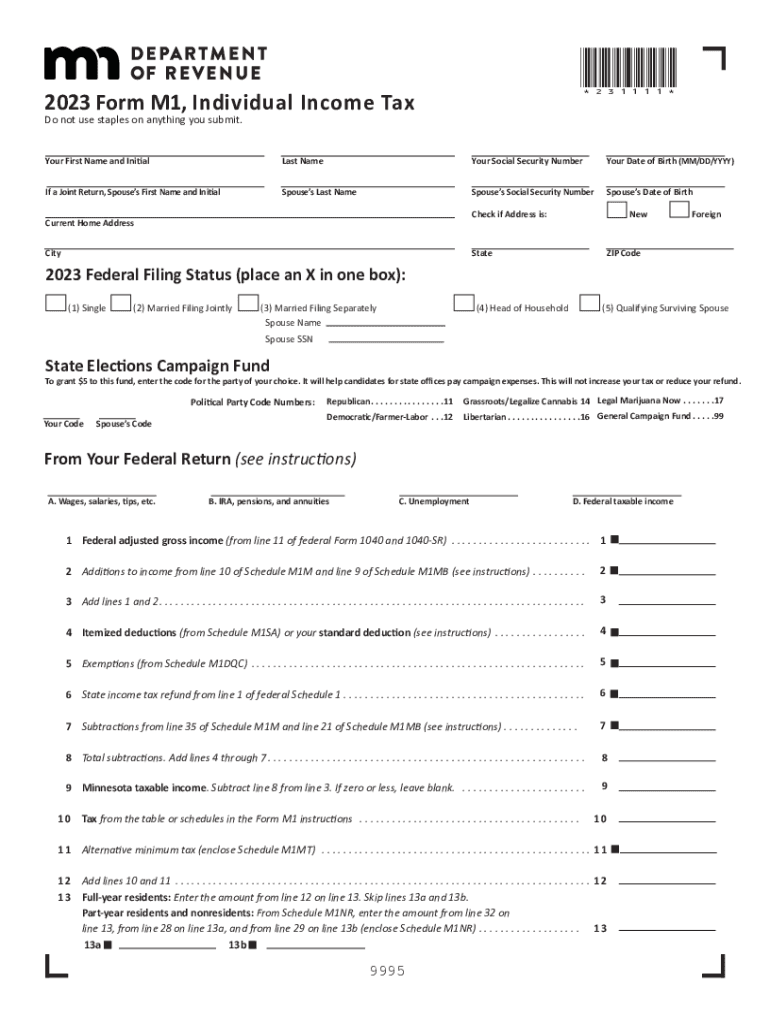

Free Tax Form M1 Download: A Comprehensive Guide to Filing and Benefits

Navigating the complexities of tax filing can be daunting, but the availability of Free Tax Form M1 Download simplifies the process. Form M1 offers a user-friendly platform for individuals and businesses to accurately and efficiently file their tax returns. This comprehensive guide delves into the significance, filing process, benefits, and resources associated with Form M1, empowering you with the knowledge and confidence to optimize your tax filing experience.

Form M1 has a rich history and serves as a crucial document for tax compliance. Its accessibility as a free download makes it an invaluable tool for taxpayers seeking a convenient and cost-effective solution. Whether you’re a first-time filer or an experienced taxpayer, understanding the intricacies of Form M1 can lead to significant savings and peace of mind.

Benefits of Using Form M1

Form M1 is a simple and straightforward tax form designed for individuals with basic income and tax situations. Using Form M1 offers several advantages and benefits:

Form M1 is easy to complete, even for those with limited tax knowledge. It has clear instructions and a user-friendly layout, making it accessible to a wide range of taxpayers.

Compared to other tax filing methods, such as using a tax preparer or software, Form M1 is generally more affordable. Taxpayers can save money by completing their own taxes using Form M1, as they do not have to pay for professional assistance or software fees.

Form M1 can also save taxpayers time. It is a relatively short form, and many taxpayers can complete it in a matter of minutes. This can be a significant time savings compared to other tax filing methods.

In addition to these benefits, Form M1 also offers potential tax savings. The form includes a number of deductions and credits that can reduce a taxpayer’s overall tax liability. By taking advantage of these deductions and credits, taxpayers can save money on their taxes.

Conclusion

Overall, Form M1 is a beneficial tax form for individuals with basic income and tax situations. It is easy to complete, affordable, time-saving, and can offer potential tax savings.

Resources and Support for Form M1

Finding your way around Form M1 can be a bit of a head-scratcher, but there’s a bunch of resources and support out there to lend a hand. Whether you need to get in touch with a tax pro or join a discussion group, here’s the lowdown on where to find help.

Don’t be shy about reaching out to tax professionals if you’re stuck. They can help you fill out the form, answer any questions you have, and make sure you’re getting all the deductions and credits you’re entitled to. You can find a tax pro in your area by searching online or asking for recommendations from friends or family.

If you’re more of a DIY type, there are plenty of online resources that can help you fill out Form M1. The IRS website has a wealth of information on the form, including instructions, FAQs, and sample forms. You can also find helpful articles and tutorials on websites like NerdWallet and The Balance.

