Free FS 545 Form Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but understanding and utilizing the Free FS 545 Form can significantly simplify the process. This form is crucial for taxpayers seeking to claim the Earned Income Tax Credit (EITC), a valuable benefit that can reduce tax liability or even result in a refund.

In this comprehensive guide, we will delve into the intricacies of Form 545, providing step-by-step instructions, essential filing requirements, and practical tips to ensure accurate and timely submission. By empowering you with the necessary knowledge, we aim to make tax filing less stressful and more manageable.

Form Overview

Form 545 is a tax return that is used to report income from self-employment. It is important to file Form 545 accurately and on time to avoid penalties.

Anyone who has net earnings from self-employment of $400 or more is required to file Form 545. This includes income from businesses, professions, and other activities that are considered self-employment.

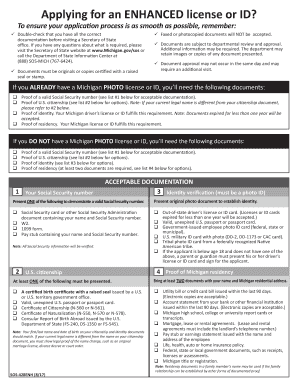

Filing Requirements

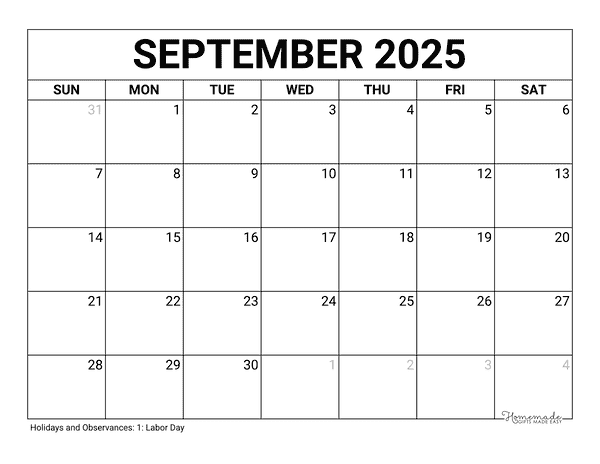

- File Form 545 with the Internal Revenue Service (IRS) by April 15th.

- If you file your taxes late, you may have to pay penalties and interest.

- You can file Form 545 electronically or by mail.

Importance of Filing Accurately

It is important to file Form 545 accurately to ensure that you pay the correct amount of taxes. If you make a mistake on your tax return, you may have to pay additional taxes and penalties.

In addition, filing Form 545 accurately can help you to qualify for certain tax deductions and credits. These deductions and credits can reduce the amount of taxes that you owe.

Form Download

It’s a doddle to get your mitts on Form 545. You can nab it straight from the taxman’s gaff or give ’em a bell and they’ll bung it in the post.

Official Website

To bag Form 545 from the taxman’s website, follow these ace steps:

- Cruise on over to the taxman’s website.

- Chuck “Form 545” into the search bar and hit enter.

- Click on the first result, which should be the download page for Form 545.

- Hit the “Download” button and save the form to your computer.

Request by Mail or Fax

If you’re not keen on downloading the form online, you can always give the taxman a tinkle or fire off a fax.

To request Form 545 by mail, send a letter to:

HM Revenue & CustomsBX9 1AS

United Kingdom

In your letter, include your name, address, and contact details. Be sure to specify that you’re requesting Form 545.

To request Form 545 by fax, dial 0300 200 3300 and follow the prompts.

