Free W2 Form 2019 Download: A Comprehensive Guide to Filing Your Taxes

Filing taxes can be a daunting task, but it doesn’t have to be. One of the most important documents you’ll need to file your taxes is the W2 form. This form reports your income and taxes withheld to the IRS. In this guide, we’ll provide you with everything you need to know about downloading and using a free W2 form for tax filing in 2019.

In this comprehensive guide, we will explore the significance of the W2 form, the benefits of downloading a free W2 form, and the step-by-step process of obtaining and utilizing it for accurate tax filing. We will also address frequently asked questions to provide additional support and clarity.

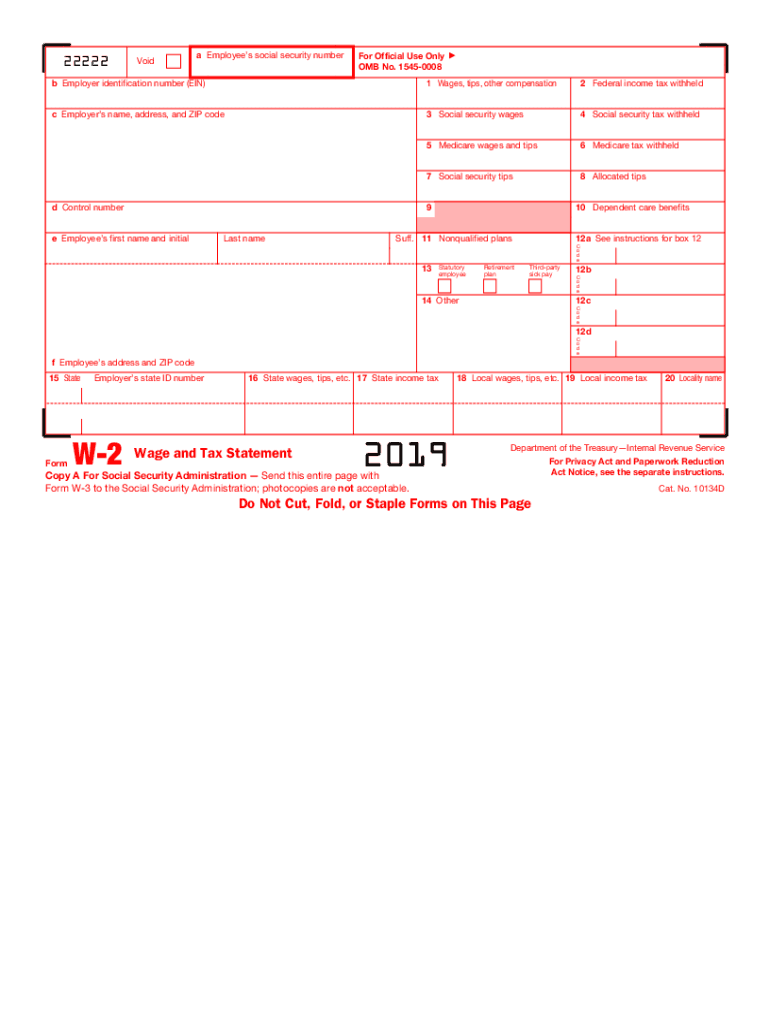

Understanding Free W2 Form 2019 Download

The W2 form, or Wage and Tax Statement, is a crucial document in the United States tax filing system. It serves as an official record of an employee’s income and taxes withheld during a specific tax year.

The W2 form includes essential information such as the employee’s name, address, Social Security number, and income earned from their employer. Additionally, it details the taxes withheld from the employee’s paycheck, including federal income tax, Social Security tax, and Medicare tax.

Historical Evolution of the W2 Form

The W2 form has undergone several changes throughout its history. Originally known as Form 1040A, it was first introduced in 1943 as a way to simplify tax filing for employees. Over the years, the form has been revised and updated to reflect changes in tax laws and reporting requirements.

Using a Free W2 Form 2019 for Tax Filing

Innit, tax filing can be a right pain, but don’t fret, mate. Using a Free W2 Form 2019 can make it a breeze. This form is a crucial bit of paperwork that shows your earnings and taxes withheld for the year. Filling it out accurately is like getting a head start on a banging night out – it’ll save you time and hassle later on.

Filling Out the W2 Form

Filling out a W2 form is like playing a game of snakes and ladders, but without the snakes. It’s straightforward, just follow these steps:

– Box 1: Wages, Tips, Other Compensation – This is the total amount you earned before any deductions.

– Box 2: Federal Income Tax Withheld – This is the amount of federal income tax your employer took out of your paychecks.

– Box 3: Social Security Wages – This is the amount of your earnings subject to Social Security tax.

– Box 4: Social Security Tax Withheld – This is the amount of Social Security tax your employer withheld from your paychecks.

– Box 5: Medicare Wages and Tips – This is the amount of your earnings subject to Medicare tax.

– Box 6: Medicare Tax Withheld – This is the amount of Medicare tax your employer withheld from your paychecks.

Common Mistakes to Avoid

Don’t be a plonker and make these common mistakes:

– Mismatched Information: Make sure the information on your W2 form matches your Social Security card and other tax documents.

– Missing Information: Fill out every box on the form, even if it’s zero.

– Incorrect Math: Double-check your calculations, especially for boxes 1, 2, 3, 4, 5, and 6.

– Late Filing: Get your W2 form to the IRS by the deadline to avoid penalties.

There you have it, bruv. Filling out a W2 form is a doddle. Just remember to be accurate and avoid those silly mistakes. Good luck with your tax filing, and may the tax gods be in your favor!

Additional Resources and Support

If you need help with your W2 form, there are a number of resources available to you.

The IRS website has a wealth of information on W2 forms, including instructions on how to fill them out and where to send them. You can also find free tax preparation software on the IRS website that can help you complete your taxes.

Official Government Websites

- Internal Revenue Service (IRS): https://www.irs.gov/

- State Tax Agencies: Visit the website of your state’s tax agency for specific information and resources related to W2 forms and state income taxes.

Tax Preparation Software Providers

- TurboTax: https://turbotax.intuit.com/

- H&R Block: https://www.hrblock.com/

- TaxAct: https://www.taxact.com/

Non-Profit Organizations

- United Way: https://www.unitedway.org/

- AARP Foundation Tax-Aide: https://www.aarp.org/taxaide/

- VITA (Volunteer Income Tax Assistance): https://www.irs.gov/individuals/free-tax-return-preparation-for-you-by-volunteers

Contacting the IRS

You can contact the IRS by phone at 1-800-829-1040. You can also get help online at the IRS website.

Frequently Asked Questions

What is the purpose of a W2 form?

A W2 form is used to report your income and taxes withheld to the IRS. It is a crucial document for tax filing as it provides the necessary information for calculating your tax liability.

Where can I download a free W2 form?

You can download a free W2 form from the IRS website or from various reputable online sources. We recommend using official sources to ensure the authenticity and accuracy of the form.

How do I fill out a W2 form?

Filling out a W2 form is relatively straightforward. Follow the instructions on the form carefully and provide accurate information in each section. If you encounter any difficulties, refer to the resources and support mentioned in this guide.

What are some common mistakes to avoid when filling out a W2 form?

Some common mistakes to avoid include entering incorrect Social Security numbers, omitting essential information, and making mathematical errors. Double-check your entries before submitting the form to minimize the risk of errors.

What should I do if I lose my original W2 form?

If you lose your original W2 form, you can request a duplicate from your employer. You can also download a free W2 form from the IRS website or other reputable sources and fill it out based on the information you have.