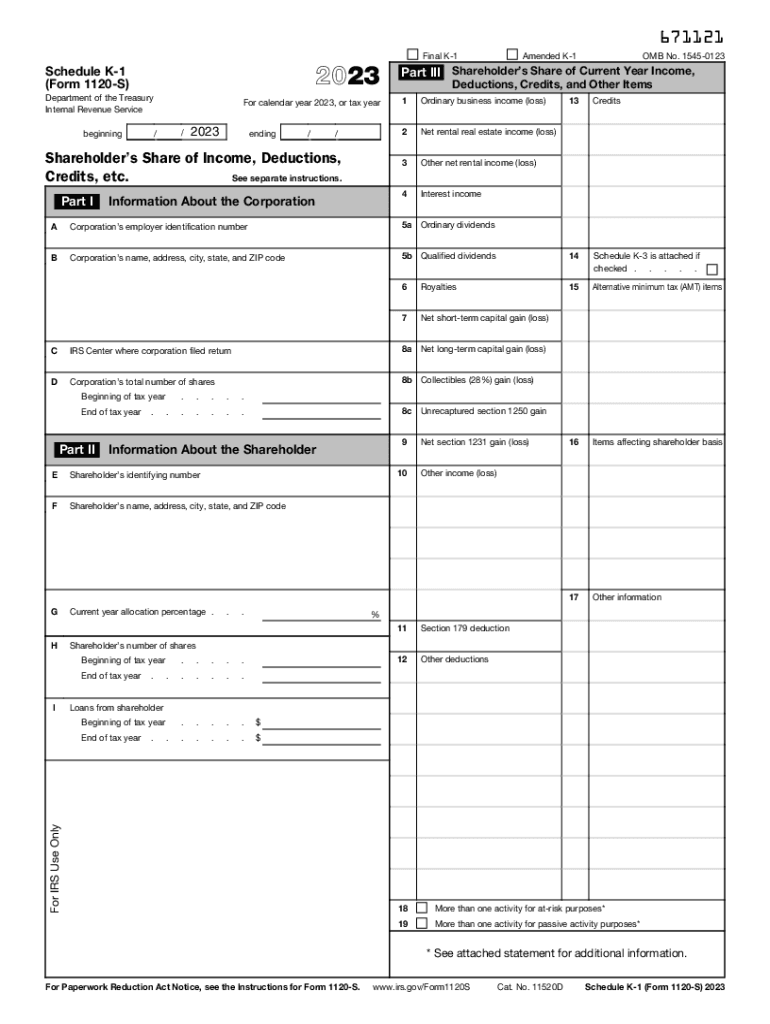

Free 1120s K1 Form Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but with the right tools, it doesn’t have to be. The K1 form plays a crucial role in ensuring accurate tax reporting for individuals and entities. In this guide, we will delve into the world of the K1 form, exploring its purpose, key features, and the benefits of using it. We will also provide a comprehensive list of free download options and step-by-step guidance on completing the form accurately.

Whether you’re a seasoned tax professional or a first-time filer, this guide will empower you with the knowledge and resources you need to effectively utilize the K1 form and fulfill your tax obligations.

Free Download Options

Mans, if you’re after a free K1 form download, there are a few sick platforms out there that’ll sort you out. Let’s suss ’em out.

Whether you’re on your laptop, phone, or tablet, these platforms make it easy to get your hands on the latest and greatest K1 form, no strings attached.

Government Websites

The official government websites are always a safe bet for finding the most up-to-date and accurate version of the K1 form. Here are a few of the top dogs:

- Internal Revenue Service (IRS): The IRS website is the go-to spot for all things tax-related, including the K1 form.

- State Tax Agencies: Many state tax agencies also provide free downloads of the K1 form. Just search for your state’s tax agency website.

Tips for Completing the K1 Form

The K1 form is an important document that must be completed accurately and submitted to the USCIS. Here are some tips to help you fill out the form correctly:

Use clear and concise language. The USCIS will not accept forms that are difficult to read or understand. Use simple, straightforward language that is easy to understand.