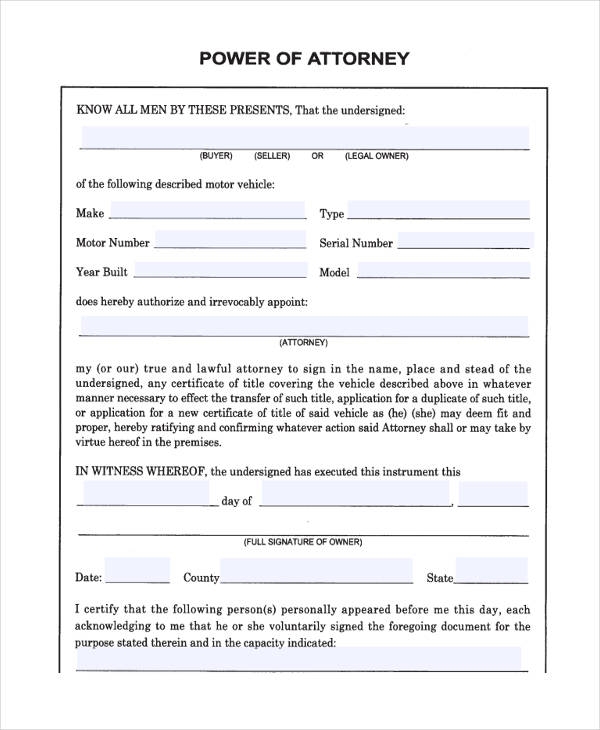

Form Structure

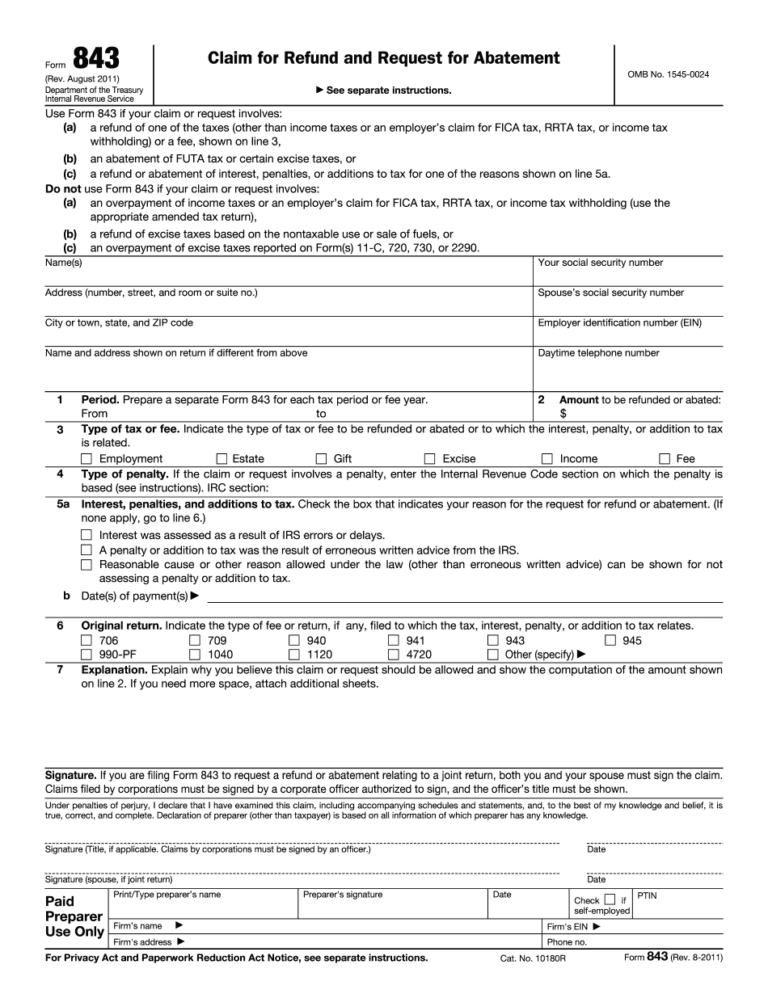

Form 545 is a three-page document with four main sections: Personal Information, Income and Deductions, Credits, and Tax Due or Refund.

The Personal Information section includes your name, address, Social Security number, and filing status. The Income and Deductions section includes information about your wages, salaries, tips, and other income, as well as your deductions for things like taxes, Social Security, and health insurance.

Credits

The Credits section includes information about any tax credits you may be eligible for, such as the child tax credit or the earned income tax credit.

Tax Due or Refund

The Tax Due or Refund section includes information about how much tax you owe or how much of a refund you will receive.

Related Forms

Forms related to Form 545 can provide additional information or assist with specific tasks related to the disposal of firearms.

Here are some related forms that you may find useful:

ATF Form 4473

- The ATF Form 4473 is used to conduct background checks for the sale or transfer of firearms.

- It is required by federal law to be completed by all individuals who purchase or receive a firearm from a licensed dealer.

- You can obtain the ATF Form 4473 from the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) website.

ATF Form 5300.11

- The ATF Form 5300.11 is used to register certain types of firearms, such as machine guns, short-barreled rifles, and short-barreled shotguns.

- It is required by federal law to be completed and submitted to the ATF before possessing or transferring these types of firearms.

- You can obtain the ATF Form 5300.11 from the ATF website.

ATF Form 8540.1

- The ATF Form 8540.1 is used to apply for a Federal Firearms License (FFL).

- An FFL is required by federal law for individuals or businesses that engage in the sale or transfer of firearms.

- You can obtain the ATF Form 8540.1 from the ATF website.

Questions and Answers

What is the purpose of Form 545?

Form 545 is specifically designed to claim the Earned Income Tax Credit (EITC), a tax credit that reduces the amount of taxes owed or increases the refund received.

Who is required to file Form 545?

Individuals who meet the eligibility criteria for the EITC are required to file Form 545. These criteria include income limits, filing status, and residency requirements.

Where can I download Form 545?

Form 545 can be downloaded from the official IRS website or obtained by mail or fax upon request.

What are the common errors to avoid when filing Form 545?

Common errors include incorrect calculations, missing or incomplete information, and failure to meet eligibility requirements. Careful review and attention to detail can help avoid these errors.

Can I get assistance with completing Form 545?

Yes, the IRS provides resources such as online tools, phone assistance, and Volunteer Income Tax Assistance (VITA) programs to help taxpayers complete Form 545 accurately.