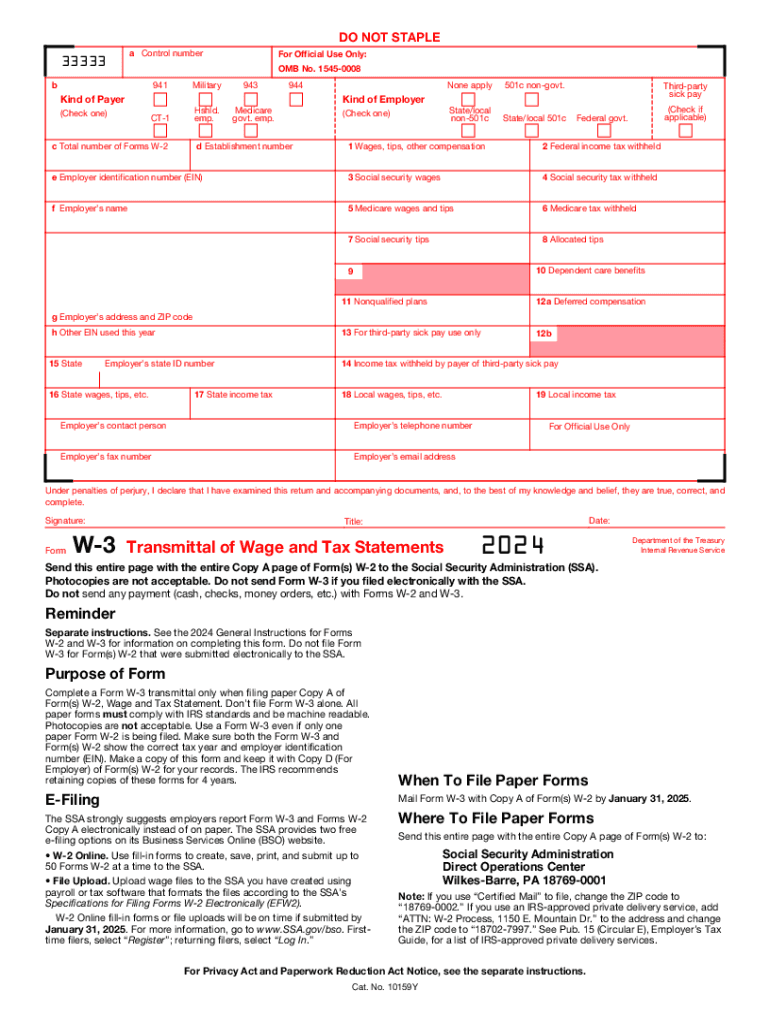

Free Form W3 2024 Download: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but understanding and completing Form W3 is essential for accurate reporting. This guide provides a comprehensive overview of Form W3, including its purpose, how to download and complete it, and common errors to avoid. Whether you’re a seasoned taxpayer or filing for the first time, this resource will empower you with the knowledge and confidence to tackle Form W3 with ease.

Form W3 is an important document used to transmit wage and tax information from employers to employees. It serves as the basis for calculating federal income tax withholdings and ensuring accurate tax reporting. By understanding the intricacies of Form W3, you can ensure compliance, avoid penalties, and maximize your tax savings.