Avoid common mistakes. There are a few common mistakes that people make when filling out the K1 form. These mistakes can delay the processing of your application or even lead to your application being denied. To avoid these mistakes, be sure to read the instructions carefully and follow them closely.

Submit the form accurately. Once you have completed the K1 form, be sure to review it carefully for any errors. Make sure that all of the information is correct and that you have signed and dated the form.

Step-by-Step Guidance

To fill out the K1 form, follow these steps:

Gather the required documents. You will need to gather a number of documents before you can start filling out the K1 form. These documents include your passport, birth certificate, and marriage certificate.

Complete the online form. You can complete the K1 form online at the USCIS website. The online form is easy to use and will guide you through the process step-by-step.

Submit the form. Once you have completed the online form, you will need to print it out and mail it to the USCIS. The address for the USCIS is listed on the website.

Frequently Asked Questions

What is the purpose of the K1 form?

The K1 form is used to report the income, deductions, and credits of a pass-through entity to its individual members or partners. It serves as a vital document for tax purposes, providing the necessary information to accurately determine each member’s share of the entity’s taxable income or loss.

Where can I find free downloads of the K1 form?

There are several platforms that offer free downloads of the K1 form. Some popular options include the IRS website, tax preparation software providers, and accounting firms. You can easily access and download the form from these platforms by following the provided instructions.

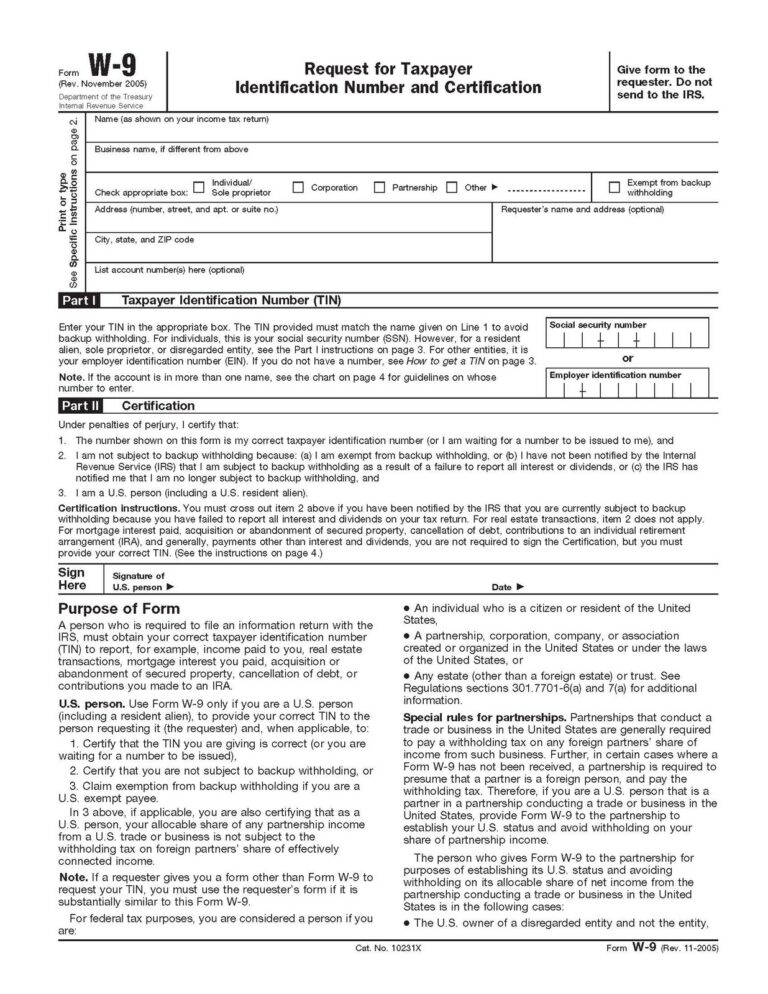

How do I complete the K1 form accurately?

To complete the K1 form accurately, it is important to use clear and concise language and provide all necessary information. Refer to the instructions provided on the form and seek professional assistance if needed. Ensure that the Employer Identification Number (EIN) and other relevant details are correctly entered. Carefully review the sections related to income, deductions, and credits to ensure that all applicable information is reported.