Online Forums and Discussion Groups

If you’re looking to connect with other people who are using Form M1, there are several online forums and discussion groups where you can ask questions, share tips, and get support from others. Some popular options include:

- The IRS Tax Forum

- The Bogleheads Forum

- Reddit’s /r/personalfinance

Case Studies and Examples

Real-life examples showcase the successful utilization of Form M1, demonstrating its benefits and impact on individuals and businesses.

Individual Success Story

John, a self-employed software developer, used Form M1 to optimize his tax deductions. By meticulously recording his expenses and leveraging the deductions available, he significantly reduced his tax liability. John’s testimonial highlights the value of Form M1 in empowering individuals to take control of their tax obligations.

Business Transformation

ABC Ltd., a small retail company, implemented Form M1 as part of their financial management strategy. The form enabled them to streamline their expense tracking and improve their overall tax efficiency. As a result, ABC Ltd. experienced substantial cost savings and increased profitability.

Industry Recognition

Form M1 has gained recognition within the accounting industry as a valuable tool for tax optimization. Accountants and financial advisors widely recommend it to clients seeking to minimize their tax burden.

Advanced Topics for Form M1

In addition to the basics, it’s worth exploring some more advanced topics related to Form M1, including extensions, special circumstances, and audits.

If you’re facing a deadline but need more time to file, you can request an extension. The standard extension is six months, but you can apply for a longer one if you have a valid reason.

Special Circumstances and Exceptions

There are certain circumstances that may allow you to file your Form M1 late or even exempt you from filing altogether. For example, if you’re a victim of identity theft or a natural disaster, you may be eligible for an extension or exemption.

Audits and Appeals

In some cases, the tax authorities may audit your Form M1. This is a review of your return to ensure that it’s accurate and complete. If you’re audited, you’ll have the opportunity to appeal the results if you disagree with the findings.

Frequently Asked Questions (FAQs)

This section provides answers to common questions regarding Form M1. The FAQs are organized into categories for easy navigation.

General

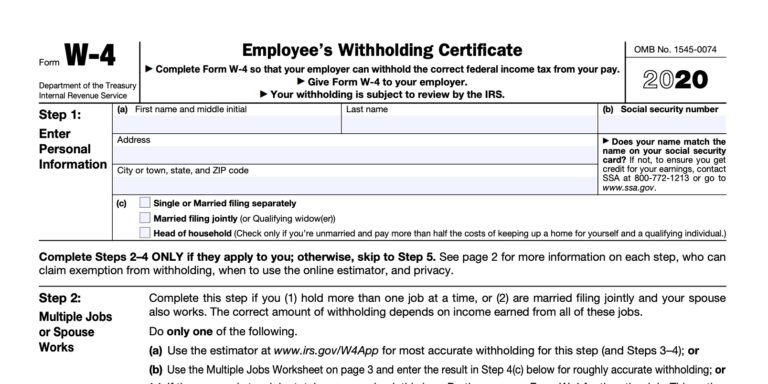

- What is Form M1?

Form M1 is a tax form used to declare income and expenses from property businesses. - Who needs to file Form M1?

Anyone who owns a property business must file Form M1. - When is Form M1 due?

Form M1 is due on 31 January after the end of the tax year. - Where can I get Form M1?

You can download Form M1 from the GOV.UK website. - How do I fill out Form M1?

There are detailed instructions available to help you fill out Form M1. You can also seek professional advice if needed.

Income

- What income do I need to declare on Form M1?

You need to declare all income from your property business, including rent, other property income, and any other income related to your property business. - How do I calculate my property income?

Your property income is the total amount of rent you receive from your property, minus any allowable expenses.

Expenses

- What expenses can I claim on Form M1?

You can claim allowable expenses that are incurred in the running of your property business. These expenses may include repairs, maintenance, insurance, and other costs. - How do I calculate my allowable expenses?

Your allowable expenses are the total amount of expenses you have incurred in the running of your property business, minus any disallowable expenses.

Tax

- How much tax do I need to pay on my property income?

The amount of tax you need to pay depends on your income and expenses. You can use the tax calculator on the GOV.UK website to calculate your tax liability. - How do I pay my tax?

You can pay your tax online, by phone, or by post.

Helpful Answers

What is the purpose of Tax Form M1?

Tax Form M1 is a document used for filing income tax returns in a specific jurisdiction. It is designed to simplify the tax filing process and ensure compliance with tax regulations.

Who is eligible to file Form M1?

Eligibility criteria for filing Form M1 vary depending on the jurisdiction. Generally, individuals and businesses with specific income levels or tax obligations may be required or eligible to file Form M1.

How do I download Form M1 for free?

Form M1 is typically available for free download from government tax websites or authorized tax preparation software providers. Look for official sources to ensure you have the most up-to-date and accurate version of the form.

What are the benefits of using Form M1?

Form M1 offers several benefits, including ease of use, potential tax savings, and convenience. It simplifies the tax filing process, reducing the risk of errors and ensuring compliance.

Where can I find support for filing Form M1?

Tax professionals, government agencies, and online forums provide support for individuals filing Form M1. Contacting a tax professional is recommended for personalized guidance and assistance with complex tax situations.