Free Tax Certification Form Download: A Comprehensive Guide

Navigating the complexities of tax regulations can be daunting, but with the right resources, it doesn’t have to be. This comprehensive guide provides you with everything you need to know about obtaining a tax certification form, from understanding the different types available to completing and submitting it accurately.

Whether you’re a business owner, an individual taxpayer, or simply looking to stay compliant, this guide will empower you with the knowledge and tools to make the tax certification process seamless and stress-free.

Tax Forms Overview

Navigating the world of taxes can be a bit of a headache, innit? But fear not, mate, we’ve got you covered. We’ve compiled a crib sheet of all the tax forms you need to know about, so you can get your taxes sorted without any hassle.

These forms are like the secret handshake of the tax world. Each one has a specific purpose, and you need to use the right one for your situation. Don’t worry, we’ll break it down for you.

Types of Tax Forms

| Form Name | Form Number | Purpose | Availability |

|---|---|---|---|

| Self Assessment Tax Return | SA100 | For self-employed individuals and partnerships to declare their income and calculate their tax liability. | Available online or by post |

| Income Tax Return | P800 | For employees to check their tax code and ensure they are paying the correct amount of tax. | Available online or by post |

| Corporation Tax Return | CT600 | For companies to declare their profits and calculate their corporation tax liability. | Available online or by post |

| Value Added Tax (VAT) Return | VAT100 | For businesses registered for VAT to declare their sales and purchases and calculate their VAT liability. | Available online or by post |

Certification Process

Getting certified is like getting your driving license for tax – it shows you know the rules of the road. The process is pretty straightforward:

Eligibility Requirements

To be eligible for tax certification, you need to:

- Be a UK resident

- Be over 18 years old

- Have a National Insurance number

- Be able to demonstrate a good understanding of UK tax law

Documentation Needed

When you apply for certification, you’ll need to provide:

- Proof of your identity (e.g. passport or driving license)

- Proof of your address (e.g. utility bill or bank statement)

- Your National Insurance number

- Evidence of your tax knowledge (e.g. a certificate from a tax course)

How to Apply

To apply for certification, you can:

- Go online to the HMRC website

- Call the HMRC helpline on 0300 200 3300

- Write to HMRC at:

HM Revenue and Customs

BX9 1AS

United Kingdom

Form Download s

Alright, let’s get those tax certification forms sorted. It’s a doddle, innit?

Just follow these bang on steps:

Visit the HMRC Website

Head over to the Her Majesty’s Revenue and Customs (HMRC) website, the tax peeps. Once you’re there, look for the “Forms and guidance” section.

Locate the Tax Certification Forms

In the “Forms and guidance” section, you’ll find a bunch of forms. Don’t fret, mate. Just type “tax certification” in the search bar. That should bring up the forms you need.

Select the Right Form

There are different tax certification forms for different situations. Make sure you pick the one that’s right for you. If you’re not sure, check with HMRC or a tax advisor.

Download the Form

Once you’ve found the right form, click on the “Download” button. The form will be saved to your computer in PDF format.

Form Completion Assistance

Completing tax certification forms accurately is essential to ensure proper submission and avoid potential errors. Here’s a guide to help you fill out the forms correctly:

Read the instructions carefully before filling out the form. Make sure you understand the information required and the format in which it should be provided.

Common Errors to Avoid

- Inaccurate or incomplete personal information, such as name, address, and Social Security number.

- Incorrect tax year or filing status.

- Miscalculations in income, deductions, and credits.

- Missing or incorrect signatures.

Ensuring Proper Submission

- Review your completed form carefully for errors before submitting it.

- Make copies of the completed form for your records.

- Submit the form to the appropriate tax authority on time.

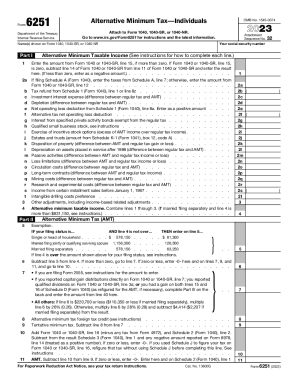

Form Section Requirements

| Section | Requirements |

|---|---|

| Personal Information | Name, address, Social Security number, filing status |

| Income | Wages, salaries, dividends, interest, and other sources of income |

| Deductions | Standard deduction or itemized deductions, such as mortgage interest, charitable contributions |

| Credits | Child tax credit, earned income credit, and other applicable credits |

| Tax Calculation | Calculation of tax liability based on income, deductions, and credits |

| Signatures | Signature of taxpayer and preparer, if applicable |

Form Submission Process

Alright, listen up, fam! Now that you’ve got your tax certification form sorted, it’s time to send it in. There are a couple of ways you can do this:

You can either post it off to the tax office or submit it online. If you’re posting it, make sure you include all the necessary documentation, like your ID and proof of address. If you’re submitting it online, you’ll need to create an account on the tax office website.

Required Documentation

- Proof of identity (e.g., passport, driving license)

- Proof of address (e.g., utility bill, bank statement)

Turnaround Time

Once you’ve submitted your form, it can take up to 10 working days for it to be processed. If you haven’t heard back within that time, give the tax office a bell to check on the status of your application.

Steps Involved in Submitting the Form

- Gather the required documentation.

- Choose your submission method (post or online).

- Submit your form and documentation.

- Wait for the tax office to process your application.

- Receive your tax certification.

Benefits of Tax Certification

Obtaining tax certification offers numerous advantages for businesses and individuals alike. It simplifies tax filing, reduces tax liability, and enhances compliance with tax regulations.

By understanding tax laws and regulations, certified individuals can optimize tax deductions and credits, resulting in reduced tax liability. This can lead to significant cost savings and improved financial performance.

Improved Compliance

Tax certification demonstrates a commitment to adhering to tax laws and regulations. Certified individuals are less likely to make errors or face penalties due to non-compliance.

Questions and Answers

Can I download tax certification forms online?

Yes, most tax certification forms are available for download on the official website of the relevant tax authority.

Do I need to be certified by a tax professional to obtain a tax certification form?

No, in most cases, you do not need to be certified by a tax professional. However, if you have complex tax situations or require specific guidance, consulting a tax professional is recommended.

What is the turnaround time for processing a tax certification form?

The turnaround time for processing a tax certification form varies depending on the tax authority and the complexity of the form. It can range from a few days to several weeks.