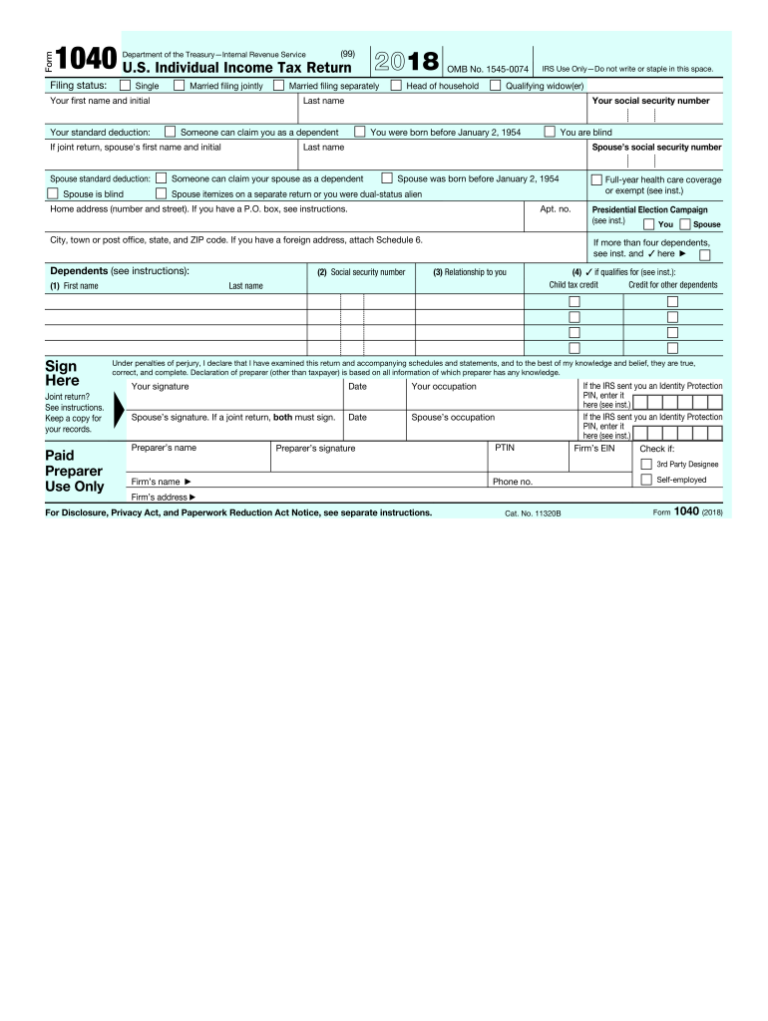

Understanding the Sections of Form W3

Form W3 is divided into sections, each with a specific purpose. Understanding these sections is crucial for completing the form accurately and efficiently.

The form can be organized into the following sections:

Section 1: Header Information

This section contains general information about the individual completing the form, including their name, address, and contact details.

Section 2: Income and Expenses

This section summarizes the individual’s income and expenses for the tax year. It includes details of earnings from employment, self-employment, and investments, as well as allowable expenses.

Section 3: Tax Calculation

This section calculates the individual’s tax liability based on their income and expenses. It includes details of tax allowances, deductions, and credits.

Section 4: Payment and Repayment

This section summarizes the individual’s tax payments and any repayments due. It includes details of tax paid through PAYE, self-assessment, and any additional payments or refunds.

| Section | Line Numbers |

|---|---|

| Header Information | 1-7 |

| Income and Expenses | 8-21 |

| Tax Calculation | 22-28 |

| Payment and Repayment | 29-35 |

Types of Information Required

Each section of Form W3 requires specific types of information, including:

- Section 1: Personal details, address, contact information

- Section 2: Income from employment, self-employment, investments; expenses

- Section 3: Tax allowances, deductions, credits; tax calculation

- Section 4: Tax payments, repayments, refunds

Common Errors and Troubleshooting

Filling out Form W3 can be a breeze, but even the most eagle-eyed can make mistakes. Here’s a heads-up on the most common pitfalls and how to dodge them like a pro.

If you do hit a snag, don’t panic! We’ve got your back with troubleshooting tips to help you sort it out.

Incorrect Employer Identification Number (EIN)

- Make sure the EIN you enter is the correct one for your employer. Check your pay stubs or contact your HR department to confirm.

- Double-check that you’ve entered the numbers correctly. A single typo can throw the whole thing off.

Missing or Incorrect Personal Information

- Ensure you’ve filled in all the required personal information, including your full name, address, and Social Security Number (SSN).

- Check that the information matches what’s on your official documents, like your passport or driving license.

Incomplete or Inaccurate W-4 Information

- Take your time filling out the W-4 section. Make sure you understand the instructions and enter the correct number of allowances.

- If you’re unsure about anything, refer to the IRS website or consult a tax professional for guidance.

Troubleshooting Tips

- If you encounter any errors when submitting Form W3, the IRS will send you a notice explaining the problem.

- Review the notice carefully and follow the instructions provided to correct the errors.

- If you need further assistance, you can contact the IRS directly by phone or mail.

Additional Resources and Support

If you need further assistance with understanding or completing Form W3, here are some additional resources:

- IRS website: https://www.irs.gov/forms-pubs/about-form-w3 provides detailed instructions, FAQs, and downloadable forms.

- IRS helpline: 1-800-829-1040 is available Monday through Friday from 7 am to 7 pm local time.

- Online forums: There are many online forums where you can connect with other taxpayers and ask questions about Form W3. Some popular forums include Reddit’s r/tax and Bogleheads.org.

FAQ Corner

Where can I download the official Form W3?

You can download the official Form W3 from the Internal Revenue Service (IRS) website at www.irs.gov.

What information do I need to complete Form W3?

To complete Form W3, you will need your personal information, such as your name, address, and Social Security number, as well as information about your employer, such as their name, address, and Employer Identification Number (EIN).

What are some common errors to avoid when completing Form W3?

Common errors to avoid when completing Form W3 include entering incorrect personal or employer information, miscalculating withholdings, and failing to sign and date the form.